Tesla’s Q3 earnings report confirms that its Bitcoin holdings remained unchanged throughout the year despite recent speculations.

The company continues to hold 11,509 BTC, currently valued at around $765 million. This means Tesla is still the fourth-largest Bitcoin holder among publicly traded US companies. It only trails behind MicroStrategy, Marathon Digital Holdings, and Riot Platforms.

Tesla’s Earlier Bitcoin Wallet Rotation Raised Fears

Earlier wallet movements raised questions about whether Tesla was planning to sell or transfer its assets. However, today’s report assures that no such actions were taken. Arkham Intelligence also confirmed that these movements were likely done for security purposes.

Read More: Who Owns the Most Bitcoin in 2024?

“We believe that the Tesla wallet movements that we reported on last week were wallet rotations with the Bitcoin still owned by Tesla. The Bitcoin has been split between 7 wallets holding 1100 and 2200 BTC,” Arkham Intelligence wrote in a X post (formerly Twitter)

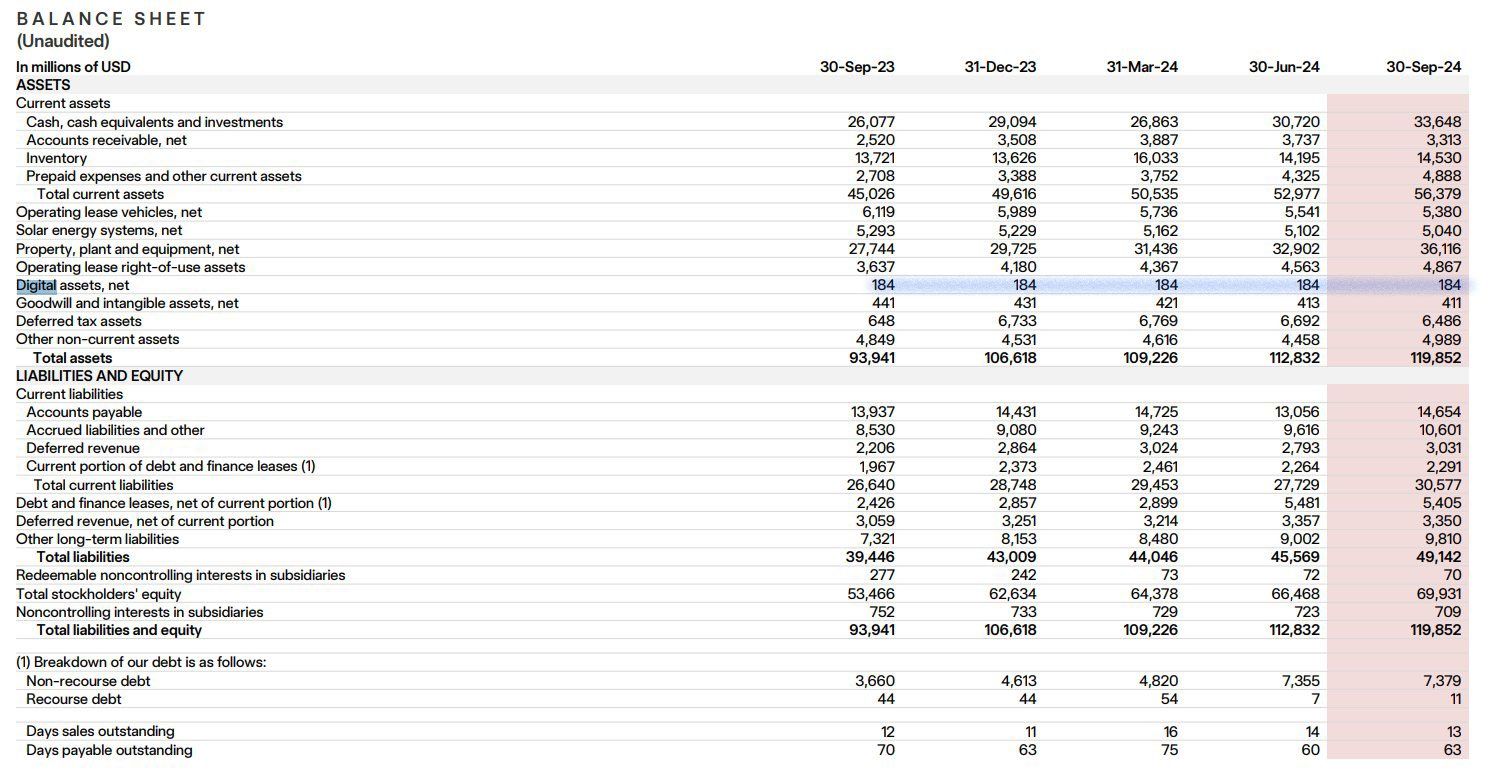

Tesla’s third-quarter earnings report surprised many analysts, exceeding expectations in some areas. The company posted a gross margin of 19.8%, an improvement from 18.0% in the second quarter.

However, revenue came in slightly lower than anticipated, reaching $25.1 billion instead of the projected $25.4 billion. Despite this, the revenue still reflects an 8% year-over-year increase, demonstrating strong global sales growth.

Tesla CEO Elon Musk previously addressed the company’s profit challenges, attributing a nearly 50% drop at the end of the second quarter to competition from cheaper electric vehicles. He assured investors that this decline was temporary.

What Does It Mean for the Bitcoin Market?

Tesla’s earnings report provides some relief for the Bitcoin community. The fact that the company’s holdings remained unchanged throughout the quarter suggests that it’s likely optimistic about the market.

Read More: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

Elon Musk’s other venture, SpaceX, also holds 8,285 Bitcoin worth $560 million. This makes it the seventh-largest Bitcoin holding by a private firm.

Tesla’s relationship with Bitcoin goes back to 2021 when it briefly accepted cryptocurrency for vehicle purchases.

The policy was later reversed due to concerns over the environmental impact of Bitcoin mining. Musk has hinted that Tesla might reconsider accepting Bitcoin if mining practices become more sustainable.

Bitcoin’s price remains steady at around $66,500. It will be interesting to see if the optimism after the company’s quarterly report has any significant impact on the market in the coming days.