The price of the Telegram coin Banana Gun (BANANA) slowly halted its ongoing decline after the investors decided to sell, which caused them losses.

Nevertheless, the price drop has placed BANANA in a lucrative position as accumulation now could bring profits.

Banana Gun Investors Take a Hit

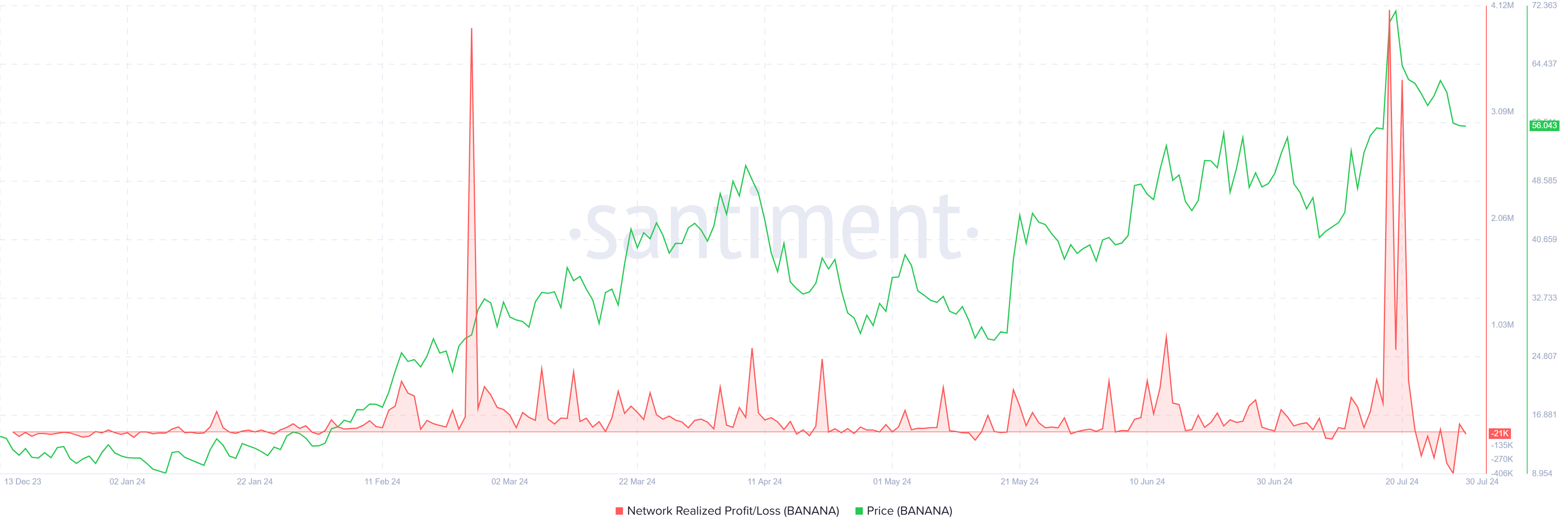

BANANA price painted the daily chart red over the last two weeks, which hurt the optimism of the Telegram coin holders. Consequently, they chose to move their supply into the exchange’s wallets by selling it away.

The decision, however, did not help them much as it led to the largest bout of losses noted in Banana Gun’s history. The realized losses were collectively worth close to $1 million in the past week.

Read More: What Are Telegram Bot Coins?

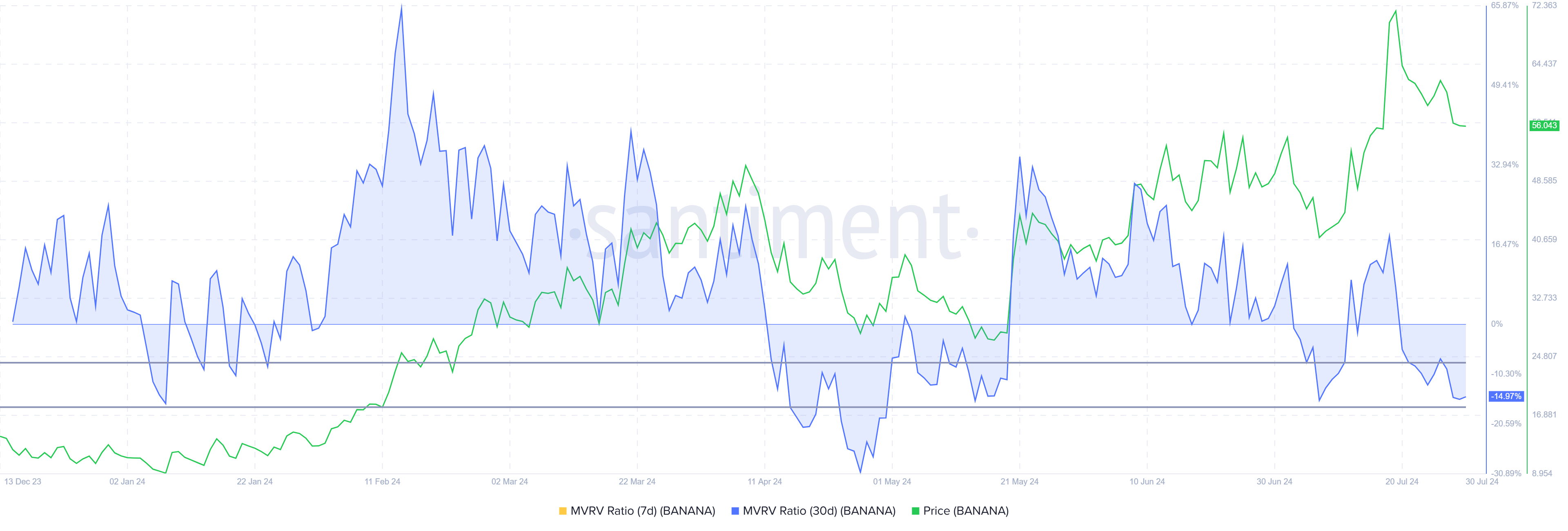

However, the decline may not be sustained as the Telegram coin is back in the opportunity zone, according to the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio assesses investor profit and loss. Currently, BANANA’s 30-day MVRV stands at -15%, indicating losses and possible buying pressure. Historically, MVRV between -7% and -17% usually signals the start of rallies, marking it as an accumulation opportunity zone.

This could be a positive turnaround for the Telegram coin.

BANANA Price Prediction: Keeping the Support Intact

BANANA price has dropped by 21% over the last two weeks from $72 to $56. Incidentally, over the last two days, the Telegram coin has kept above the critical support level of $55.

This level has been tested as a resistance level multiple times throughout June and July and is now being tested as a support. If accumulation begins in the coming days, a bounce back from this support could send BANANA to the psychological resistance of $65.

Read More: Crypto Telegram Groups To Join in 2024

Consolidation under $70 is the likely outcome for the coming days. However, if the support of $56 is lost, a drop to $47 is possible. This could invalidate the bullish thesis, leaving BANANA’s price struggling to recover.