The massive outflow of liquidity from the Uniswap decentralized exchange has continued unabated and the beneficiaries appear to be rival protocols SushiSwap and Bancor.

Over $1.5 billion in cryptocurrency collateral has been shifted over the past few days as Uniswap’s farming incentives came to an end on Nov 17. The DeFi protocol did very little to prevent the largely anticipated exodus of liquidity and now its rivals are benefiting.

From a record $3 billion in liquidity last week, Uniswap has been hemorrhaging so much that it has slumped by 53% to around $1.4 billion today.

From Uniswap to SushiSwap

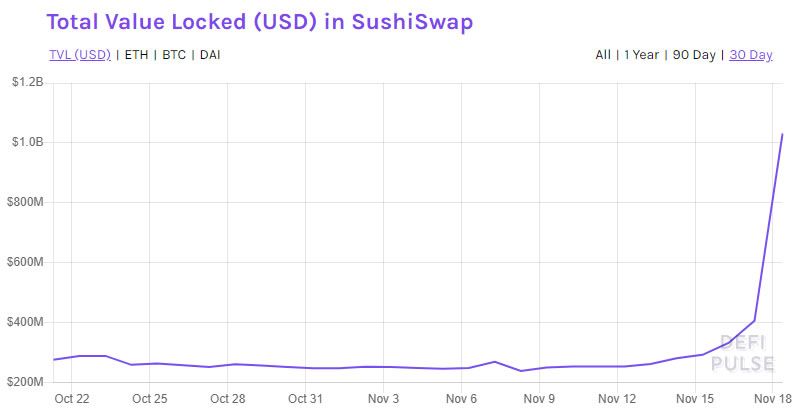

It appears that Uniswap fork and rival protocol SushiSwap is getting the lion’s share of this billion-dollar river of crypto collateral. According to DeFi Pulse, SushiSwap total value locked has surged by 300% over the past couple of days to top out at over $1 billion. This has propelled the protocol up to sixth place on the total value locked (TVL) charts, flipping Curve Finance, Synthetix, and Yearn Finance.

“Other projects are now looking to siphon off yield-hungry traders by offering incentives of their own, best highlighted by SushiSwap boosting SUSHI rewards and Bancor’s BNT liquidity mining released yesterday.”Bancor TVL has surged 50% over the past 24 hours but it is still a small fry compared to its billion-dollar brethren. The total across the industry is just off its all-time high at $13.7 billion according to DeFi Pulse.

Uniswap Community Vote Update

Uniswap community members expressed their concerns about the premise of a mass exodus in a recent community call but core team members remained tight-lipped. Governance came too little too late and an ongoing ‘temperature check’ vote and proposal has not mitigated the migration of money. At the time of press, the three-day vote was a close call with 51.9% supporting the proposal to continue farming incentives for another two months and 47.7% voting against it. UNI prices meanwhile have been holding steady over the past 24 hours with little change, trading at just below $3.70.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored