The SushiSwap (SUSHI) price increased significantly in November and has begun December with another breakout.

The breakout from the parallel channel suggests that SUSHI is likely in an impulsive move and will move higher towards the resistance levels outlined below.

November Increase

The SUSHI price has been moving upwards since it reached an all-time low of $0.47 on Nov 4. In the month of November alone, SUSHI increased by 154%.

Furthermore, December began with another breakout, one which took SUSHI above the $1.75 area, which previously acted as a resistance.

At the time of writing, SUSHI was trading very close to the $2.35 resistance area, which is the 0.618 Fib retracement level of the most recent drop. If a breakout occurs, SUSHI could rally all the way to $3.50.

A closer look at the movement reveals that SUSHI has been following an ascending support line since it reached the previous low on Nov. 5. The support line was accentuated by a validation on Nov. 26 which created a bullish hammer.

Technical indicators are bullish and support an eventual breakout above the $2.35 resistance area.

Channel Breakout

The shorter-term two-hour chart shows that SUSHI has broken out from an ascending parallel channel, a sign that the move is impulsive instead of corrective.

Afterward, it has somewhat retested the resistance line of the channel before moving upward again.

Therefore, the channel breakout supports the possibility that SUSHI will continue increasing and break out above the previous resistance levels.

However, the RSI shows a significant bearish divergence, indicating that SUSHI is likely to decline once more in the short-term before resuming its upward movement.

Wave Count

Cryptocurrency trader @TheTradingHubb outlined a SUSHI chart, showing a bullish movement that would take the price all the way to $3.20.

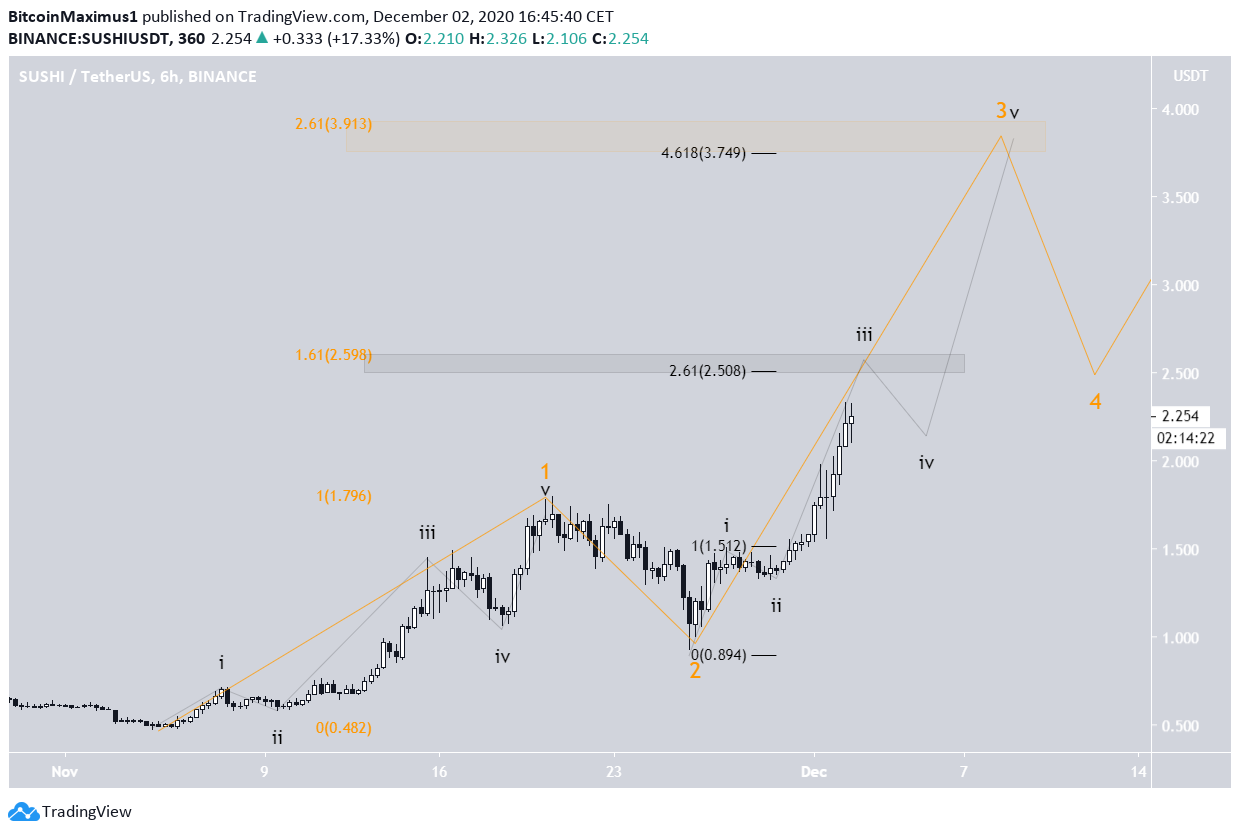

Since the previous Nov. 5 low, the SUSHI price has likely begun a bullish impulse (shown in orange below), currently trading in an extended wave three. The sub-wave count is shown in black.

The most likely target for the top of wave three is found between $3.75 and $3.91 (highlighted in orange), the 2.61 Fib extension of wave one (orange), and the 4.61 Fib extension of sub-wave one (black).

On the other hand, the most likely top for the end of sub-wave three is found between $2.50 and $2.60 (highlighted in black), the 1.61 fib extension of wave one and the 2.61 extension of sub-wave one.

Conclusion

To conclude, the SUSHI price should continue increasing towards the resistance levels at $2.35 and possibly $3.80. While short-term declines could occur, it seems that SUSHI is in a bullish impulse.

For BeInCrypto’s latest Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto