Sui (SUI), a Layer-1 blockchain, has recently experienced substantial growth, particularly in daily transaction volume. In tandem with this spike in activity, SUI’s price has climbed by 10% in the last 24 hours.

As network activity accelerates, could SUI’s price be in pole position for a significant rally? This analysis looks at the key factors driving Sui’s transaction boom and how the development could fuel a breakout in the coming days.

SponsoredStablecoin and Meme Coins Join Forces to Help Sui

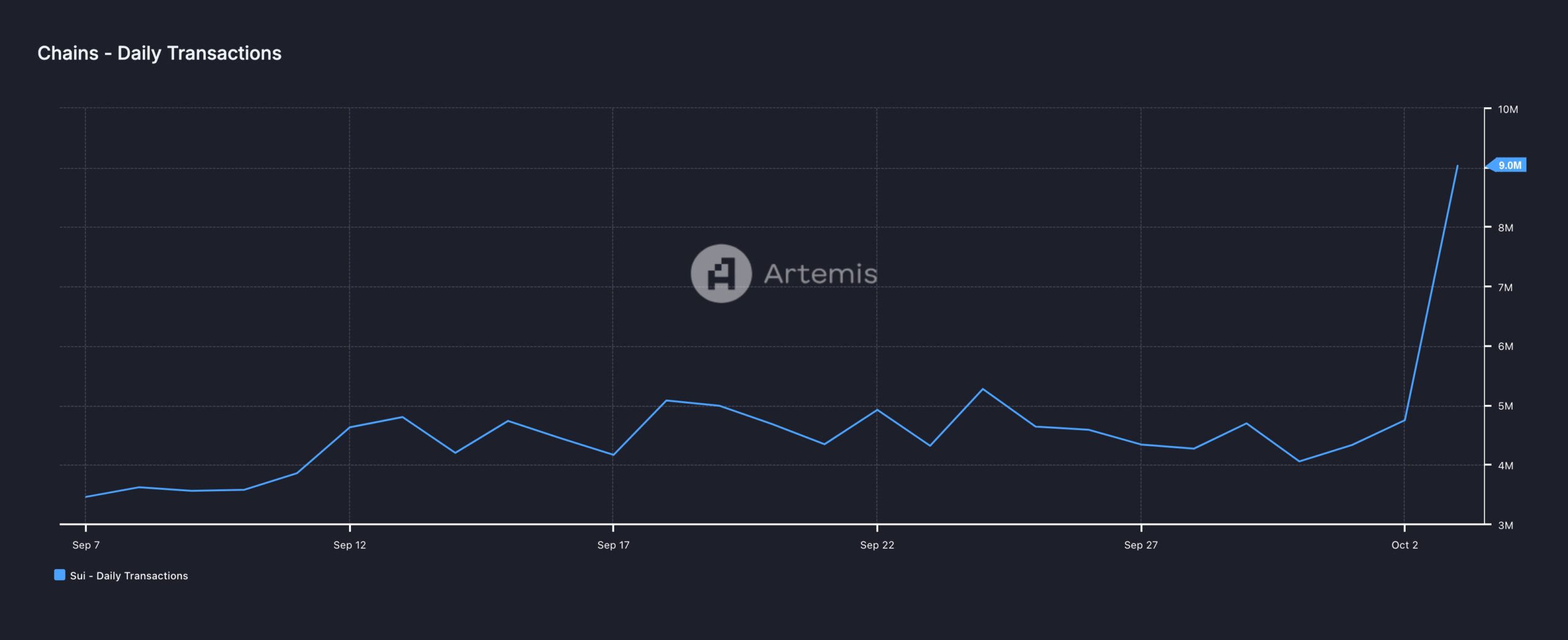

On October 2, the number of daily transactions on Sui was 4.8 million. One day later, the transaction count rose to nearly 9 million, indicating a notable 85% increase within 24 hours, and has held that threshold since then.

The surge in transactions implies a notable increase in interacting with the blockchain as well as rising demand for the SUI token. From BeInCrypto’s investigation, the hike could be linked to the launch of the Circle (USDC) stablecoin on Sui some weeks ago.

Beyond that, the growth of meme coins on the network has also played a market part. For instance, sudeng (HIPPO), the meme coin with the highest market cap on the network, has seen its price increase by 165% in the last seven days, while another one — aaa cat (AAA), jumped by 370%.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

This surge in transactions could also serve as proof that Sui could be a clear Solana competitor, as we previously analyzed.

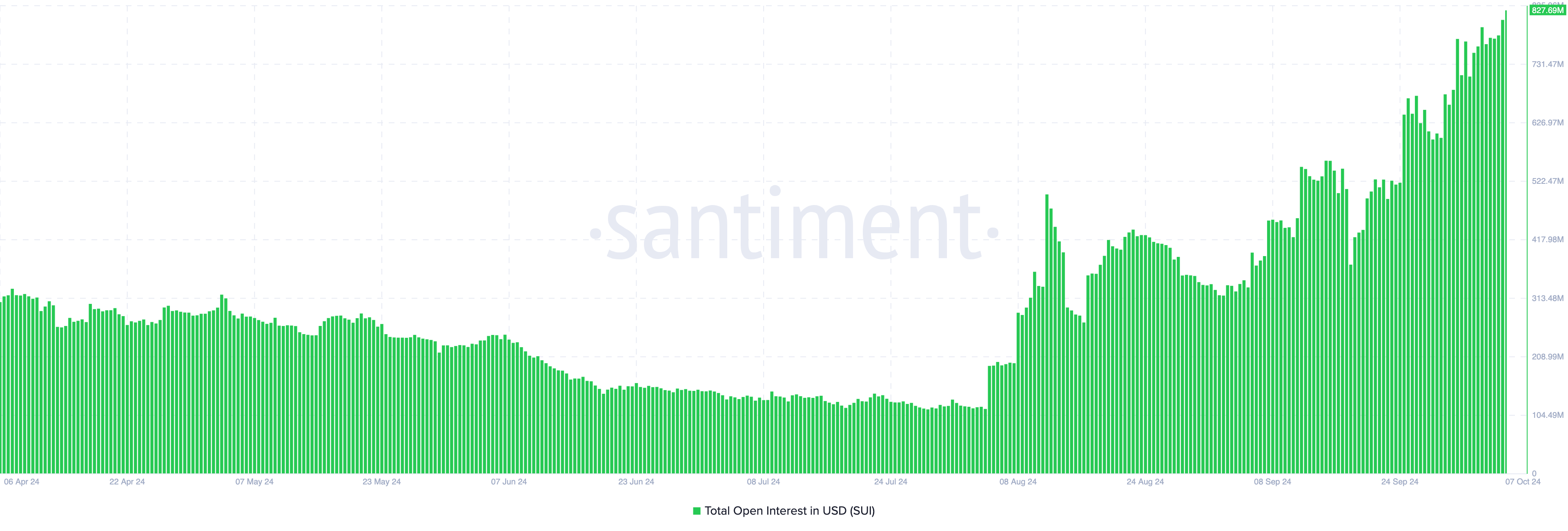

Amid these developments, Sui’s Open Interest (OI) has also climbed. As of this writing, OI stands at $827.69 million, nearing its yearly high. A rise in OI indicates increasing market liquidity, while a decline suggests traders are closing positions and withdrawing funds.

SponsoredWith OI rising and SUI’s price trending upward, the token could reach a higher value as more liquidity flows into the market.

SUI Price Prediction: 20% Hike Likely From Here

Currently, SUI’s price is $1.92 and is 12% away from hitting a new all-time high. On October 4, the altcoin had initially dropped to $1.66 after exhibiting readiness to hit $2. This development erased hopes that SUI would break the threshold again.

But as it stands, the token could be set to rise above the region. One reason for this forecast is the Exponential Moving Average (EMA). The EMA places great significance on recent price movements to determine the next trend.

Usually, when the price is below the EMA, the trend is bearish. But when it is above, the price trend is bullish. At press time, SUI’s price is above both the 20 EMA (blue) and 50 EMA (yellow).

Read more: Top 9 Safest Crypto Exchanges in 2024

Should this remain the same, SUI’s price could surpass its all-time high of $2.18, potentially rising by 20% to reach $2.30. However, this rally may stall if holders start taking profits before it hits $2. In that scenario, SUI’s price could retrace to $1.66, reflecting a pullback as selling pressure increases.