SUI has experienced significant volatility in recent weeks, with its price fluctuating amidst a 30% decline. This decline has been accompanied by rising outflows as investors and traders react to the altcoin’s uncertain short-term outlook.

However, despite these challenges, SUI has managed to hold above the crucial $2.00 support level.

SUI Traders Are Skeptical

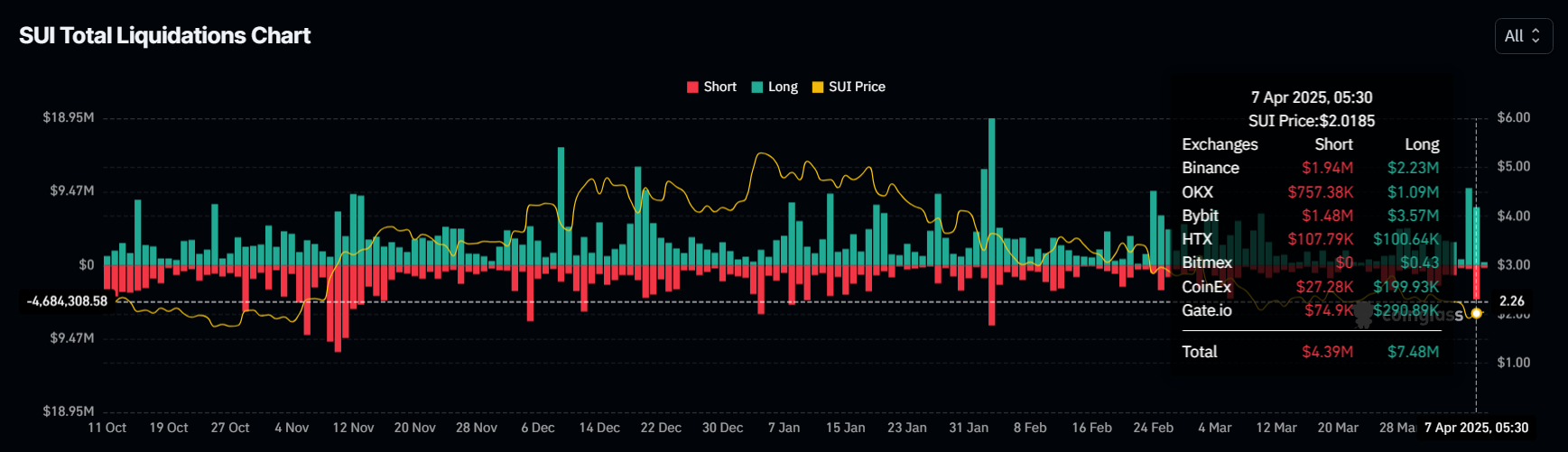

Data from futures markets reveals that SUI recently experienced a two-month high in short liquidations, contributing to a total of $12 million in liquidations over a single day. These liquidations reflect the increased skepticism among traders, as many were forced to close their positions amid a rising bearish sentiment. The liquidations highlight the challenges faced by SUI traders, whose bullish outlook failed to materialize.

Despite the short liquidations, the volatility and liquidation events may have contributed to investor caution. The actions of traders, who quickly pulled their positions in the face of adversity, further underscore the uncertain sentiment surrounding the asset. With this pressure on traders, the market could see less buying activity in the near term, keeping bullish momentum subdued.

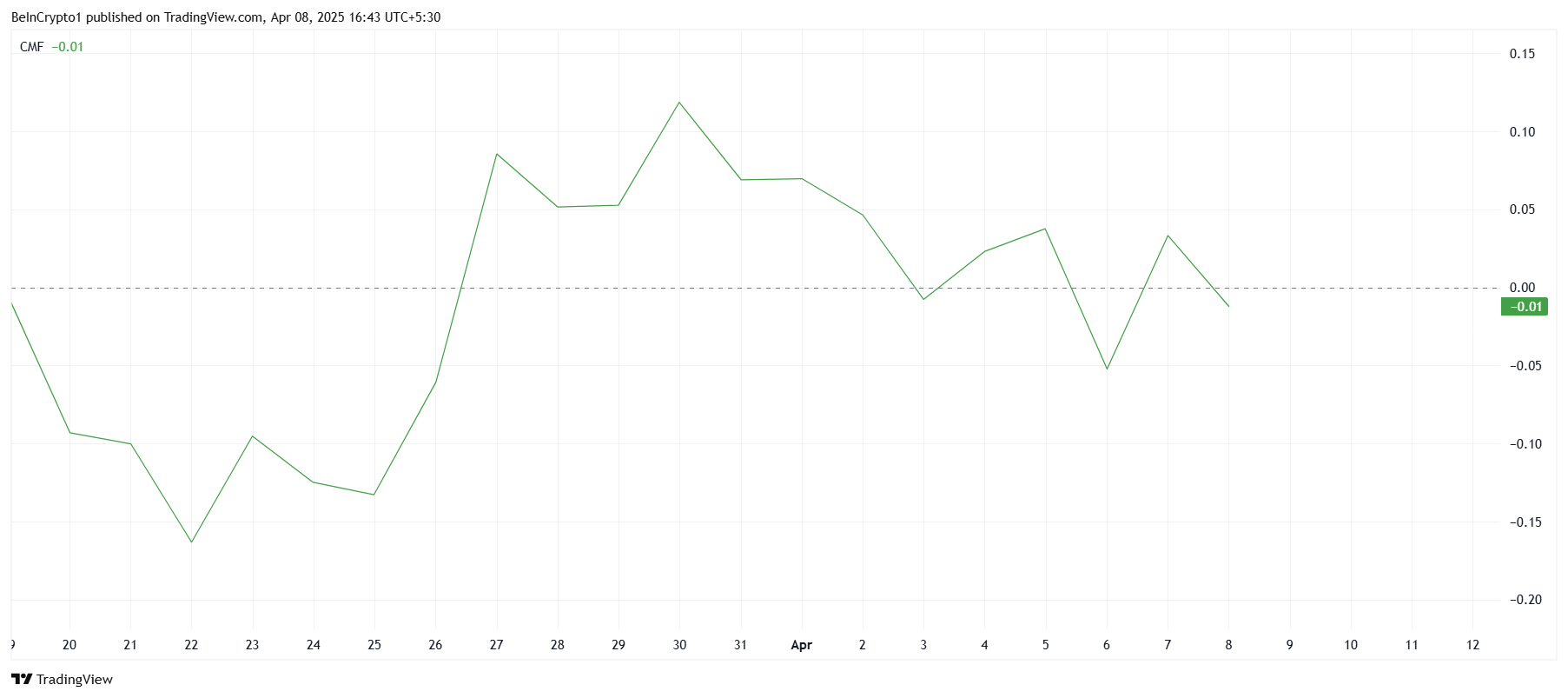

On a broader scale, the Chaikin Money Flow (CMF) indicator, which tracks capital inflows and outflows, signals rising skepticism about SUI’s price trajectory. Since the beginning of the month, the CMF has moved below the zero line, reflecting more outflows than inflows. This suggests that investors are hesitant, and the lack of buying pressure could hinder any immediate price recovery.

Given that the CMF is an essential indicator of market sentiment, its position below zero adds weight to concerns regarding SUI’s current market position. As the outflows continue, skepticism is likely to persist, making it more difficult for the altcoin to achieve sustained upward movement.

SUI Price Is In Danger

SUI’s price currently stands at $2.04, having dipped 30% over the past ten days. Despite this drop, the altcoin has managed to hold above the $2.00 support level, indicating some resilience.

If the bearish sentiment continues, SUI could face a further decline, with $1.75 potentially acting as the next level of support. Should the current trend persist, SUI’s inability to maintain its position above $2.00 could lead to additional losses.

However, if SUI secures $2.22 as support and rallies from there, it could reclaim upward momentum and push past the resistance at $2.47. Should SUI surpass $2.77, the bearish outlook would be invalidated, opening the door for potential growth.