Layer-2 (L2) token STRK is today’s top gainer, soaring over 20% in the past 24 hours. This rally comes amid a surge in network activity and liquidity on Starknet, following the network’s launch of Bitcoin staking on its mainnet on September 30.

With this uptick in on-chain participation driving renewed demand for STRK, the altcoin could be poised for further upside in the near term.

STRK Soars as Bitcoin Staking Ignites On-Chain Activity

Last week, Starknet, in partnership with LayerZero, an advanced omni-chain interoperability platform, rolled out Bitcoin staking on its mainnet. The integration allows BTC to participate in network consensus, where the STRK token holds a 75% majority weight while BTC contributes 25%.

While users cannot stake BTC directly on the L2, Starknet supports wrapped BTC variants such as WBTC, LBTC, tBTC, and SolvBTC, each featuring a reward pool.

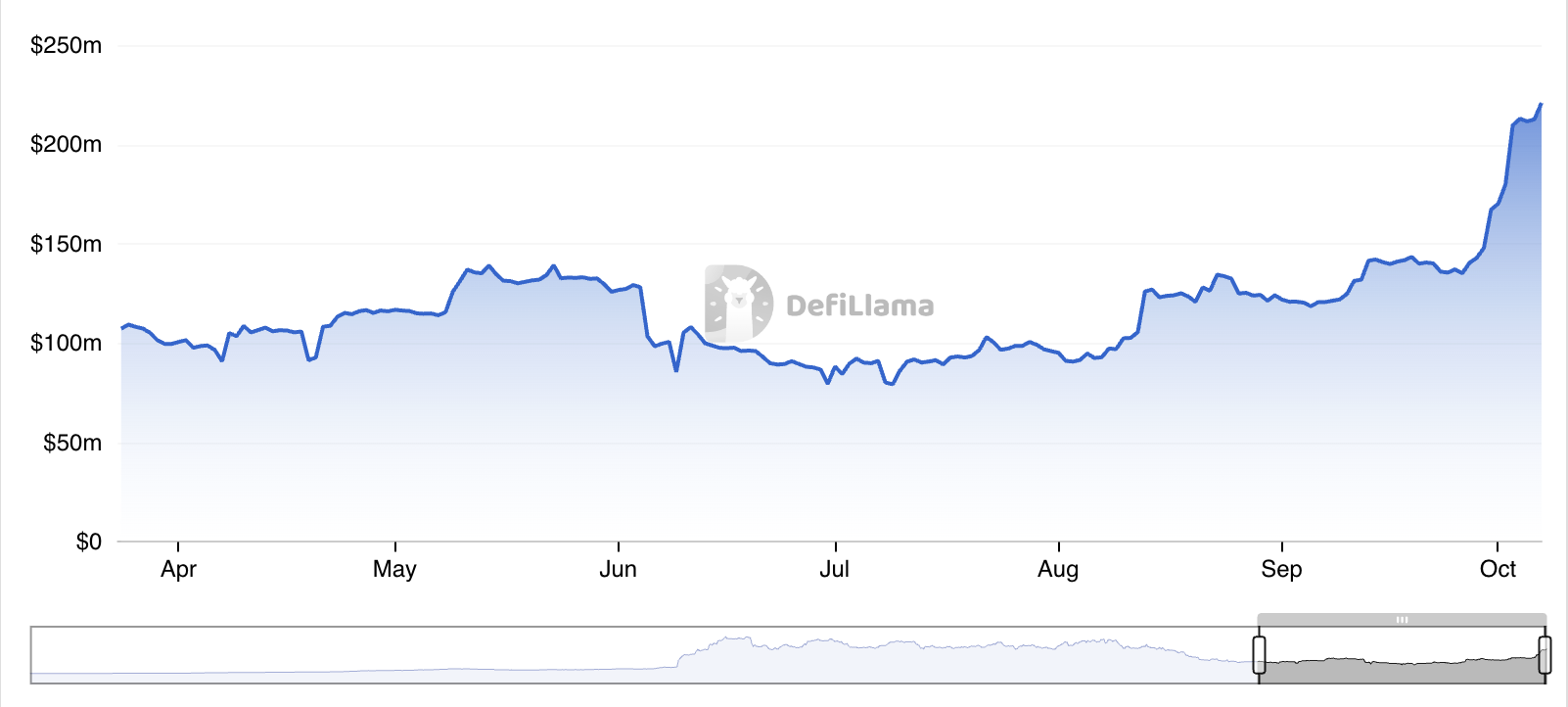

This development has triggered a surge in user engagement and liquidity across the network. For example, the network’s decentralized finance (DeFi) total value locked (TVL) sits at $221.04 million, up 37% since September 30, when Bitcoin staking went live on the protocol.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The spike in TVL signals a clear increase in on-chain activity, as users lock more assets to participate on Starknet.

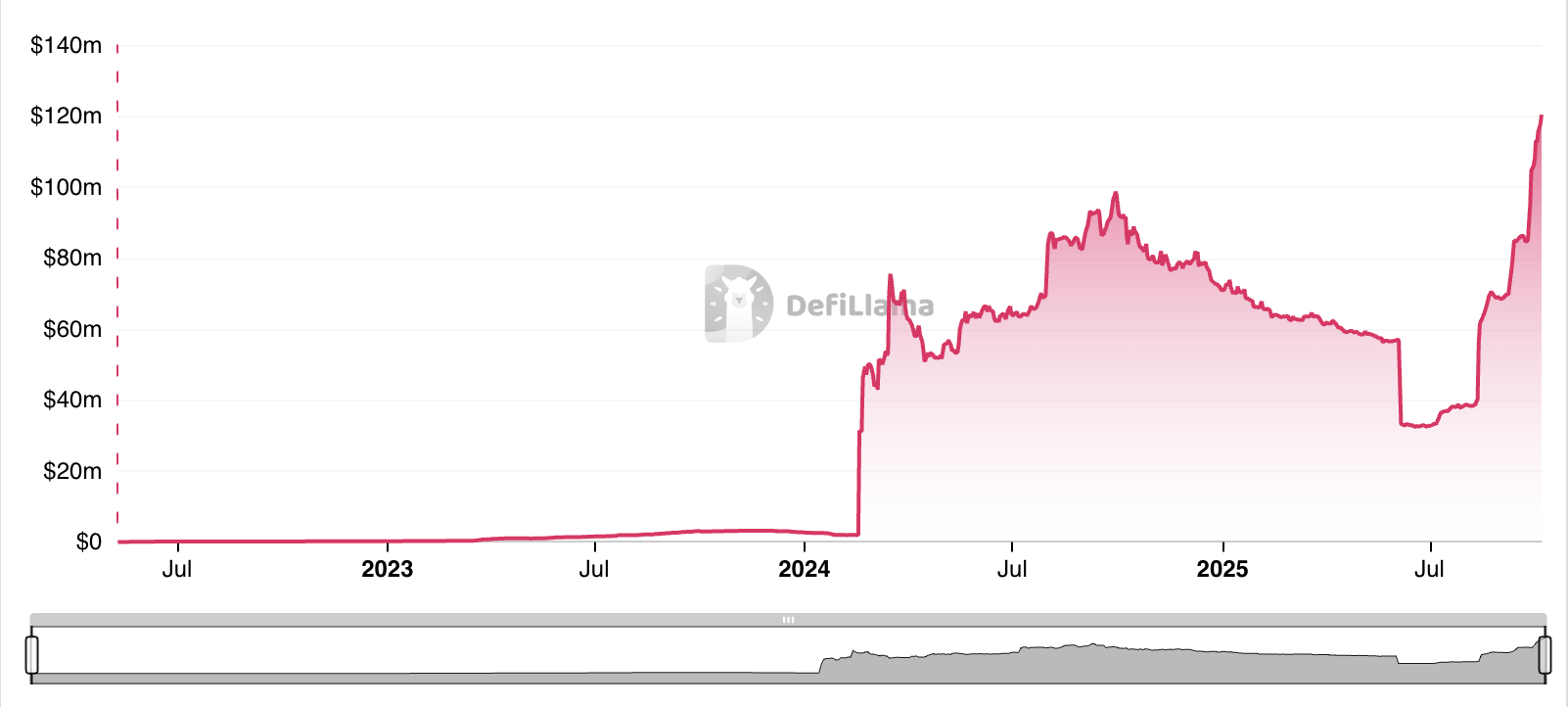

Furthermore, stablecoin liquidity on the L2 has risen by 13% in the past week, confirming sustained liquidity inflows into the chain. Per DefiLlama data, this stands at an all-time high of $118 million, up 11% since September 30.

Stablecoins often serve as a proxy for on-chain liquidity and user participation. Therefore, their recent uptick on Starknet since Bitcoin staking went live suggests that investors are moving funds onto the network in anticipation of higher yields and greater utility.

STRK Traders Target $0.25 if Bulls Hold the Line

This combination of heightened liquidity and growing user participation has strengthened bullish sentiment around STRK. The token trades above its Super Trend indicator on the daily chart, confirming the buy-side pressure among spot market participants.

At press time, this indicator forms dynamic resistance below STRK at $0.1408.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

When an asset’s price trades above its Super Trend indicator, buying pressure dominates the market. If this trend holds, it could drive STRK’s price above $0.1987 and towards $0.23

However, a resurgence in profit-taking could invalidate this bullish outlook. In that scenario, the token’s price could fall to $0.1012.