Donald Trump has followed through on his promises and signed an executive order to establish a Strategic Bitcoin Reserve and a separate US Digital Asset Stockpile.

While some industry figures have lauded the order, others remain skeptical. They argue that the initiative is little more than a rebranding of existing government holdings with no substantive new strategy.

Donald Trump Signs Order for Strategic Bitcoin Reserve

The order directs the US Department of Treasury to initially fund the Strategic Bitcoin Reserve with BTC seized through criminal and civil asset forfeiture. The administration has vowed not to sell these assets.

“Bitcoin, the original cryptocurrency, is referred to as “digital gold” because of its scarcity and security, having never been hacked. With a fixed supply of 21 million coins, there is a strategic advantage to being among the first nations to create a Strategic Bitcoin Reserve,” the order read.

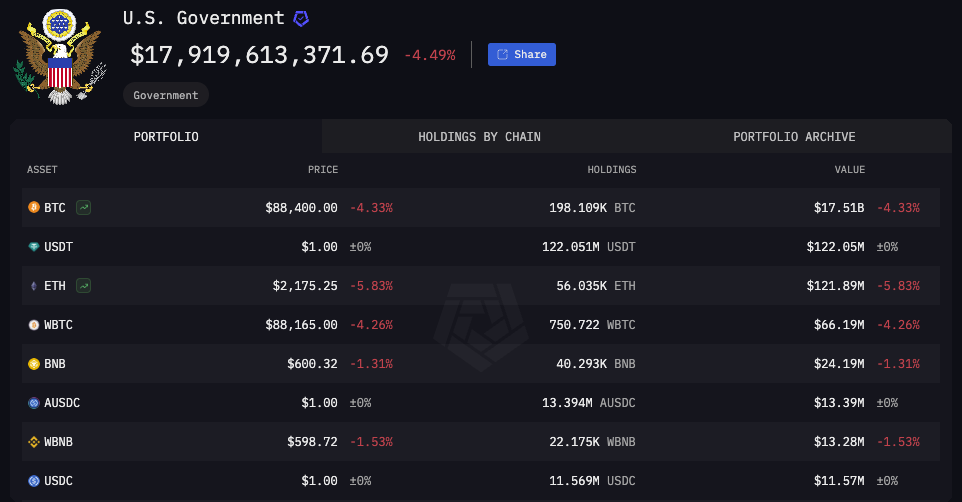

Arkham Intelligence data shows that the US government holds 198,109 BTC in its public wallets, valued at $17.5 billion at current market prices.

Despite this substantial holding, David Sacks, the White House’s AI and Crypto Czar, noted that a comprehensive audit of the government’s digital assets has never been conducted. The new executive order mandates this accounting.

“Premature sales of Bitcoin have already cost US taxpayers over $17 billion in lost value. Now the federal government will have a strategy to maximize the value of its holdings,” he wrote.

It also authorizes budget-neutral strategies for potentially acquiring more Bitcoin. Yet, critics argue that the reserve lacks substantive impact.

Industry Experts Divided on Strategic Bitcoin Reserve

Jacob King, founder of WhaleWire, dismissed the recent attention around the reserve.

“In reality, this has existed for over a decade—they’re just slapping a fancy title on it to appease Bitcoiners,” he remarked.

King also pointed out that the reserve would not involve any new Bitcoin purchases. Therefore, he believes, this makes the move largely insignificant in the grand scheme of the market.

Peter Schiff, an outspoken critic of Bitcoin, also weighed in on the order. According to Schiff, the move was made under pressure from donors and conflicted cabinet members.

He described the order as a “bogus” attempt to capitalize on the Bitcoin the government already holds.

“If they seize any more Bitcoin they can keep that too. But they can’t buy any more, as buying by definition requires a payment,” Schiff posted.

Despite the criticisms, some industry leaders see the order as a significant step toward legitimizing Bitcoin on the world stage.

“The end game was never the US government buys all of the world’s Bitcoin,” Ryan Rasmussen, Head of Research at Bitwise, said.

Rasmussen explained that the move will likely prompt other countries to buy Bitcoin. He also expects it to pressure wealth managers, financial institutions, pensions, and endowments to adopt the cryptocurrency.

The reserve, Rasmussen said, will alleviate concerns about the US selling its holdings and may pave the way for future acquisitions. He added that the move increases the likelihood of US states adopting Bitcoin.

Matt Hougan, CIO at Bitwise, also concurred. He pointed out that the order could significantly reduce the likelihood of future Bitcoin bans. Hougan added that the reserve,

“Accelerates the speed at which other nations will consider establishing strategic bitcoin reserves, because it creates a short-term window for nations to front-run potential additional buying by the US.”

Analyst Nic Carter also praised the decision, calling it a successful fulfillment of a key campaign promise. He highlighted that Bitcoin had received official US government approval, a distinction not granted to other cryptocurrencies. Carter emphasized that using no taxpayer funds helped shield the initiative from backlash.

“Announcement couldn’t have gone better,” he claimed.

The signing of the executive order took place just one day before the White House Crypto Summit. Initially, it was anticipated that Trump would sign the Bitcoin reserve order at the summit, which had driven Bitcoin prices up. Nonetheless, the actual signing led to a dip in the cryptocurrency’s value.

After briefly regaining that level on March 5, Bitcoin dropped below $90,000 again. At press time, Bitcoin was trading at $87,469, marking a 4.5% decrease over the past 24 hours.