Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee, as financial markets are flashing warning signs eerily similar to those seen before some of the biggest crashes in modern history. This time, however, analysts and traders are debating whether Bitcoin (BTC), trading above $120,000, can escape the gravitational pull of a potential equity market collapse.

Crypto News of the Day: Stock Market Crash Warnings Mount — Will Bitcoin and Ethereum Soar or Sink?

Robert Kiyosaki, who featured in a recent US Crypto News publication, warns that stock market crash indicators warn of a massive crash. In his view, this could be good news for gold, silver, and Bitcoin owners but a severe blow for Baby Boomers with heavy exposure to 401(k) plans.

Some of those indicators are found in the bond market, with Financelot, a market commentator, highlighting a historical correlation between spikes in the US 3-month Treasury yield and major market meltdowns.

Today, the yield’s pattern mirrors those pre-crash peaks, including March 2002, September 2008, and February 2020. This has raised fears that history may repeat itself.

Meanwhile, not everyone buys into the narrative that Bitcoin will rally if traditional markets falter. Commentator Beka challenged Kiyosaki’s optimism, arguing that Bitcoin has been absorbed into the conventional financial (TradFi) system and is unlikely to decouple during a stock market crash.

Gold, often a safe-haven asset, has also faced headwinds. It tumbled the most in three months on reports that the US may clarify its tariff policy on bullion.

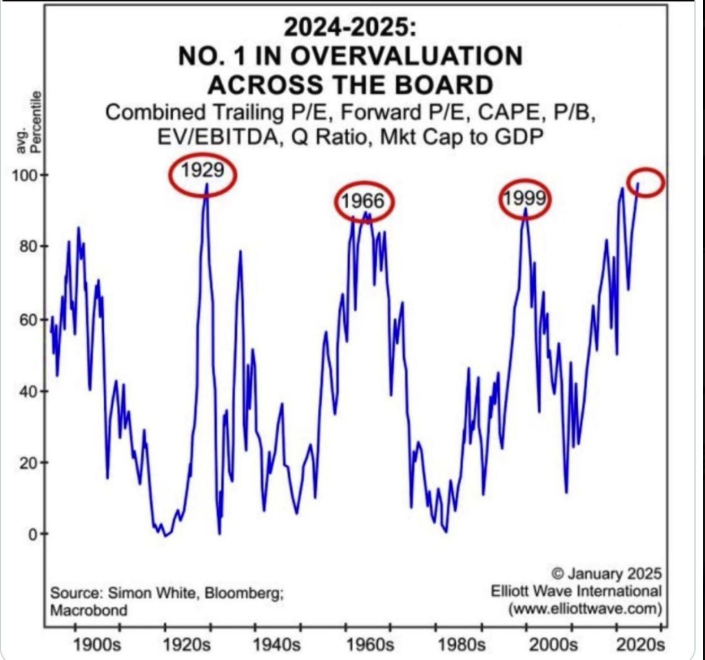

Against that backdrop, US equities are at their most expensive valuation since the Great Depression, adding another layer of risk.

Still, crypto traders remain focused on short-term catalysts, with Bitcoin reclaiming the $122,000 mark. Analyst Ted Pillows notes that altcoins had dominated last week, but a softer CPI reading due tomorrow could trigger a Bitcoin surge to new all-time highs.

Global Market Turmoil Tests Crypto’s Safe-Haven Status

Ethereum, meanwhile, continues to attract institutional attention. Investment firm BitMine has more than doubled its ETH holdings in a week, now controlling 1.2 million ETH worth $4.96 billion.

The firm’s stock has climbed, and Wall Street’s liquidity rankings reflect strong investor interest in the second-largest cryptocurrency.

Globally, market instability is not confined to the US. Iran’s stock market has shed over 75% of its dollar value since 2020, highlighting the fragility of emerging markets.

The central question now is whether Bitcoin will follow the script of past market downturns or finally break free. History suggests that even alternative assets can get caught in the sell-off when fear grips Wall Street.

But with inflation data, Fed policy shifts, and deepening institutional crypto adoption in play, the stage is set for a high-stakes test of Bitcoin’s resilience.

Charts of the Day

This chart shows the US 3-month Treasury yield’s technical indicators before the June 2002, September 2008, and February 2020 stock market crashes. Current yield patterns closely resemble past peaks, raising fears of another potential market downturn.

A long-term view of the U.S. 3-month yield reveals a recurring 40-year trend, with spikes preceding major market crashes. The latest surge matches historical pre-crash levels, hinting that the cycle may be repeating again in the current market.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- The Ethereum developer has been reportedly detained in Turkey.

- Four US economic indicators to watch this week as Bitcoin reclaims $122,000.

- Lido price jumps 58% in five days as LDO active addresses hit two-year high.

- BNB’s price is $1,200 after overtaking Nike in market capitalization.

- Bitcoin’s next all-time high could be close as two indicators signal more upside.

- Two factors suggest Solana could soon break past the $190 mark.

- Ripple’s $3.28 billion Escrow unlock derails XRP price breakout.

- Three altcoins are at risk of major liquidations in the second week of August.

Crypto Equities Pre-Market Overview

| Company | At the Close of August 8 | Pre-Market Overview |

| Strategy (MSTR) | $395.13 | $406.00 (+2.75%) |

| Coinbase Global (COIN) | $310.54 | $320.50 (+3.31%) |

| Galaxy Digital Holdings (GLXY) | $27.78 | $28.90 (+4.03%) |

| MARA Holdings (MARA) | $15.38 | $15.86 (+3.12%) |

| Riot Platforms (RIOT) | $11.08 | $11.46 (+3.43%) |

| Core Scientific (CORZ) | $14.41 | $14.23 (-1.25%) |