Stellar (XLM) is showing renewed momentum, up 10% in the last 24 hours and over 25% in the past 30 days. Despite the rally, XLM has remained below the $0.30 mark since March 2, struggling to reclaim that key psychological level.

Recent technical signals—including a sharp rise in RSI, a positive CMF shift, and a potential golden cross—are drawing attention from traders. As bullish momentum builds, XLM now faces a critical test at the $0.279 resistance zone.

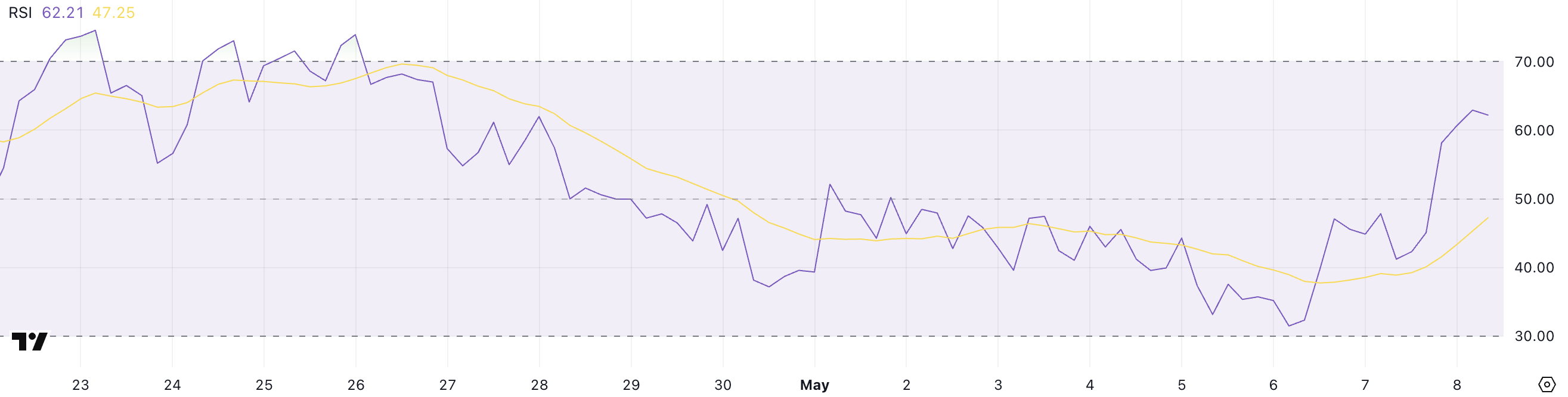

Stellar RSI Surges—Is XLM Gearing Up for a Breakout?

Stellar has seen its Relative Strength Index (RSI) jump sharply to 62.21, up from 31.47 just two days ago.

This steep rise signals a surge in buying momentum, as XLM rebounds from oversold territory.

Such a move often reflects a shift in sentiment, with traders rotating back into the asset after a period of weakness. If this momentum continues, XLM could be setting up for a bullish breakout in the short term.

The RSI is a technical indicator used to measure the speed and change of price movements. It ranges from 0 to 100, with values below 30 generally considered oversold and values above 70 considered overbought.

Readings between 50 and 70 typically indicate growing bullish momentum. With RSI now at 62.21, XLM is gaining strength but still has room to run before hitting overbought conditions.

This suggests there may be more upside potential if buyers continue stepping in, though traders should stay alert for signs of exhaustion as the RSI approaches 70.

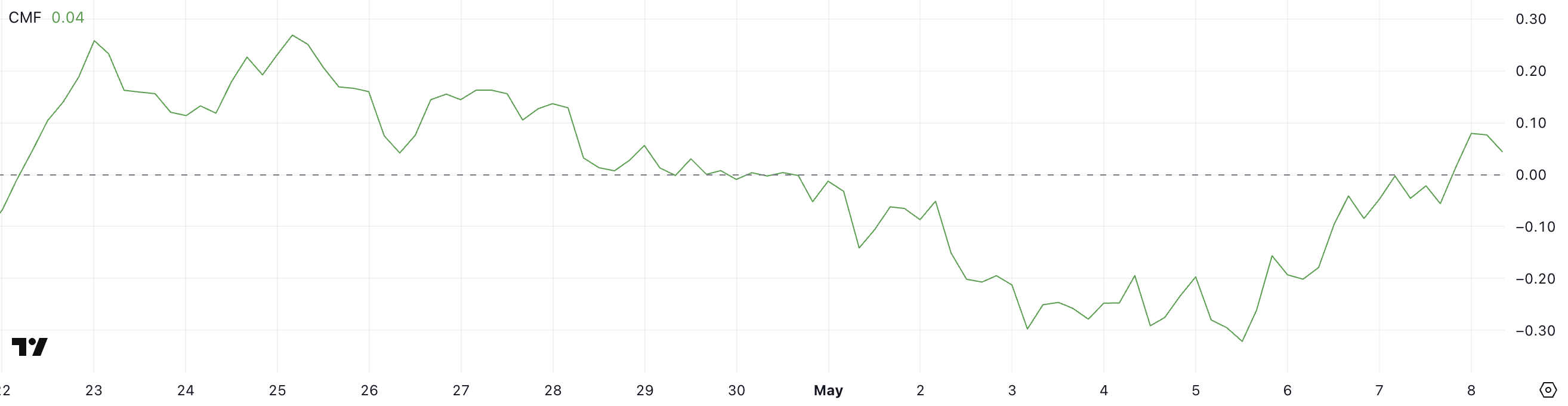

Stellar CMF Turns Positive, But Buying Pressure Remains Cautious

Stellar’s Chaikin Money Flow (CMF) indicator currently sits at 0.04, rebounding from -0.32 just three days ago.

This return to positive territory signals a short-term shift toward buying pressure, though it has pulled back slightly from 0.08 earlier today.

While the bounce is encouraging, the CMF hasn’t broken above the key 0.10 level since April 28, suggesting that sustained capital inflows remain limited for now.

The CMF measures the volume-weighted flow of money into and out of an asset over a set period. It ranges between -1 and +1, with values above 0 indicating buying pressure and values below 0 signaling selling pressure.

A CMF reading above 0.10 typically confirms strong accumulation, while readings near zero reflect indecision or weak conviction.

With XLM’s CMF at 0.04, the market is showing early signs of accumulation, but not enough to confirm a strong bullish trend. For further upside, XLM would likely need to see CMF push consistently above 0.10.

XLM Eyes Breakout as Golden Cross Nears

Stellar price is currently trading in a narrow range between resistance at $0.279 and support at $0.267.

Its EMA lines are tightening, and a golden cross may be forming soon—a bullish signal that occurs when the short-term EMA crosses above the long-term one.

If XLM breaks above $0.279, it could rally toward $0.30, with further upside targets at $0.349 and $0.375. Should bullish momentum remain strong, a move to $0.443 is also possible.

However, if the breakout fails, XLM could fall back to $0.267 support. A breakdown below that level would expose the token to $0.25, followed by $0.239 and $0.230.

Beyond technicals, concerns about supply concentration remain in focus—data shows the top 10 XLM wallets hold nearly 80% of the circulating supply. Binance’s XLM balance has also grown from 180 million to 1 billion since late 2023, raising the risk of volatility if large holders sell.

Still, adoption is growing. Stellar’s tokenized real-world asset (RWA) market has surged 84% in 2025, with key players like Franklin Templeton and Circle helping drive over $500 million in on-chain value.