Staking Adoption: A new survey has thrown light on why cryptocurrency holders hesitate when it comes to staking their crypto.

The company that commissioned the survey, is liquid staking platform Claystack. They surveyed 999 respondents who actively invest in proof-of-stake cryptos, and hold $5,000 worth, or more. Survey participants came from Europe, Asia, and the United States.

Mohak Agarwal is the CEO of ClayStack. “The findings confirm our belief that for staking to reach mainstream adoption, users must not be forced to lock up their crypto in order to receive passive returns from staking. Staking must evolve in order to provide users the benefits of staking while also allowing them to participate in the DeFi ecosystem – this is where liquid staking comes in, which we believe is the future of staking.”

To get around the lock-up period, 15% of respondents said they would do liquid staking. With liquid staking, people can stake their crypto, but still have that amount freely available to use elsewhere in the form of a token.

Staking Adoption: Key Findings

-People that don’t have any plans to stake won’t change their mind because of lock-ups, hacks, and technical risk.

-But 45% would change their opinion and be willing to stake. The condition? If returns were 15% or higher.

-The most popular way to stake? Setting up their own validator node. There are other popular ways to stake crypto. These include using a third-party staking service. Or they stake through an exchange.

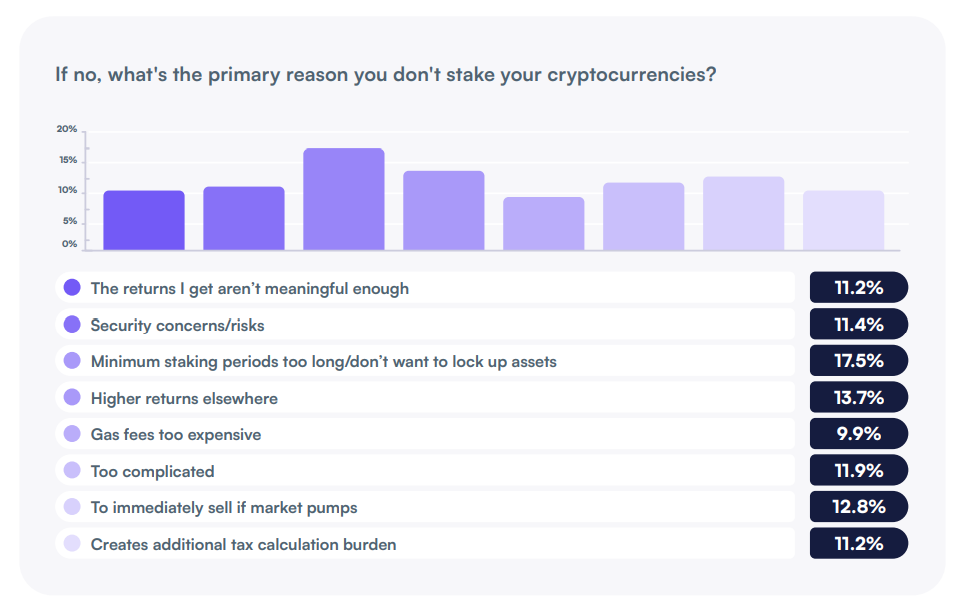

– The main reason why respondents don’t stake? So they don’t have to lock up their assets for a protracted period of time.

-Others don’t stake because they find higher returns elsewhere. They are also worried that they won’t be able to sell immediately if the market becomes volatile.

-People would change their mind on staking if they could use a lower minimum amount. They also want clearer tax regulations when it comes to staking.

-When it comes to staking, hacks are the major concern. Other worries are validator risk, market volatility risk, opportunity cost, and lock-ups or lack of liquidity.

-56% of people surveyed plan to stake in the next year. This includes people who haven’t staked before. Most planned to stake 20% to 30% of their portfolio. And they expected a 15% return for staking.

Got something to say about staking adoption or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.