Stablecoins continue to break into the mainstream due to their use in settling cross-border payments and in the process reached a new milestone in adjusted transaction volume in August.

Stablecoins have become a major part of the decentralized finance industry after their launch in 2014. The use of stablecoins in cross-border transactions is far cheaper and faster than in centralized systems.

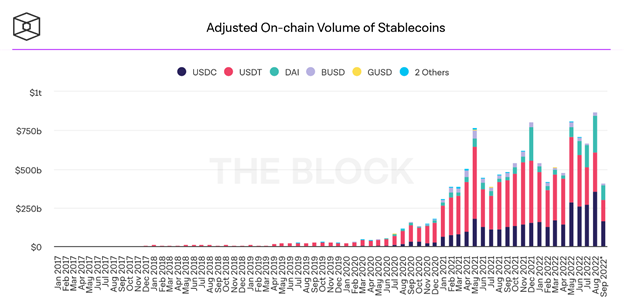

This has led to an adjusted on-chain volume of approximately $866 billion throughout August.

In August of 2021, the crypto market bounced back from a brief bearish period that began three months prior. It was during this time that due BTC was removed as a payment method for Tesla-related products. In terms of stablecoin volume, August 2022 was an 86% year-over-year (YoY) gain from August 2021’s figure of $464 billion.

Stablecoin volume reached an all-time high in August

In May 2021, the market stalled soon after Ethereum (ETH), Internet Computer (ICP), and other digital assets reached then all-time highs. As investors sought to exit positions and trade assets, stablecoin usage became more popular. As a result, adjusted on-chain volume for May 2021 was roughly $766 billion led by Tether’s (USDT) share of $463 billion.

Another market decline followed in May 2022, exacerbated by the collapse of the algorithmic stablecoin, TerraUSD (UST (currently USTC)), and a wider crackdown of digital assets by China and other crypto-unfriendly countries. Investors moved to stablecoins again causing a spike in adjusted on-chain volume to about $808 billion. While still being a lower volume than April, May 2022’s figure marked a 5% increase year-over-year.

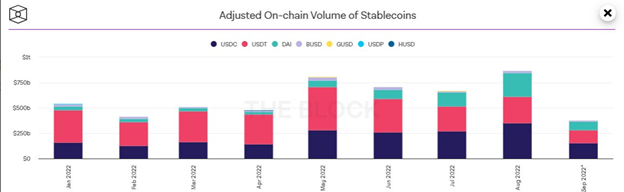

Despite volume plunging to $668 billion in July, the adjusted on-chain volume of stablecoins reached a peak of $866 billion in August. USDC, USDT, DAI, and BUSD made up a majority of the volume.

Soaring transaction counts

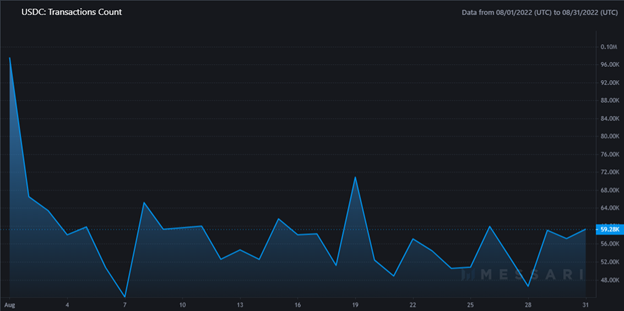

USDC had the lion’s share in volume with roughly $353 billion, corresponding to 41% of the total volume. The total transaction count for August was 1.8 million, a ~6% increase from July’s 1.7 million.

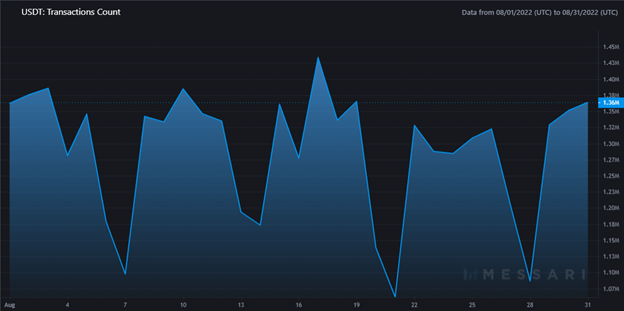

USDT came in second place at around $258 billion, representing 30% of the total on-chain adjusted volume. The total transaction count for August 2022 was 41 million, a 5% increase from July’s figure of 39 million.

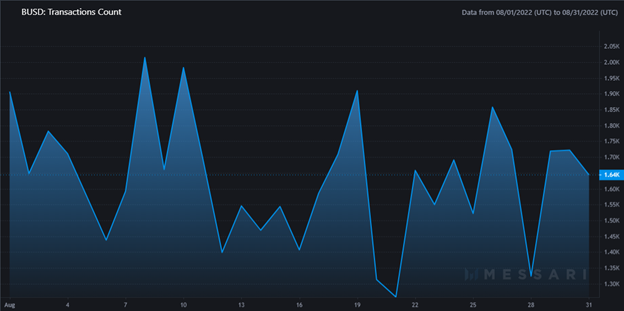

BUSD adjusted on-chain volume for August was $21 billion, corresponding to 2% of total volume. BUSD transaction count clocked in at 50,561.

DAI moved up the ranks

DAI which reached a then all-time high of $218 billion in adjusted on-chain volume in December 2021 plummeted in the first seven months of 2022, generating around $140 billion.

Contributing 27% of total volume, the Ethereum-based stablecoin shot back to $234 billion in August.

Are stablecoins a threat to the stability of centralized finance?

Reaching more than three-quarters of a trillion dollars in volume has raised eyebrows in the industry. Addressing an audience at the Brookings Institution in Washington, D.C., Michael Barr, the Vice Chair for Supervision of the Board of Governors of the Federal Reserve System said, “Stablecoins, like other unregulated private money could pose financial stability risks. History shows that in the absence of appropriate regulation, private money is subject to destabilizing runs, financial instability, and the potential for widespread economic harm.”

“I believe Congress should work expeditiously to pass much-needed legislation to bring stablecoins, particularly those designed to serve as a means of payment, inside the prudential regulatory perimeter,” he added.

With Barr’s submission at the event titled Making the Financial System Safer and Fairer, stablecoins could be seeing new regulatory oversight in the not-too-distant future.

Binance CEO gives his thoughts

Speaking at Binance Blockchain Week Paris 2022 on Sept. 14, Chanpeng Zhao, founder, and CEO of Binance exchange made it known that the Market in Crypto Assets (MiCA) regulation by the European Union (EU) is a little bit strict on stablecoins.

“The drafts are not adopting USD-based stablecoins, which have 75% of the liquidity in the market,” said Zhao.

Searching for answers to whether stablecoins are a threat to the global financial system, Be[In]Crypto reached out to Slava Demchuk, CEO of AMLSafe, PureFi, and AMLBot, an anti-money laundering (AML) program that checks crypto wallets for illicit funds.

“Stablecoins have become an essential part of the crypto economy, as well as the “classic” economy in some developing countries, complementing fiat payment methods. Stablecoins have clear advantages for their users – easy and cheap to store and transfer, exposure to fiat–denominated currency (such as USD, which is very important in the places where access to USD is limited), etc. However, some types of the stablecoins, such as the algorithmic ones, have recently created a disaster on the market by actually being very “unstable” and causing billions of losses for the crypto community. The other issue with not only stablecoins but all of the cryptocurrencies is money laundering and terrorist financing, which is actually fueled by the ease with which they can be obtained and transferred,” said Demchuk.

“With that in mind, I tend to believe that stablecoins are rather beneficial than posing a threat to the global financial system. They provide a flight to safety for the ones in the developing countries with high inflation increasing global inclusiveness in the global financial system. In addition, it becomes increasingly harder to conduct illegal activities using stablecoins – the tokens can be frozen or blacklisted by the eminent. Then, numerous crypto AML solutions analyze wallets and transactions to provide a risk score and sources/connections making it close to impossible for the bad actors to launder or hide the funds,” he added.

Demchuk concluded, “Furthermore, stablecoins can and will be regulated ultimately protecting their users from collapses as seen recently. At the end of the day, the stablecoins themselves are just tokens backed up by a fiat currency (such as USD), which should already relieve some Fed officials.”