St. Kitts and Nevis: Crypto holders can now use ‘electronic gold’ to get a passport to a tax haven. And you don’t even have to live there to get the passport. Here’s how.

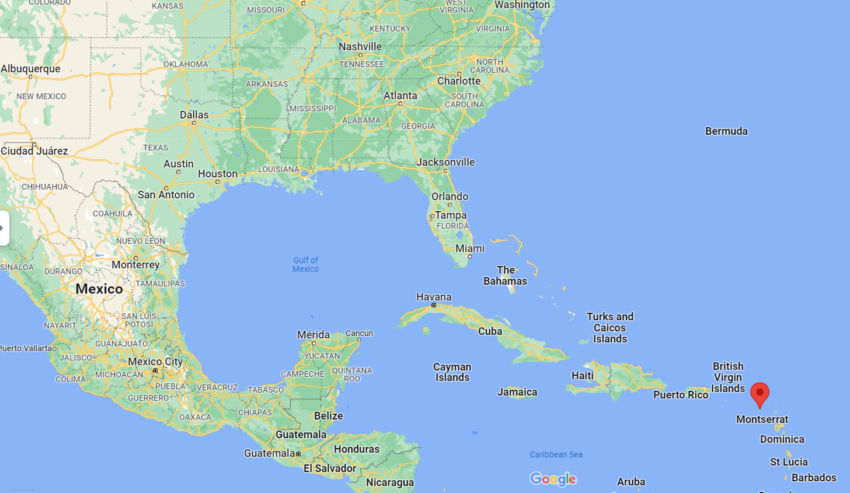

Saint Kitts and Nevis is an island country in the Caribbean. It is the smallest sovereign state in the Western Hemisphere. The island is part of the Commonwealth realm, with Elizabeth II as Queen and head of state.

This two-island nation is known for its warm and welcoming people. It has stunning beaches and beautiful mountains, and local culture is all about ‘limin’’ … hanging out, drinking, and talking.

Several well-preserved sugar plantations are now luxurious hotels. It’s a beautiful part of the world.

But here’s the interesting bit for crypto holders.

St. Kitts and Nevis has a citizenship by investment program. This has been established for quite some time, since deep in the 1980s. Investors can obtain a St. Kittian passport in exchange for an investment of $150,000. But now, suddenly, if you have 3.89 BTC to invest, a passport is as good as yours. As long as you aren’t a crim.

St. Kitts and Nevis: Crypto life

The crypto good life doesn’t end there. Once you have your new passport, you’ll be delighted to know that in St. Kitts and Nevis, crypto gains are not taxed. The small country in the West Indies doesn’t impose any capital gains tax on anything, including cryptocurrencies. Local banks work happily with crypto investors. The twin-island nation has Bitcoin ATMs placed throughout the country.

Savory & Partners is an accredited agent for multiple governments that helps people to get citizenship by investment. They say that cryptocurrencies may be shackled by a certain government or regulation. “In the US, for example, cryptocurrency investors can have a tough time dealing with their crypto-assets. Americans are notoriously excluded from certain new coin offerings, while the US Internal Revenue Service (IRS) taxes capital gains on profit made from cryptocurrency sales exceeding $10,000. But that is just the start of it. Let’s say a crypto investor sells Bitcoin worth about $68,000. A staggering $58,000 of that sum would be liable for capital gains tax.”

Savory and Partners say that Biden’s government is currently working on tax reform. “It will increase capital gains tax from 20% to a whopping 39.6%. This reform could destabilize, if not outright demolish, a cryptocurrency investor’s profit margin.”

St. Kitts and Nevis and the famous passport holders

Roger Keith Ver is a famous figure in crypto. He was an early investor in Bitcoin and is referred to as ‘Bitcoin Jesus.’ Savory and Partners say that Roger Ver has taken the plunge and got a St. Kitts and Nevis passport, renouncing his US one. Now he is living life to the fullest in the Caribbean. “Cryptocurrency gives people a certain degree of financial freedom, but its entire potential is unlocked through obtaining citizenship of a crypto-friendly, tax-favorable country like St. Kitts and Nevis. St. Kitts and Nevis’ citizenship by investment program has long been a route for high-net-worth individuals, to obtain greater global mobility, enhanced financial freedom, and a robust plan to mitigate political and economic instability.

“Those with more than one nationality enjoy greater travel, economic, and political freedom than single nationality holders. This sovereignty gives breath to an entirely different lifestyle, just as cryptocurrency destroys the shackles of centralized finance. Hence, it is only reasonable that both ventures go hand in hand.”

Freedom

There are a lot of thoughts at the moment around sovereignty and freedom. Individuality, identification, and cryptocurrency have been at the heart of these ponderings. As blockchain technology evolves, the allure of total freedom beckons.

Says Savoy and Partners, “Cryptocurrency is truly decentralized, giving its holders the freedom to roam free. Yet, there is another venture that provides similar advantages in terms of physical freedom; citizenship by investment. The intersection point of both cryptocurrency and citizenship by investment is clear – freedom. Combining Citizenship by Investment Programs with cryptocurrency elevates the degree of freedom, allowing a person to roam the globe along with their wealth.”

Other countries in this region are tax havens for cryptocurrency enthusiasts. Happy tropical islanding!

Got something to say about the St. Kitts and Nevis tax haven or anything else? Write to us or join the discussion in our Telegram channel.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.