SPX6900 (SPX) price has experienced sharp movements, rising 25% in the last seven days but dropping 15% in the past 24 hours amid a broader meme coin market correction.

The correction follows a period of overbought conditions, with technical indicators suggesting potential further downside or a possible reversal if buying momentum returns. The coming days will be crucial in determining whether SPX price can regain its bullish trend or face deeper corrections.

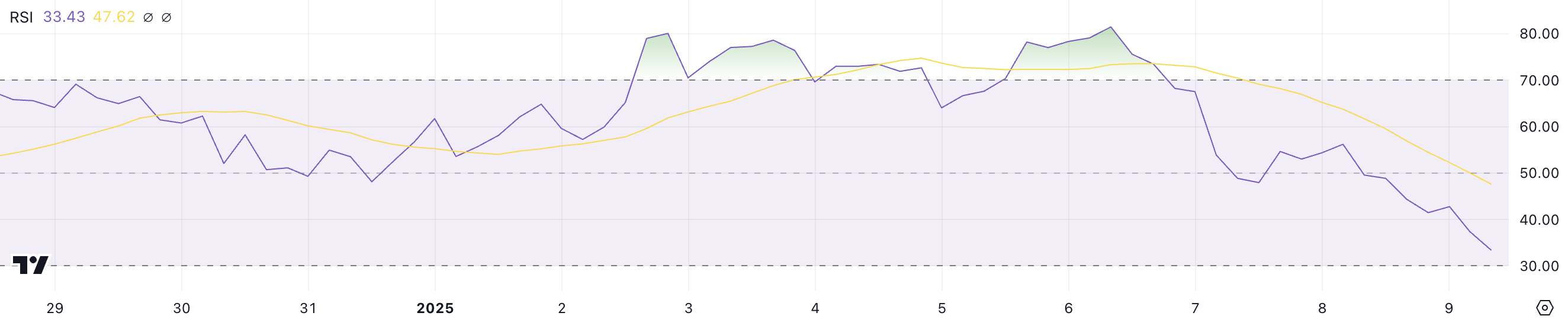

SPX RSI Dropped For Its Lowest Level In 20 Days

SPX Relative Strength Index (RSI) has sharply dropped to 33.4, a significant decline from its overbought level of 81.4 just three days ago. RSI is a momentum indicator that measures the speed and magnitude of price movements on a scale of 0 to 100.

Readings above 70 typically indicate overbought conditions, suggesting a potential for a price pullback, while values below 30 suggest oversold conditions, often signaling the possibility of a rebound. At 33.4, SPX’s RSI hovers just above the oversold threshold, marking its lowest point since December 20.

This steep decline in RSI highlights heavy selling pressure and weakening momentum for SPX. While the current level suggests that bearish sentiment is dominant, it also signals that SPX price may be approaching oversold conditions.

If the RSI drops further or stabilizes near 30, it could create conditions for a price recovery as buying interest might return. However, without a strong shift in market sentiment, SPX price may continue to consolidate or decline in the near term, like other meme coins.

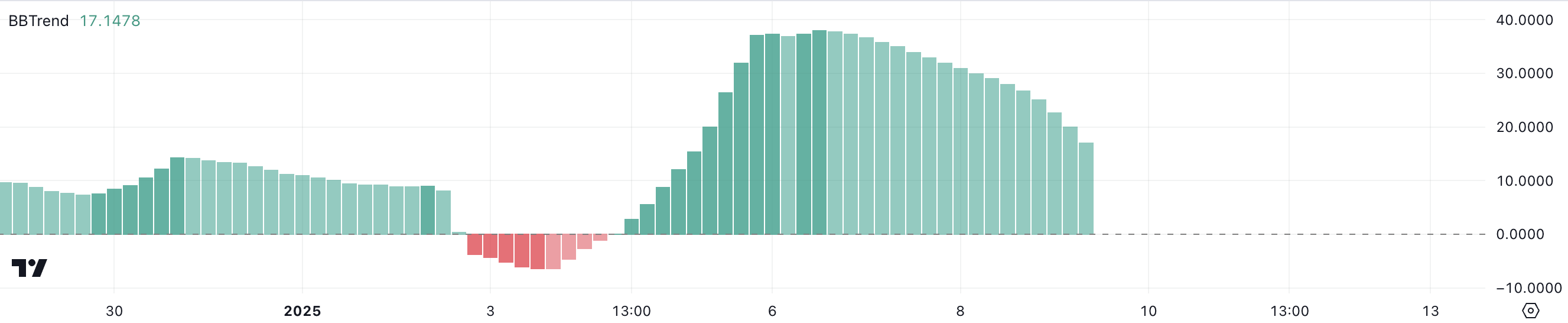

SPX BBTrend Is Declining

SPX BBTrend remains positive at 17.1 despite a steady decline from its recent peak of 38 on January 6. Derived from Bollinger Bands, BBTrend measures the strength and direction of a price trend. Positive values indicate bullish momentum, while negative values suggest bearish conditions.

At its current level of 17.1, SPX BBTrend suggests that while the recent correction of nearly 15% in the last 24 hours has dampened upward momentum, the coin retains some underlying bullish sentiment. However, the steady decline in BBTrend indicates that the risk of further downside persists unless buying activity increases to stabilize the price.

A continuation of the current trajectory could lead to consolidation or additional corrections. Still, a recovery in BBTrend could signal a resurgence of bullish momentum, keeping SPX in the top 10 ranking among the biggest meme coins.

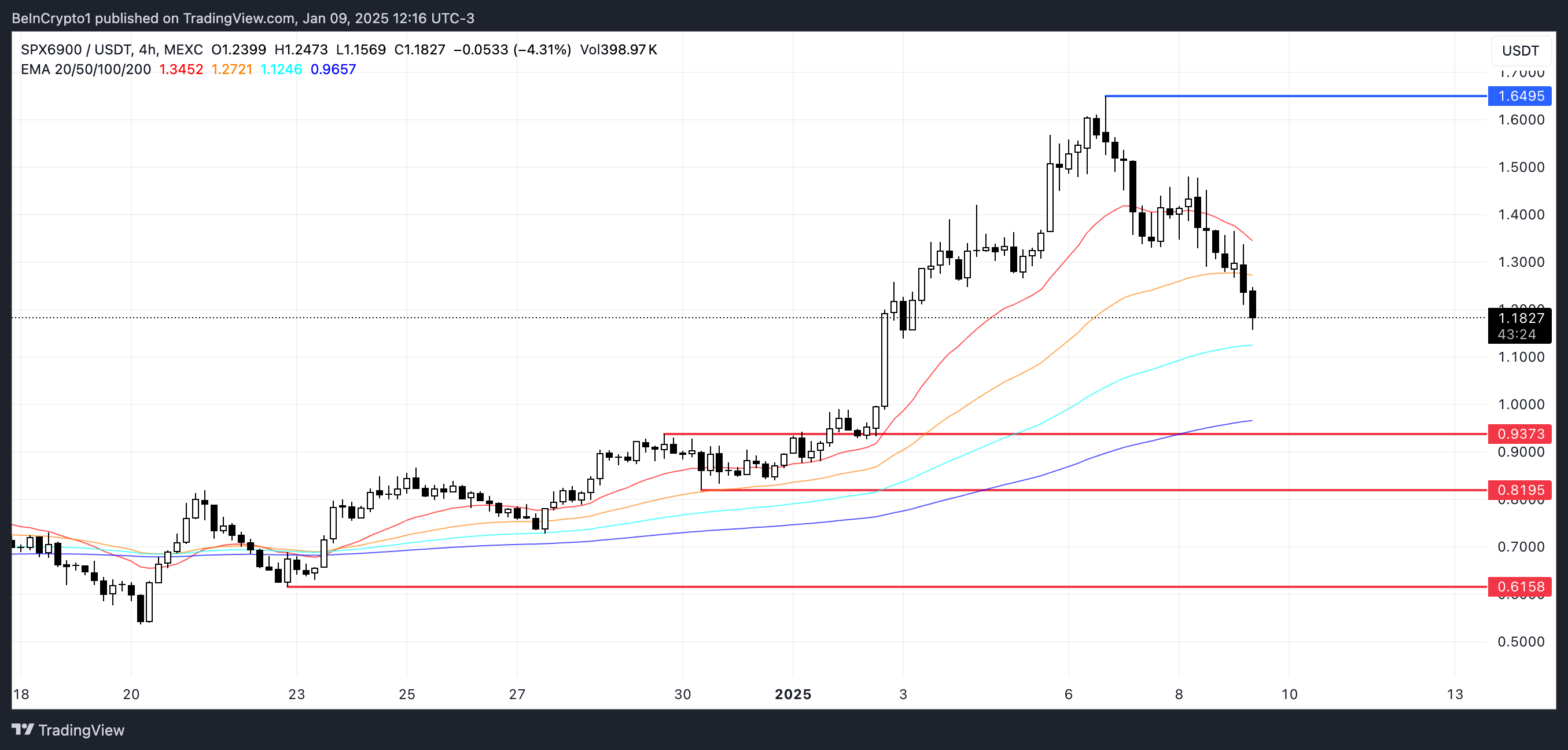

SPX Price Prediction: A Further 48% Correction?

SPX’s EMA lines still maintain a bullish setup, with short-term EMAs positioned above long-term ones. However, the short-term lines are trending downward, raising the possibility of a death cross — where short-term EMAs cross below the long-term ones.

This bearish signal could exacerbate SPX price recent correction, leading the price to test the support at $0.937.

If this critical level is lost, the meme coin may face further declines, potentially dropping to $0.819 or even $0.615, marking a significant 48% correction from current levels.

Conversely, renewed enthusiasm around meme coins could provide SPX price with the momentum needed to reverse its current trend. In such a scenario, the coin might rise to challenge its nearest resistance at $1.64.