The most prominent narrative for the crypto industry, which has been battered over the past couple of years, is the potential approval of a spot Bitcoin exchange-traded fund.

Pantera Capital founder Dan Morehead has explained why this is such a big deal in a recent report. On November 21, Pantera Capital managing partner Dan Morehead anticipated the likely approval of a spot Bitcoin ETF in the near future and discussed the potential impact.

Spot Bitcoin ETF is Bullish

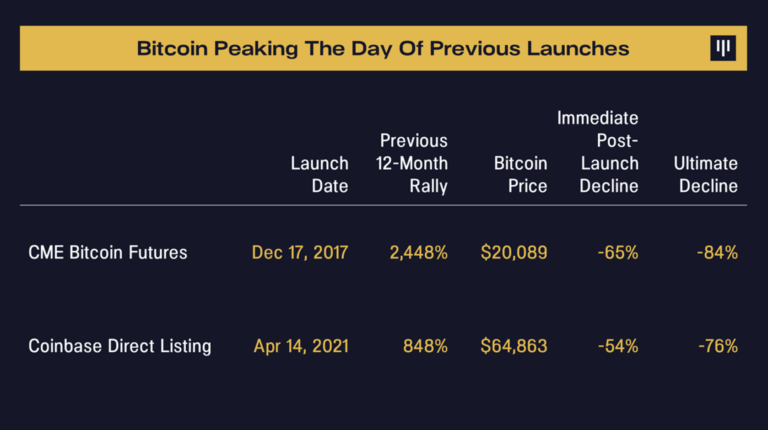

The old Wall Street adage “buy the rumor, sell the news” worked literally perfectly in the last two big regulatory announcements in our space, he noted.

The day CME Bitcoin futures went live in December 2017 marked the peak of that bull market at $20,000. By early February, the asset had crashed 65%.

Moreover, the day the Coinbase IPO went live in April 2021, the BTC price was around $65,000, but it had tanked 54% by July of the same year.

“While starting a prediction with “This time is different…” is not usually an auspicious way to begin, I believe it here,” he said.

“Neither of those events had any impact on real-world access to Bitcoin.”

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Speculators bought the rumor and sold the news. Moreover, BTC futures did not open up markets to new investors, just a handful of arbitragers. Additionally, the change in who owned Coinbase stock did not change access to Bitcoin.

“This is different. A BlackRock ETF fundamentally changes access to Bitcoin. It will have a huge (positive) impact.”

The Pantera executive strongly believes that several spot BTC ETFs will be approved within a matter of months.

Contracts on the Chicago Mercantile Exchange back a futures crypto ETP. However, a spot product is backed by the asset itself, so issuers need to buy BTC to offer the contracts to their clients.

Comparisons to Spot Gold ETP

“The existence of an ETF is a very important step in becoming an asset class,” he said before adding, “Once an ETF exists, if you don’t have exposure, you’re effectively short.”

Analysts have also compared it to the launch of the first spot gold ETF in November 2004. Demand for the asset skyrocketed afterward as the ETF legitimized gold as an investment.

By the end of 2011, gold prices had surged more than 300% to reach $1,800/oz.

If BTC demand mirrors that of gold, it could surge to a potential $150,000 in the next few years. The asset is currently changing hands for $37,363.