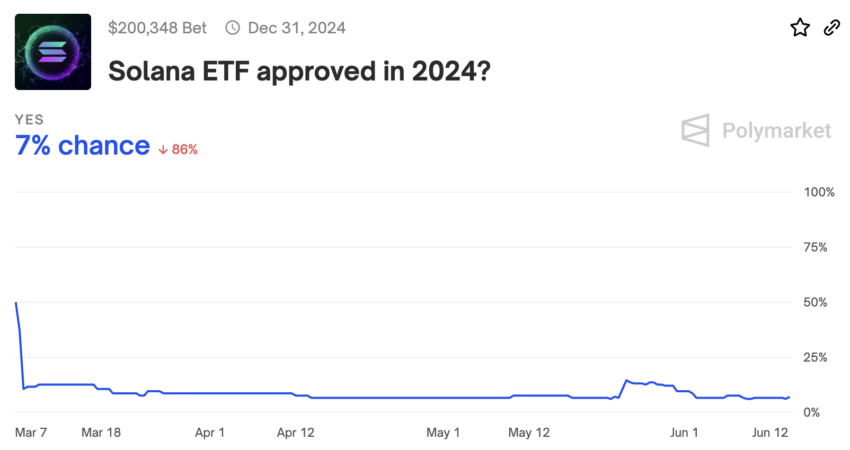

Decentralized prediction market platform Polymarket has seen over $200,000 in wagers on whether spot Solana exchange-traded funds (ETFs) will gain approval by December 31, 2024.

This interest reflects a significant bet on the future of Solana within the cryptocurrency market.

Speculators Bet Big on Solana ETF

Earlier this week, US Securities and Exchange Commission (SEC) Chair Gary Gensler indicated the likely approval of spot Ethereum ETFs in the US by the end of summer. This would be the first time a non-Bitcoin digital asset receives such a classification, sparking speculation about the potential for Solana ETFs.

Despite this optimism, betting on Polymarket for a Solana ETF approval has remained at a cautious 7%. The discussion around Solana ETFs comes amid a shifting regulatory environment and increasing bipartisan support for cryptocurrency.

For instance, Republican presidential candidate Donald Trump has positioned himself as a strong crypto supporter, criticizing Democratic efforts to regulate the sector. Ryan Selkis, CEO of Messari, highlighted Trump’s advocacy for the industry but noted he did not provide specific policy details.

“I didn’t expect to share that I was in Mar-a-Lago tonight, but President Trump spoke very highly about crypto,” Selkis said.

In addition, the recent passage of the Financial Innovation and Technology for the 21st Century (FIT21) Act by the House, which saw significant Democratic support, reflects a potential political shift. Crypto advocates welcomed the bipartisan bill’s success in the House of Representatives but remain vigilant about its final form.

While the industry sees this intent to address the regulatory ambiguity as a symbolic win, there is caution about the potential regulatory implications. Approval of Solana ETFs would be a significant milestone, indicating broader acceptance and integration of crypto into mainstream finance.

Read more: Solana vs. Ethereum: An Ultimate Comparison

However, with Ethereum ETFs still awaiting final approval, the crypto community remains cautiously optimistic. The industry’s focus is on navigating the regulatory environment and ensuring that new policies support rather than hinder crypto innovation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.