Financial authorities in South Korea have announced plans to crack down on crypto exchanges that fail to comply with new stringent standards, signaling a significant shift in the country’s approach to regulating the industry.

In fact, this action is part of a wider push to enhance oversight and examination of crypto exchanges. Starting this year, crypto exchanges deemed unsuitable due to failing to meet stringent standards will face expulsion from the nation’s market, according to the Korea Financial Intelligence Unit (KoFIU).

Crypto Exchanges Under Scrutiny in South Korea

The plan includes a trading halt system for suspect transactions, used in 49 countries like Britain, Germany, and Finland. This aims to stop crime early, following the Financial Action Task Force’s advice. These steps are in KoFIU’s annual plan, made after talks with the flagbearers of the crypto sector and advisors.

KoFIU’s focus on tightening regulations comes amid growing concerns about the compliance of prominent players in the crypto industry. Web3 game developer Wemade is currently under investigation for potentially evading legal obligations as a virtual asset operator. The company faces allegations ranging from abnormal transactions to accusations of coin over-issuance fraud by its top executives.

Specifically, authorities focus on WEMIX 3.0, Wemade’s play-to-earn platform that blends virtual assets with gaming. The probe also examines Phoenix, the crypto exchange, and PlayWallet, a digital wallet linked to Wemade. They’re under scrutiny for allegedly not giving users private keys.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Wemade’s decision to retract its virtual asset operator registration in late 2021 raised further suspicions about its regulatory compliance. The KoFIU is also investigating crypto exchange OKX for allegedly engaging in unregulated activities within South Korea, including questionable promotional strategies involving local influencers.

The regulatory environment in South Korea is poised for a significant overhaul with the implementation of the Virtual Asset User Protection Act, set to begin on July 19, 2024. The act imposes tough penalties, including lifetime imprisonment, for individuals involved in illicit crypto gains exceeding $3.7 million. It aims to safeguard the crypto industry, which is expected to grow substantially in the coming years.

“In preparation for the enactment of the virtual asset consumer protection act from the latter half of this year and the large-scale renewal registrations, KoFIU will agilely push forward with the necessary institutional improvements to ensure the seamless operation of the cryptocurrency industry,” Rhee Yun-su, the commissioner at the KoFIU, said.

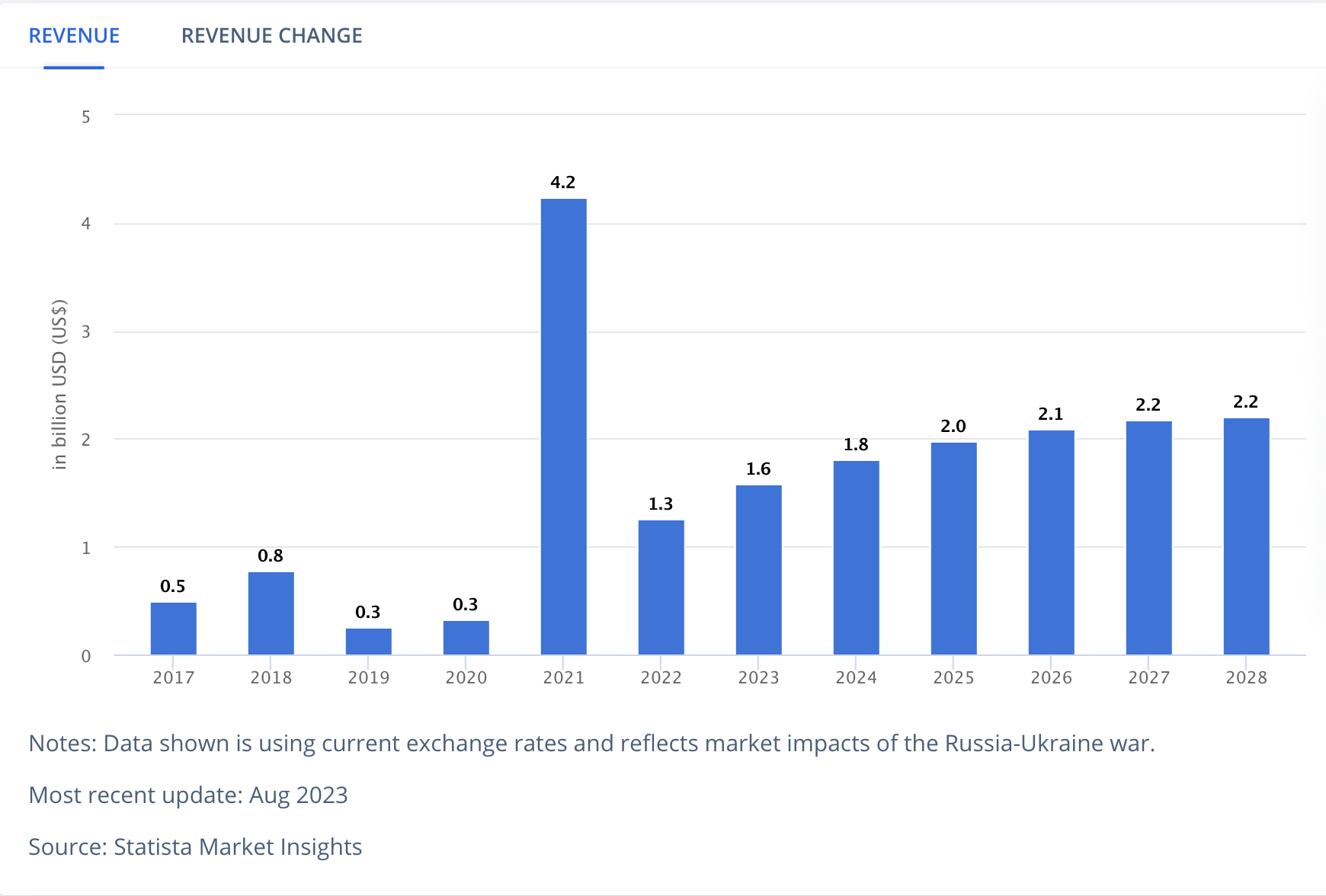

With an anticipated Compound Annual Growth Rate (CAGR) of 5.12% from 2024 to 2028, South Korea’s crypto market is projected to reach $2.2 billion in revenue by 2028. However, robust regulations will be essential to ensure the integrity and stability of the crypto asset ecosystem in South Korea.