Sonic (S) has recovered, surging by 31% after hitting an all-time low just three days ago. It trades at $0.46, surging almost 10% in the past 24 hours.

The sharp rebound comes as traders seized the opportunity to buy the dip, driving renewed demand for the token.

Sonic’s Trading Activity Heats Up

The gradual uptick in inflows into Sonic’s spot markets on Thursday highlights the resurgence in demand for the altcoin. According to Coinglass, this totals $215,000 at press time.

While the figure may seem minimal, it marks a significant comeback from the two consecutive days of outflows from S’ spot markets. Spot inflows like this indicate a growing demand for an asset and a surge in investor confidence, which can contribute to upward price momentum.

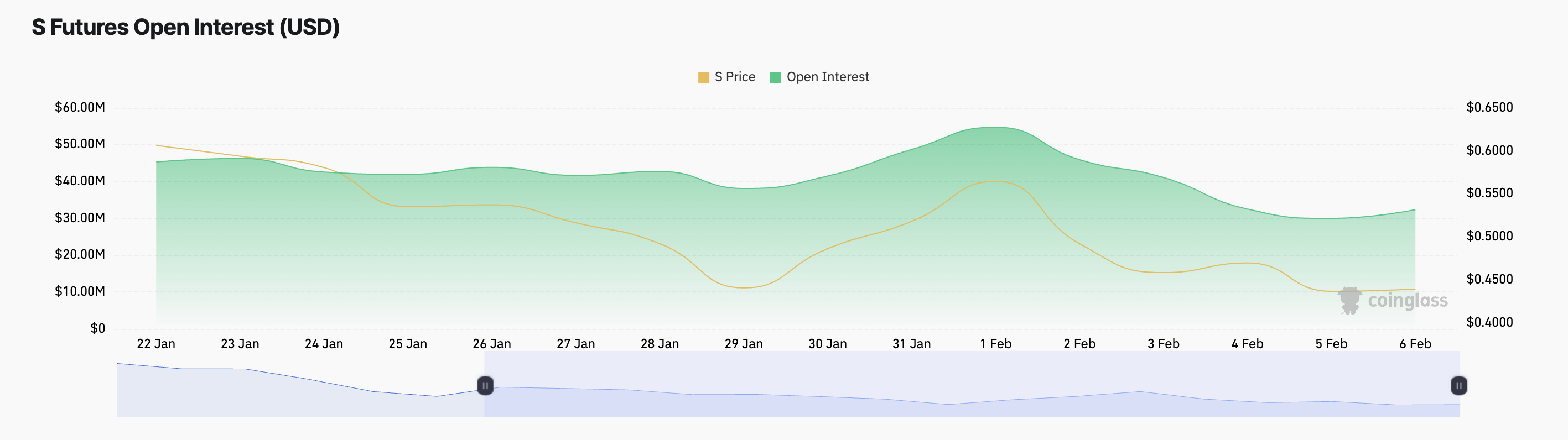

Additionally, S’ open interest is on an upward trend, confirming the steady rally in trading activity around the altcoin. At press time, it is $41.05 million, climbing 33% over the past 24 hours.

Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not been settled. When open interest increases during a price rally, it suggests that new money is entering the market, reinforcing the uptrend. This indicates stronger conviction among traders, as more participants are opening positions rather than closing existing ones.

A sustained rise in S’ open interest alongside its price would signal continued bullish momentum, but if it declines, it may suggest weakening demand or potential profit-taking.

S Price Prediction: A Break Above This Level Could Fuel More Gains

On a 12-hour chart, S appears poised to break above its 20-day Exponential Moving Average (EMA), which has formed a major resistance level since the beginning of February.

This key moving average measures an asset’s average trading price over the past 20 days. It is a short-term trend indicator emphasizing recent price movements, making it more responsive to changes than a simple moving average.

When an asset’s price attempts to break above its 20-day EMA, it suggests potential bullish momentum, signaling that buyers may be gaining control and a trend reversal or continuation could be underway.

A succesful break above the 20-day EMA would offer more credibility to S’ current rally. The price could climb in that scenario and extend its gains to $0.059.

However, if profit-taking makes a comeback among traders, S’ price could drop to $0.33.