Yesterday, Solana developers announced that the network’s second mobile phone, Seeker, will be released in 2025. The news triggered a surge in trading activity, pushing SOL prices up by nearly 10% over the past 24 hours.

With the altcoin now trading above two key moving averages, it could break through the $160 resistance level and potentially move toward $190.

Solana’s New Phone Excites Traders

On September 19, during the Token2049 event, Solana Labs announced that the network’s second phone, Seeker, will launch in 2025. Solana’s General Manager, Emmett Hollyer, stated that the Seeker mobile phone will improve upon the network’s first phone, Saga, which faced a lot of criticism.

The hype around Seeker’s announcement has propelled SOL’s price above its 20-day exponential moving average (EMA) and its 50-day small moving average (SMA).

Read more: 11 Top Solana Meme Coins to Watch in August 2024

The 20-day EMA, a short-term moving average that quickly responds to price changes, shows an asset’s average closing price over the past 20 days. When an asset trades above this level, it signals strong short-term momentum, with demand driving the price upward. This suggests increased coin accumulation, as buyers begin to take control.

The 50-day SMA, a longer-term moving average, reflects the average price over the past 50 days. Trading above this level indicates the asset is in a sustained uptrend.

With SOL trading above both the 20-day EMA and 50-day SMA, the market shows strong upward momentum. This alignment of short- and long-term trends is often seen by traders as a signal to exit short positions and enter long ones.

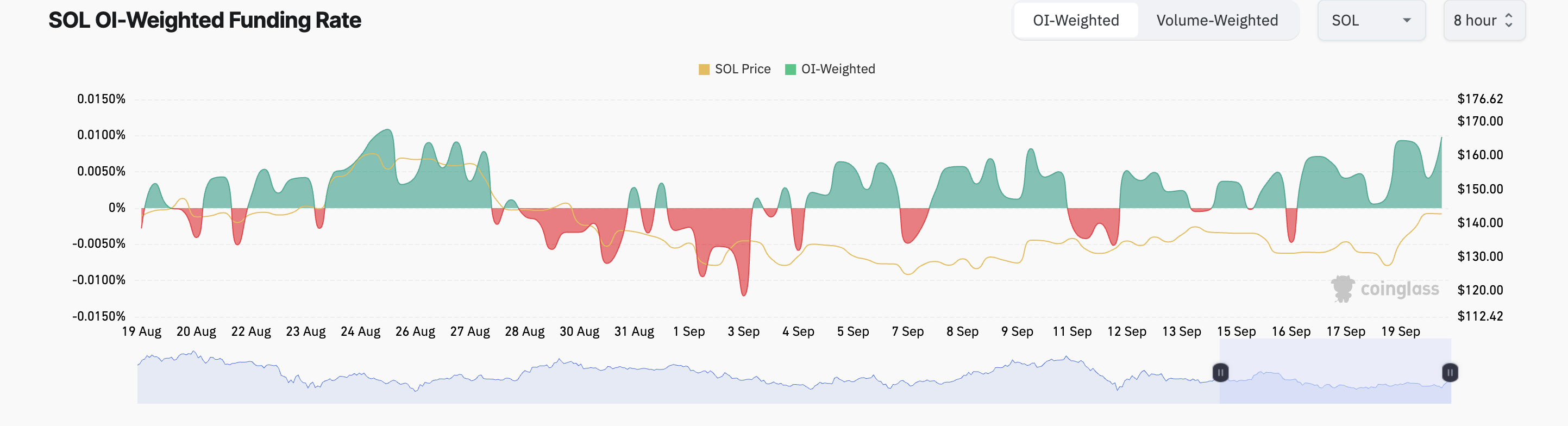

This has played out with SOL’s aggregated funding rate climbing to its highest level in almost 30 days. At press time, the coin’s funding rate — a periodic fee paid to keep its contract price aligned with the spot price — stands at 0.0098%. This indicates a higher demand for long positions among SOL’s futures market participants.

SOL Price Prediction: Coin May Breach Resistance At $160

SOL’s rising Chaikin Money Flow (CMF) indicates that the price rally is not driven by speculation but by genuine demand from market participants. This indicator, which measures the flow of money into and out of the market, is at 0.26. This is its highest level since March, and it signals significant liquidity inflow into the SOL market.

If this trend continues, Solana’s price will break above the resistance formed at $160.15. A successful retest of this level will propel the altcoin’s value toward $186.62.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if selling pressure intensifies, Solana’s price could lose its recent gains, drop below the 20-day EMA and 50-day SMA, turning them into resistance levels, and potentially fall to $131.47.