On Tuesday, a large Solana whale transferred 494,153 SOL—valued at approximately $72 million—to the Coinbase exchange, raising concerns over a potential sell-off.

Large exchange inflows like this often signal impending selling pressure, putting SOL’s recent gains at risk.

$72 Million in SOL Hits Coinbase, Weighing on Market Sentiment

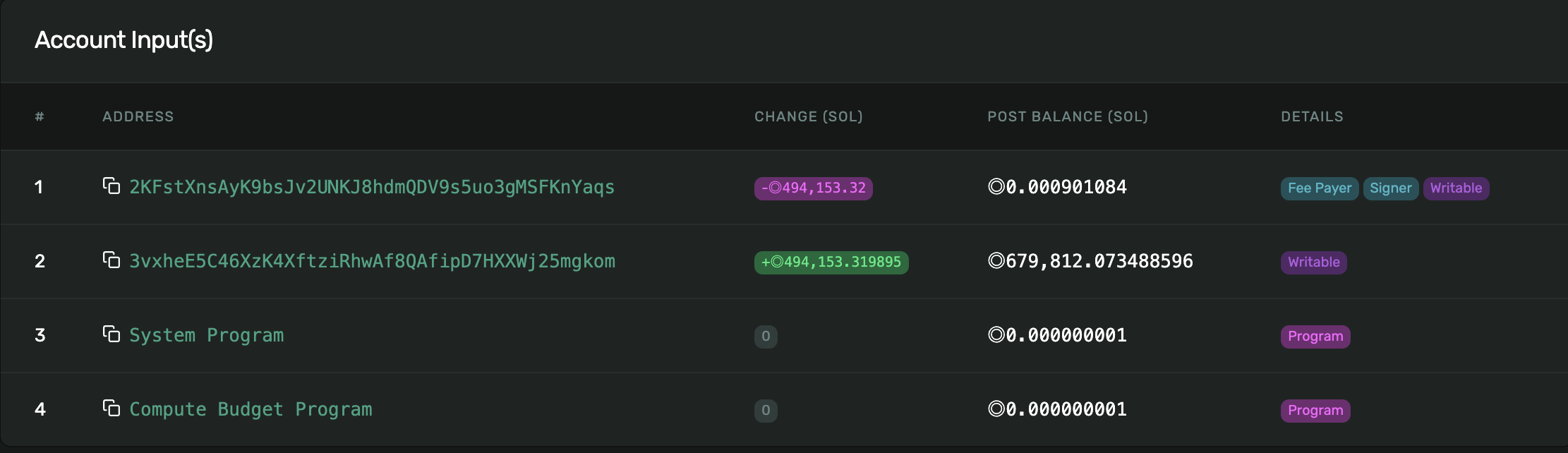

According to Whale Alert, a SOL whale transferred 494,153 SOL valued at $72 million to Coinbase Institutional on Tuesday. Significant exchange inflows such as this mean that large investors are moving their holdings from private wallets to exchanges, often signaling an intent to sell.

This increased supply on exchanges can increase the downward pressure on the SOL price, especially if there is insufficient demand to absorb the selling. As a result, its price may decline in the near term, leading to further sell-offs.

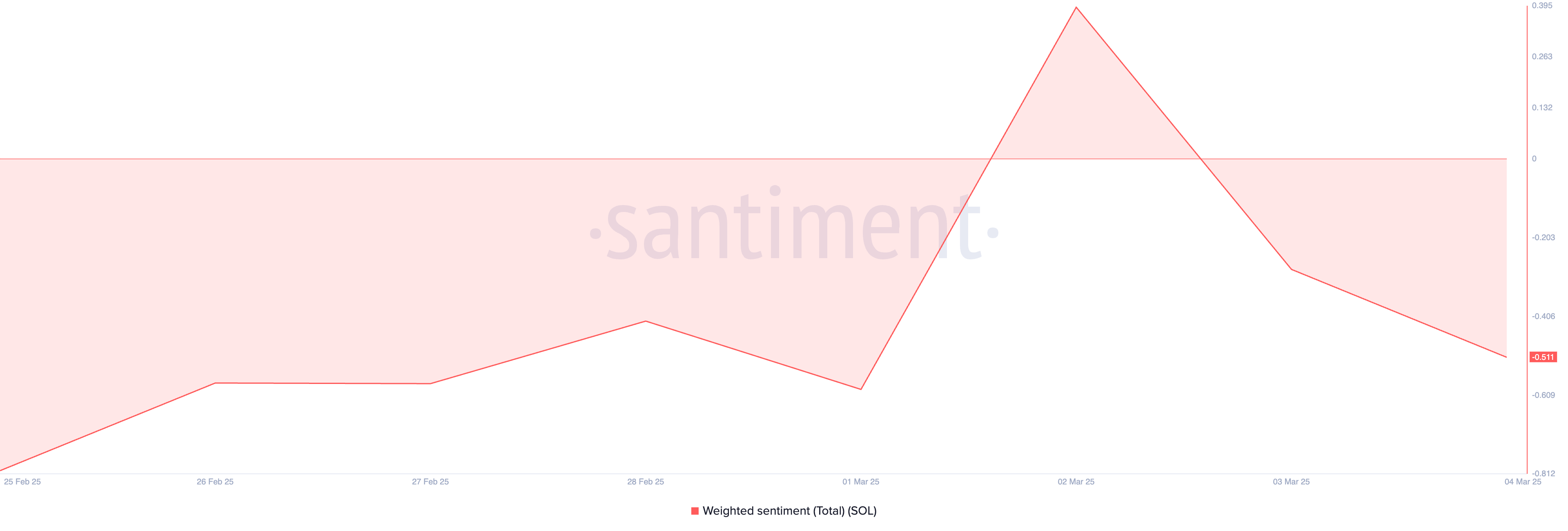

Moreover, the coin’s negative weighted sentiment heightens the risk of this selloff. At press time, this key metric is below zero at -0.51.

An asset’s weighted sentiment analyzes social media and online platforms to measure the overall tone (positive or negative) surrounding it. It considers the volume of mentions and the ratio of positive to negative comments. When weighted sentiment is positive, it indicates more positive comments and discussions about the cryptocurrency than negative ones.

On the other hand, when it is negative, the overall market sentiment is bearish, with more negative commentary and pessimism outweighing positive discussions about the asset.

This trend can increase selling pressure in the SOL market, discourage new demand, and contribute to its price decline as traders react to the prevailing bearish outlook.

Will Solana Drop to $138 or Surge to $160?

At press time, SOL trades at $145.84. If the whale selloff prompts retail traders to distribute their coins, SOL’s price may plummet to $138.84.

However, on the daily chart, SOL bulls appear ready to defend key levels. Readings from technical indicators, including the Parabolic SAR, suggest that buying momentum is gaining strength.

At press time, the dots that make up this momentum indicator rest below SOL’s price, offering dynamic support. When an asset’s Parabolic SAR is set up this way, it signals a bullish trend. It hints at the possibility of a rally in SOL’s price in the short term. If this happens, the coin could exchange hands at $160.34.