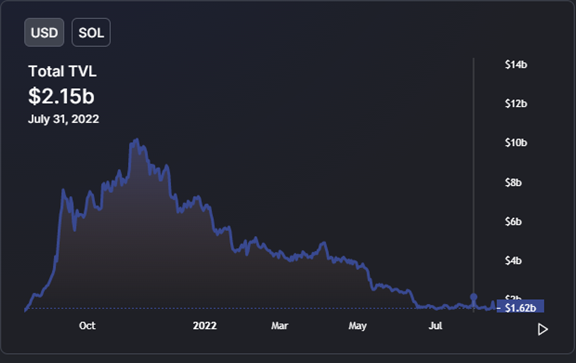

Total value locked (TVL) on Solana was on an uptrend in July due to renewed interest in the decentralized finance (DeFi) space and other sectors of the crypto finance industry.

Solana has been one of the best-performing smart contract chains in the last two months. The blockchain was up by 38% from $1.55 billion on July 1 to $2.15 billion on July 31, according to Be[In]Crypto research based on data from DeFiLlama.

Why the rise in TVL?

Solana TVL was up in July due to a spike in the value locked in decentralized applications (dApps) in its ecosystem.

Liquid staking platform Marinade Finance (which holds the most TVL on Solana), increased by 39% in July from $245.21 million on the first day to $340.99 million on the last day of the month.

Decentralized lending protocol Solend also soared by 41% from $220.08 million on July 1 to $310.74 million on July 31.

Other dApps that made significant contributions to TVL include, but are not limited to, Serum, Raydium, Atrix, Lido, and Tulip Protocol.

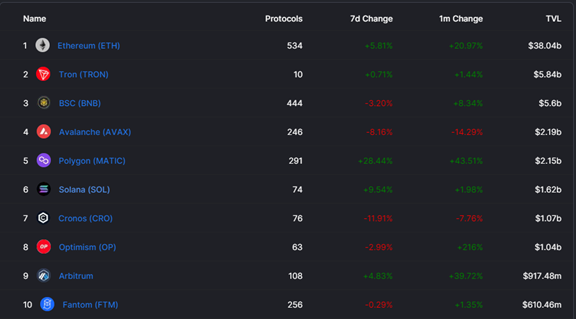

After improving in TVL, Solana trails Polygon, Avalanche, Binance Smart Chain, TRON, and Ethereum. However, it holds the lion’s share in value locked over Cronos, Optimism, Arbitrum, and Fantom.

SOL price reaction

SOL opened on July 1, with a trading price of $33.65, reached a monthly high of $47.10, tested a monthly low of $31.93, and closed the month at $42.40.

Overall, this equates to a 26% increase between the opening and closing price of SOL in July.