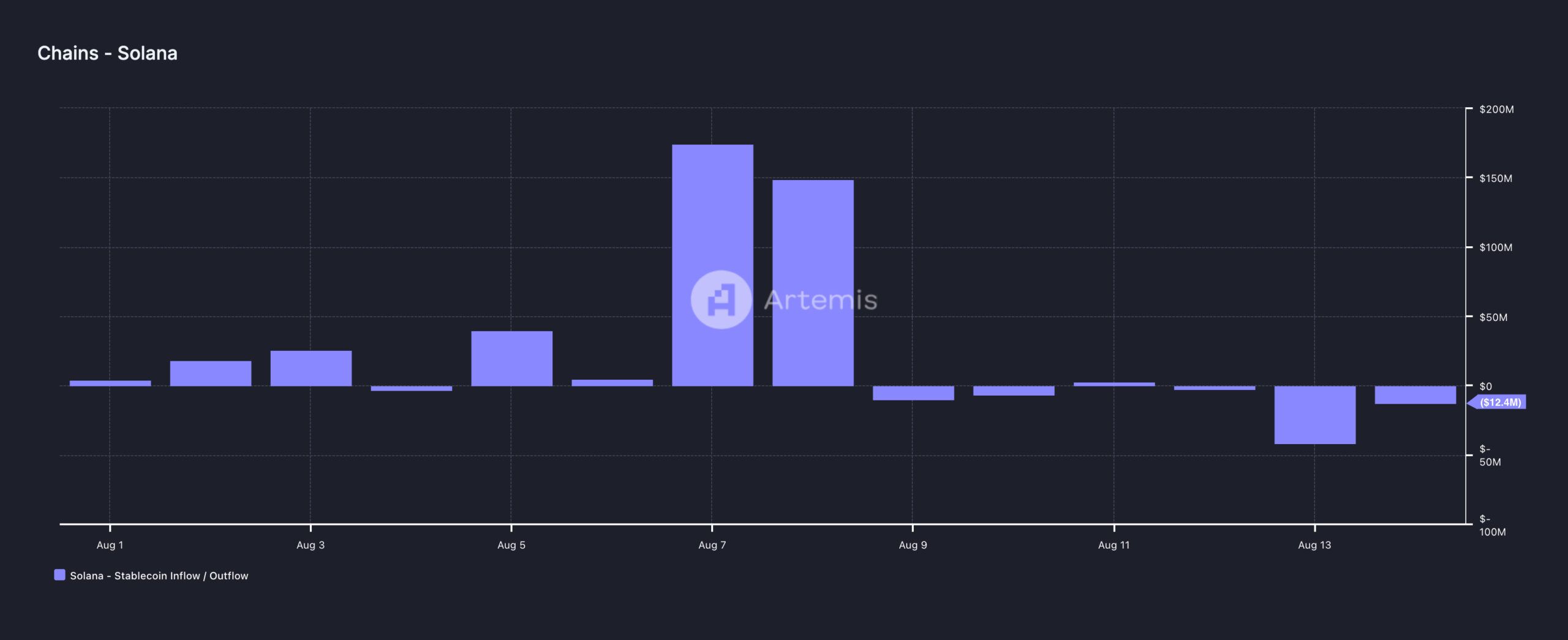

According to Artemis data, stablecoin outflow from Solana (SOL) decreased significantly from $41.20 million on August 14 to $12.40 million. This reduction could play a crucial role in influencing SOL’s price action over the coming days.

Currently, SOL is trading at $143.36, marking an 8.82% decline over the past week. The drop in outflow might help stabilize the price, potentially slowing or even halting the downtrend if liquidity remains on the network.

Solana Faces Key Turning Point

Stablecoin inflow or outflow often indicates the level of liquidity entering or leaving a blockchain. A high amount of stablecoins on a network usually signals a potential increase in demand for the network’s native token.

For instance, on August 12, Solana saw more stablecoin inflow than outflow, leading to SOL’s price retesting $150. However, the following days saw higher outflows, causing SOL’s price to dip as low as $137.97.

According to Artemis, the recent decline in stablecoin outflow could be a positive indicator for SOL. It suggests a potential shift toward increased demand for the cryptocurrency, which might help stabilize or even boost its price.

Read more: 13 Best Solana (SOL) Wallets To Consider in August 2024

Besides this, Lookonchain reports that Circle issued USDC worth $250 million on Solana in the early hours of August 16.

“Circle minted 250M USDC on Solana again 5 hours ago — a total of 4.5B $USDC on Solana since April 2,” the on-chain analytic handle specified on X.

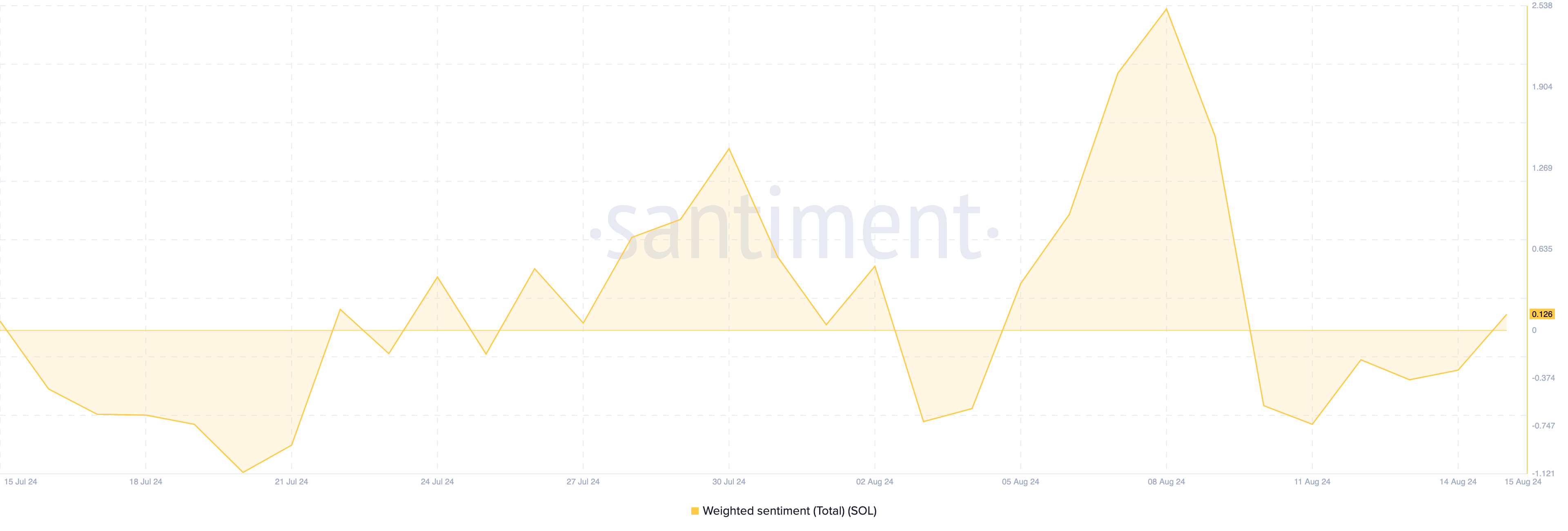

The recent shift in stablecoin flows seems to have impacted overall sentiment around SOL. Initially, Santiment data showed that Solana’s Weighted Sentiment had turned negative, reflecting growing pessimism. Weighted Sentiment measures whether comments about an asset are predominantly positive or negative, with a negative reading indicating that pessimistic remarks outweigh optimistic ones.

However, the sentiment has since shifted back into positive territory, signaling renewed short-term bullishness in the broader market. If this positive outlook continues, demand for SOL could rise, potentially driving its price higher.

SOL Price Prediction: The Journey to $156 Begins

On the daily chart, bulls appear to be defending SOL from falling below $140. This region is also a previous demand zone that has helped the token bounce. For example, a plethora of increased buying activity on July 13 happened around the same area.

By July 21, SOL’s price had reached $185. This does not mean that the pattern will repeat itself, but the price is likely to increase.

Using the Fibonacci retracement indicator, BeInCrypto spots potential support and resistance zones where the token may hit. From the chart below, SOL’s price may jump to $146.05, and if buying pressure increases, the price can hit $156.16.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

However, a lack of demand for the cryptocurrency may invalidate this thesis. If this is the case, bulls may lose hold of the defense at $140, and the price may decrease to $136.61.