Solana (SOL) currently trades at the lower line of its ascending channel, which has formed support since the beginning of the month.

This decline toward the support line began on May 20. Exchanging hands at $167 at press time, the altcoin’s value has dropped by 7% in the past seven days.

Solana Attempts to Breach Support

SOL’s move in an ascending channel began when it initiated an uptrend on April 30. On that day, the altcoin traded at $129. By May 20, its value had risen to a peak of $184, after which selling activity began.

As the coin’s price fell last week, it is now poised to drop below its 20-day Exponential Moving Average. This moving average reflects SOL’s average price over the past 20 days.

When an asset’s price falls below this key moving average, it signals that its short-term trend might be reversing from up to down. This is because the 20-day EMA is acting as a line of support, and a break below suggests that sellers are overpowering buyers.

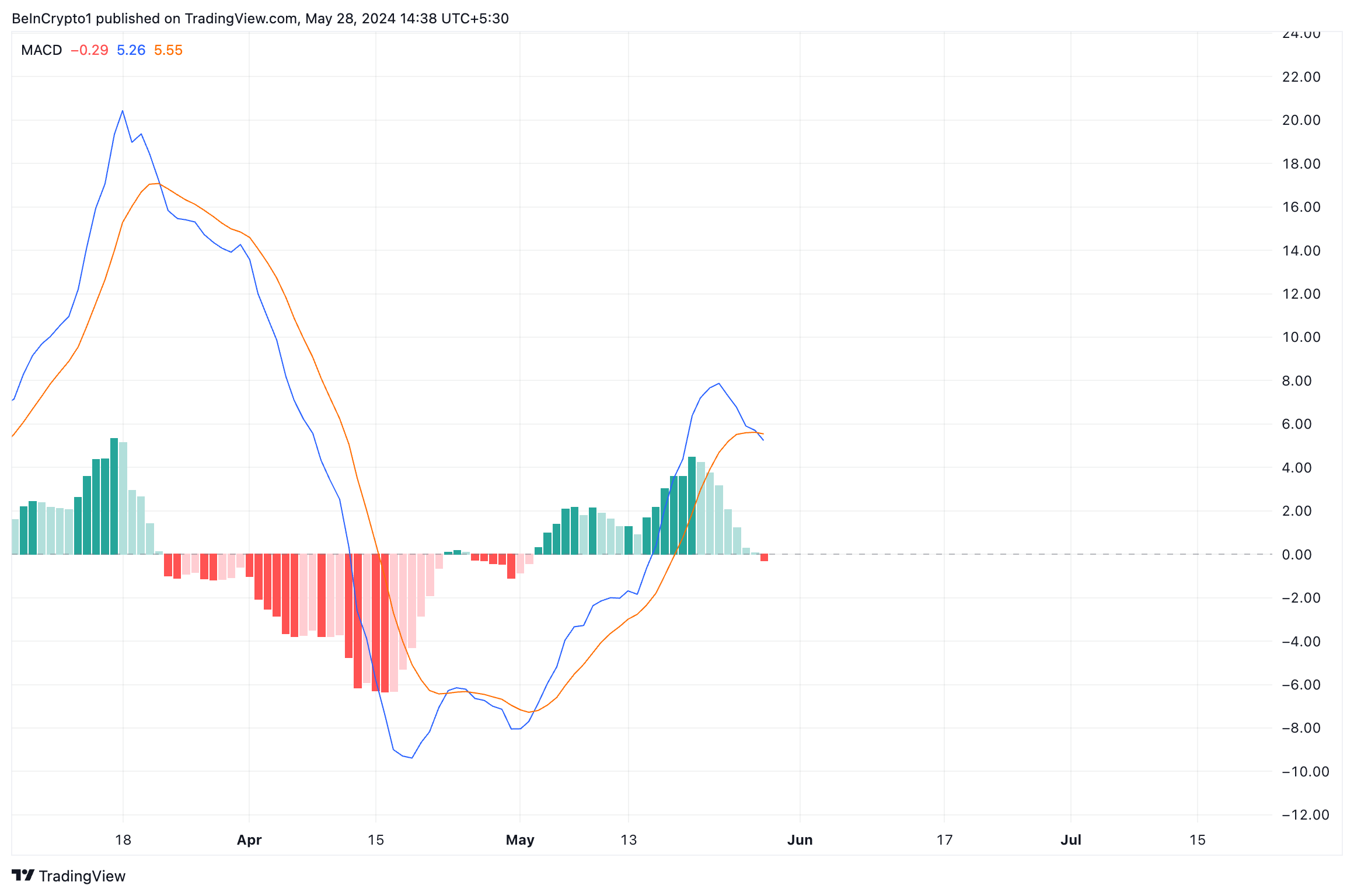

Confirming the shift in market trend from bullish to bearish, readings from SOL’s Moving Average Convergence Divergence (MACD) showed that the MACD line has intersected the signal line in a downtrend.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

This is a bearish crossover, which indicates the shift towards a downtrend. Market participants often consider it a sign to exit long and take short positions.

SOL Price Prediction: The Bulls Must Defend Support

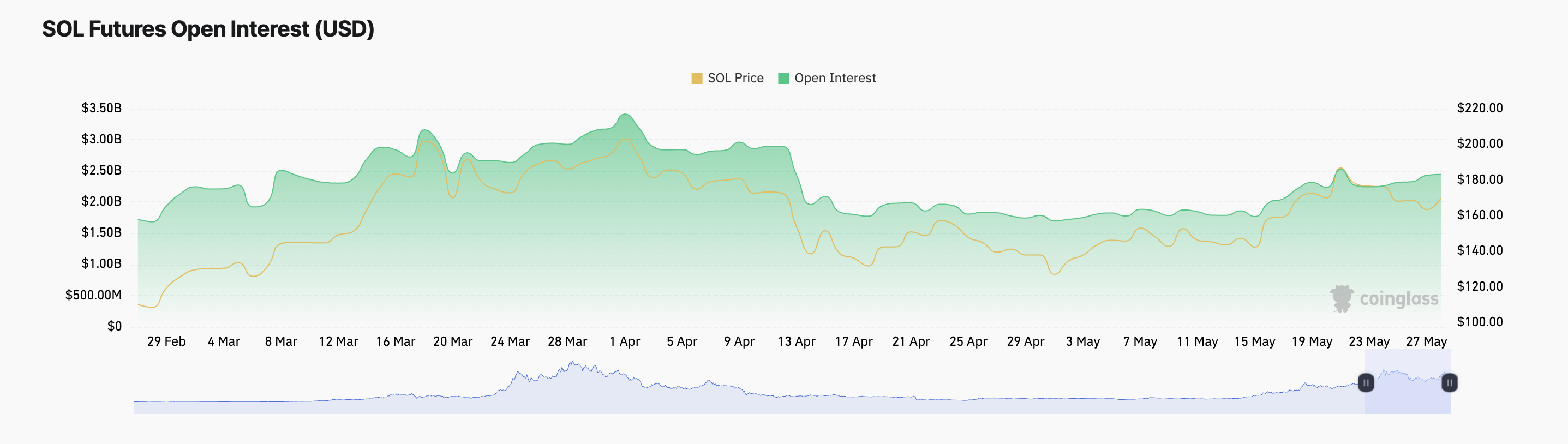

SOL has witnessed a decline in open interest in its futures market since May 20. At $2.44 billion at press time, this has cratered by 4% in the past seven days.

SOL futures open interest tracks the total number of outstanding futures contracts or positions that have not been closed or settled. When it declines like this, it suggests an increase in market participants exiting their trading positions without opening new ones.

If SOL’s price breaches support at $163, it may experience a further dip to $157.99.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

However, with its positive funding rate across cryptocurrency exchanges, its futures traders are still going long on SOL. This may lead to a spike in buying pressure, pushing the asset’s price toward $172.41.