Following the broader market’s cues, Solana’s (SOL) price ended up noting a drawdown from the critical resistance of $169.

Due to this failed breach, the traders promptly jumped on the bearish bandwagon, which, according to the market indicators, could get intense.

Solana Is Not Too Hot Right Now

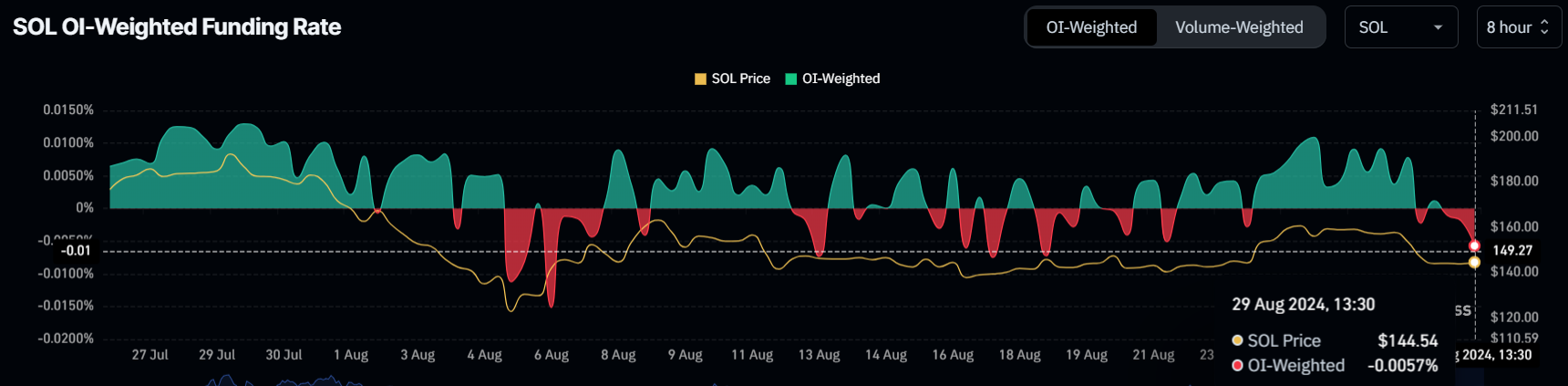

Solana’s price is likely to bear the brunt of the market’s changing sentiment. The current sentiment among Solana (SOL) traders has shifted towards bearishness, with the funding rate now in negative territory.

The negative funding rate usually occurs when short positions outweigh longs’, meaning traders are paying to maintain their short bets against SOL. It also indicates that traders are increasingly betting on a decline in SOL’s price.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

This trend suggests market participants are actively positioning themselves for further downward movement in Solana’s price.

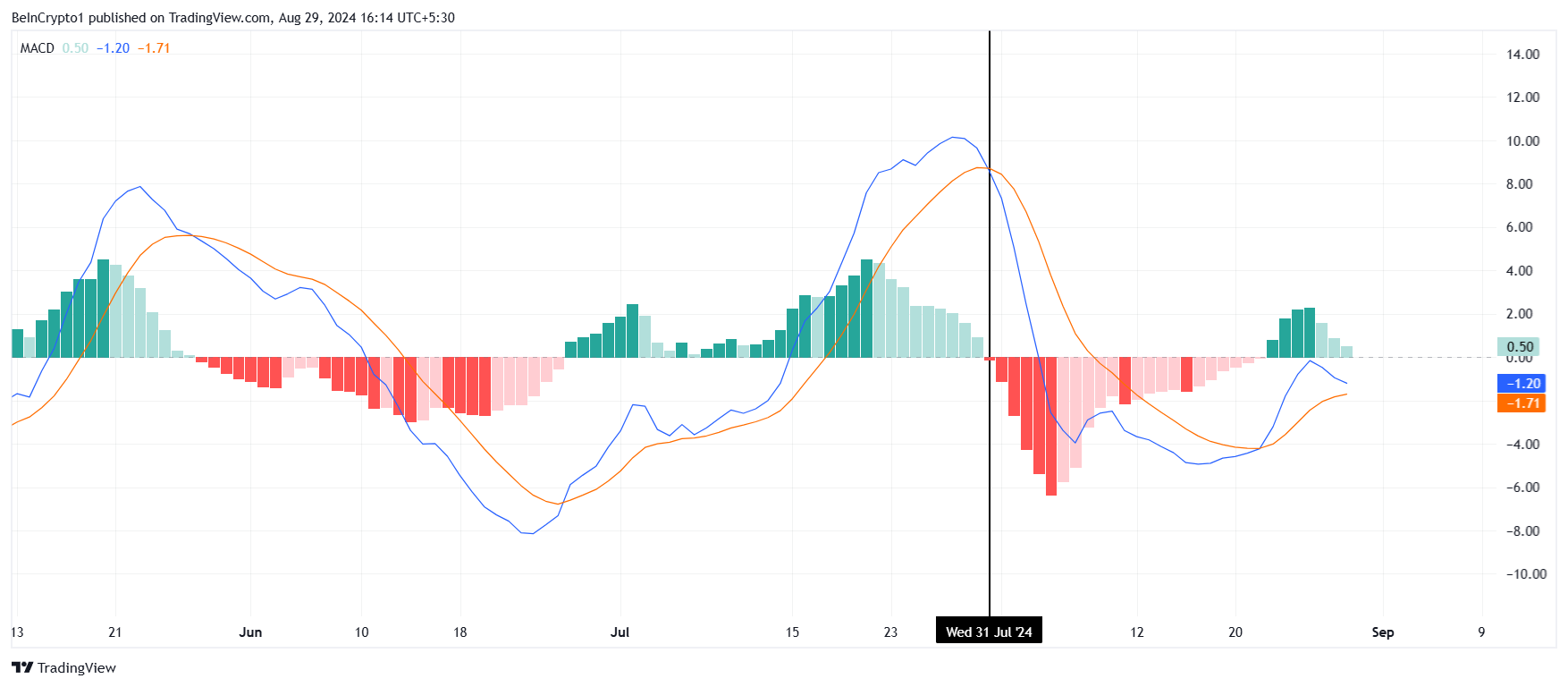

Technical indicators further reinforce this bearish outlook. The Moving Average Convergence Divergence (MACD) for Solana is on the verge of a bearish crossover. Such a crossover typically signals a shift in momentum from bullish to bearish, adding weight to the expectation of a price decline.

The approaching bearish crossover in the MACD is a critical signal to watch. It would validate the current negative sentiment and likely lead to increased selling pressure if confirmed. This could push Solana’s price even lower as traders react to the confirmed bearish signal.

SOL Price Prediction: Maintaining the Pace

Solana’s price, at $145, is close to noting further drawdown to test the critical support of $126 potentially. This is because SOL failed to breach $169, the critical resistance level, for the fourth time in the last four months.

A rise beyond this barrier would bring considerable profits to the investors, but this could take some time. For now, Solana’s price is looking at a drop and rise back up towards $137.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

If SOL somehow manages not to fall through but bounces off the local support of $137, it could prevent a drawdown. However, the bullish thesis would only be invalidated once $155 and $169 are breached and flipped into support.