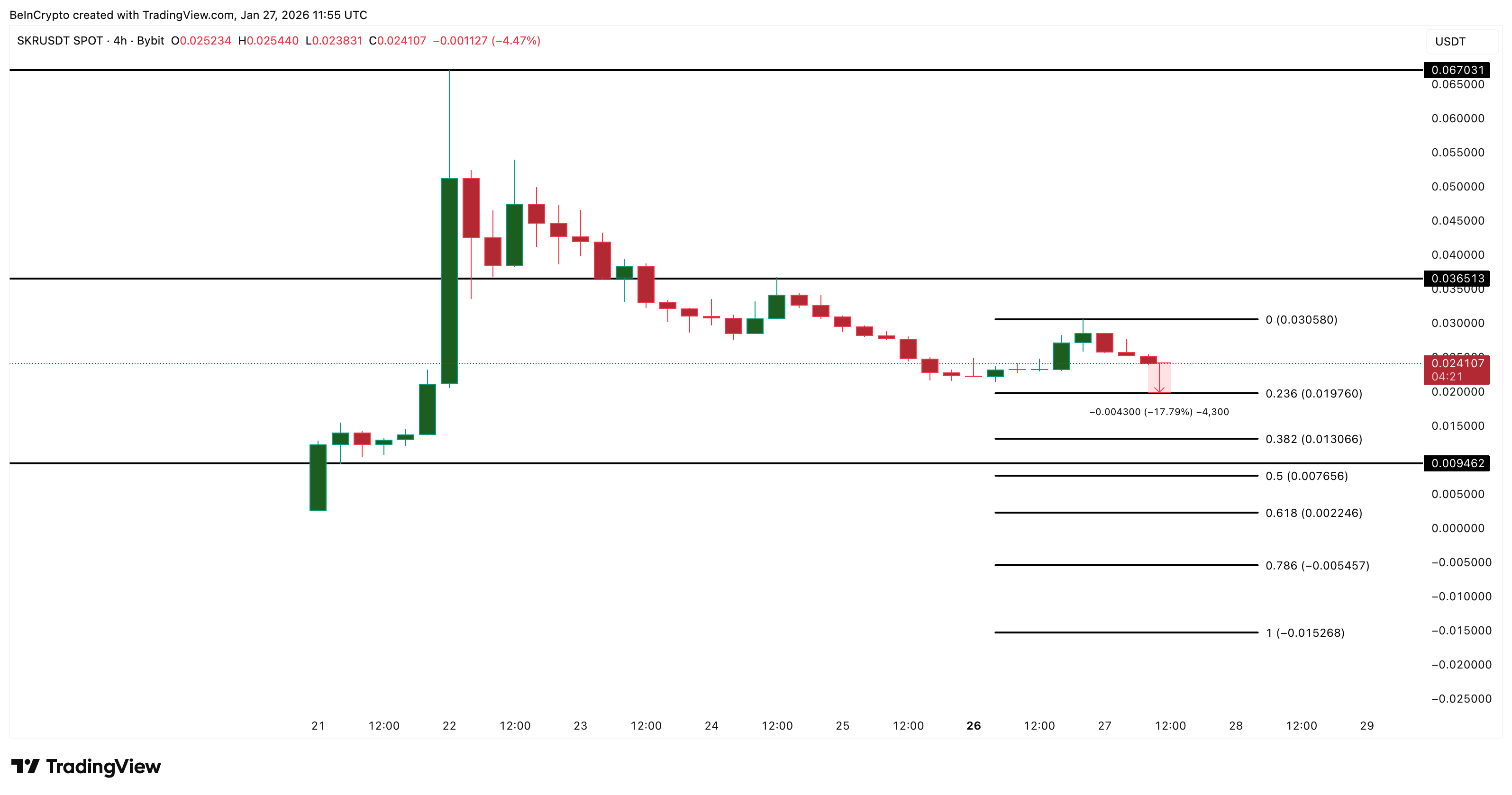

Seeker’s post-launch momentum has faded fast. After topping near $0.067, the Seeker price is now down almost 70%, trading around $0.024. That drawdown has erased most of the early excitement. While the token is still well above its launch base, price action shows buyers stepping aside rather than defending levels.

The key question is no longer upside potential. It is whether Seeker can avoid another leg lower. Right now, that outcome no longer depends on bulls. It depends on bears.

Momentum And Flow Signals Show Selling Pressure Is Still Dominant

The first warning comes from money flow.

On the 4-hour chart, Chaikin Money Flow (CMF) has stayed below zero since January 24. CMF measures whether capital is flowing into or out of an asset using price and volume. A negative reading means money is leaving, not entering.

Seeker attempted a CMF recovery on January 26, but failed. Since then, CMF has continued to trend lower, suggesting buyers are not returning with conviction. Right now, the CMF seems to be breaking down the ascending trendline, which, if confirmed, could be detrimental for the Seeker price.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Short-term momentum confirms this weakness. On the 1-hour chart, Seeker made a marginal higher high between January 26 and 27, but RSI printed a lower high.

The Relative Strength Index (RSI) measures momentum strength. When price rises, but RSI weakens, it signals that buying pressure is fading. This bearish divergence explains why recent bounces failed to extend.

Together, weakening CMF and RSI suggest the downtrend pressure is still active.

Spot Data Shows No Accumulation as Price Approaches Risk Levels

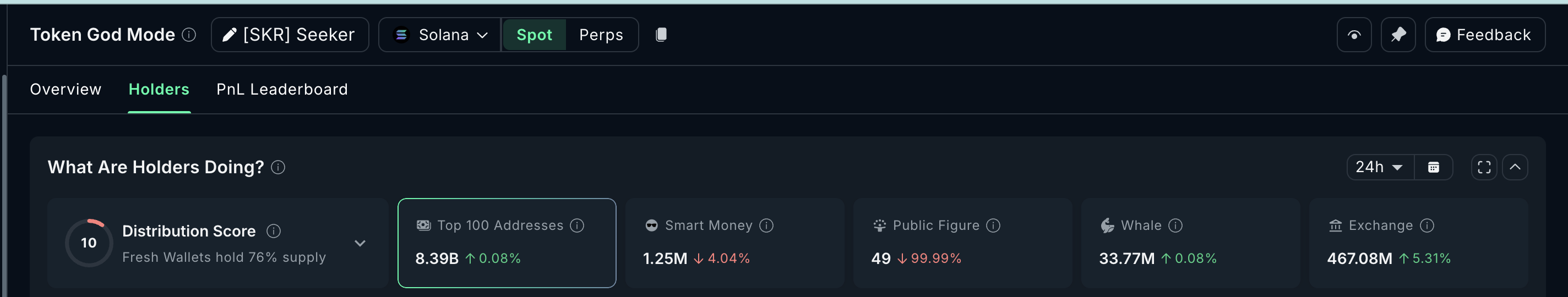

On-chain data reinforces the bearish setup. Over the past 24 hours, exchange balances rose 5.31%, lifting total exchange-held SKR to 467.08 million tokens. That equals roughly 23.6 million SKR moving onto exchanges.

When tokens move onto exchanges, it usually signals selling intent. At the same time, smart-money holdings dropped around 4%, showing no meaningful dip buying and rebound conviction.

In simple terms, spot demand is missing. That matters because Seeker is now approaching levels where buyers normally step in after correcting almost 70% from the post-launch highs. Under normal conditions, bulls would defend this zone. But they are not showing up.

Why Derivatives Bears Now Decide Whether Seeker Price Crashes

This is where the story flips. With spot buyers absent, the only remaining force capable of stopping a breakdown is bearish leverage.

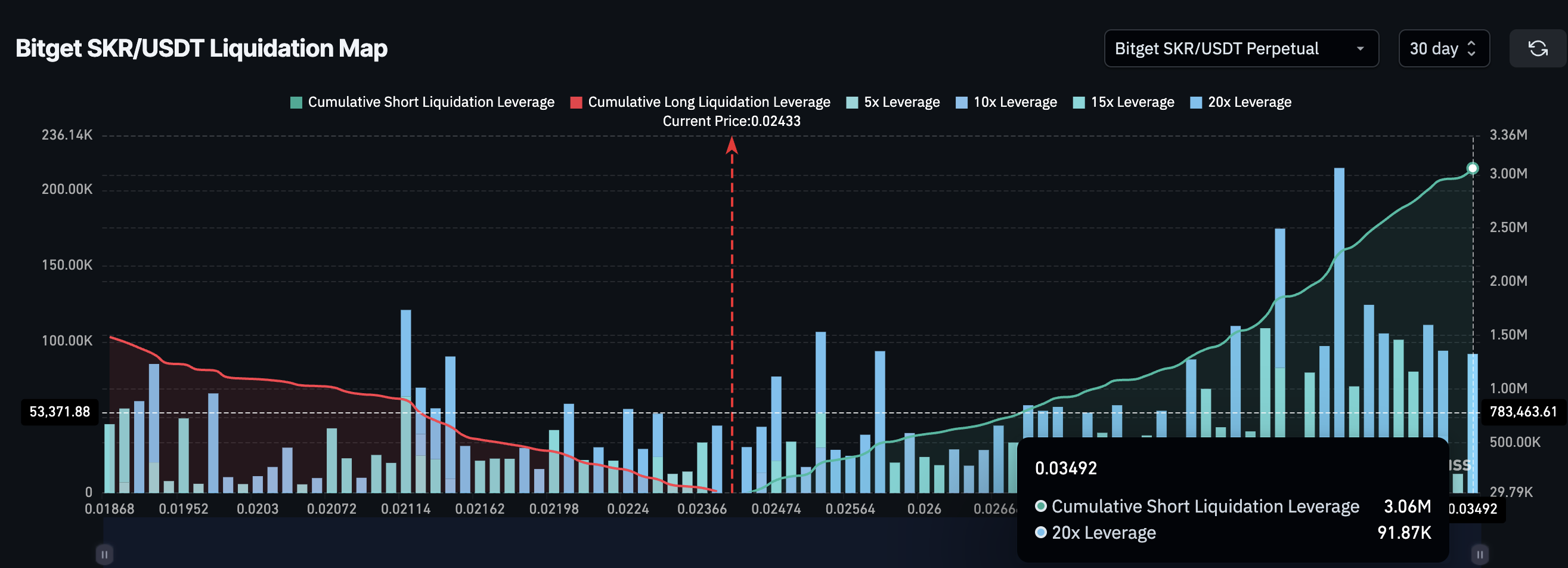

A liquidation map shows where leveraged traders would be forced to close positions. Liquidations can create sharp price moves, even without real demand. Leverage means traders are borrowing to increase position size, which increases liquidation risk.

On Bitget’s 30-day SKR/USDT perpetual market, there is roughly $3.06 million in short leverage, compared with about $1.49 million in long leverage. That means bearish positions dominate by more than 100%.

If the SKR price rebounds toward $0.030, around $1.2 million in short positions would begin to be liquidated. That could trigger a short squeeze, forcing bears to buy back SKR and pushing the price higher.

But this distinction is critical. A short squeeze is not bullish conviction. It is forced buying.

If bears are not trapped, Seeker risks sliding through $0.019 and triggering the 17% breakdown path. If bears are trapped, their liquidations may be the only thing that temporarily saves the price. That is why Seeker no longer depends on bulls.