Layer-1 blockchain Solana has seen a resurgence in user activity over the past week. Both daily active addresses and new addresses have increased, indicating rising demand. This comes after a prolonged period of declining activity, which had pushed its revenue to a multi-month low.

With network activity gaining momentum, demand for SOL is expected to rise, likely driving its price up by double digits in the near term. This analysis focuses on Solana’s recent network growth and how it may impact SOL’s price.

Users Flock Back To Solana

Since October 5, the daily count of unique addresses that have completed at least one transaction of the Solana network has risen by 12%. This spike comes after a prolonged slump in user activity on the L1.

In September, BeinCrypto reported a decline in daily transactions on Solana, which impacted its daily revenue. Over the 30-day period assessed, Solana’s revenue plunged by 46%, dropping to its lowest since March.

Read more: Solana vs. Ethereum: An Ultimate Comparison

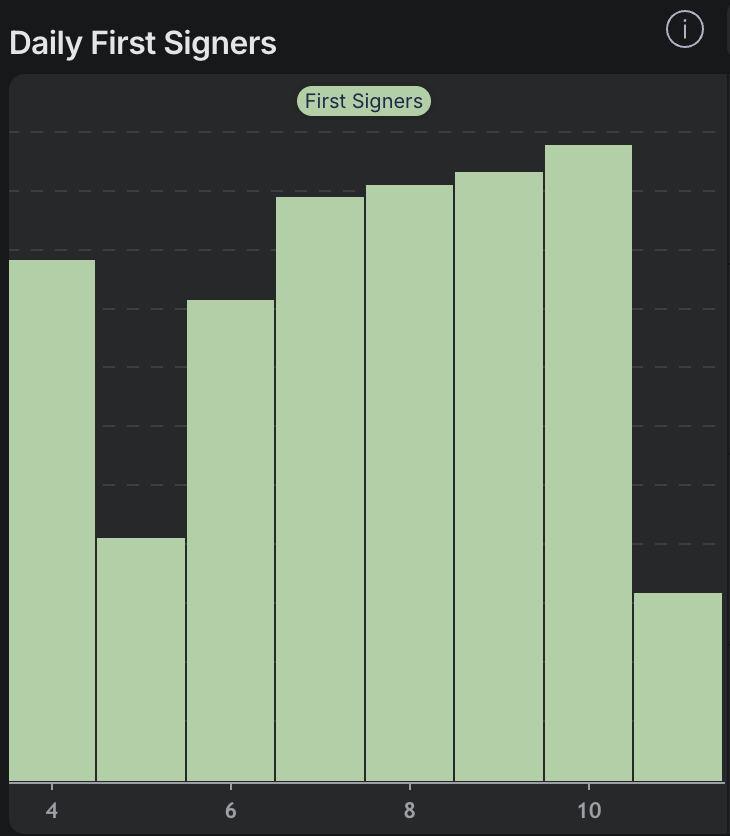

So far this month, Solana has attracted many new users. Hello Moon’s data has revealed a 15% uptick in the daily count of unique first signers transacting on the Solana Network.

When a blockchain sees an influx of new users, it shows network growth and expansion. This can drive up the value of its native coin, lead to higher network liquidity, increase developer activity, and enhance the overall network utility.

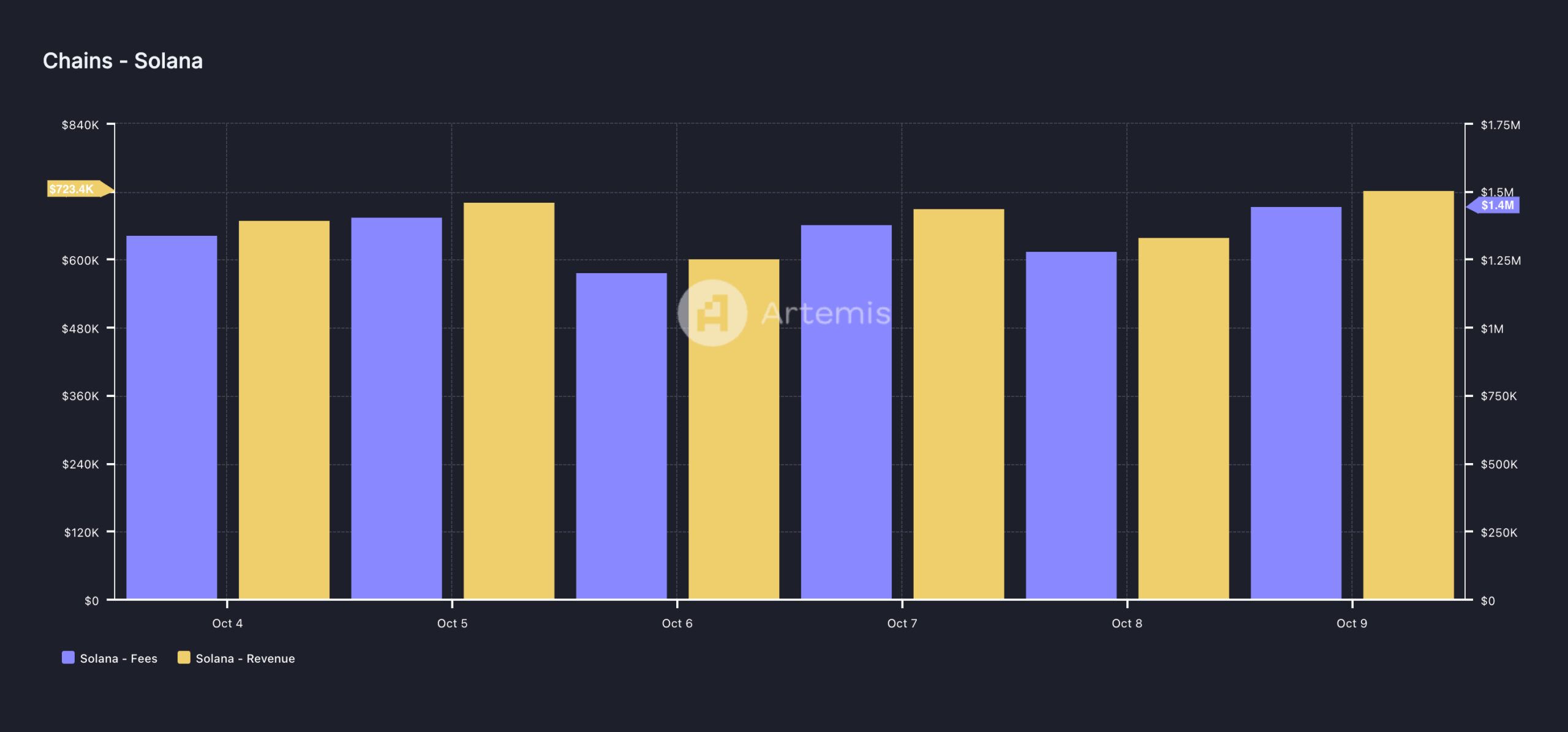

As expected, the spike in Solana’s demand has impacted its network fees and revenue. Per Artemis data, Solana’s total fees and revenue have surged by 8% over the past week.

SOL Price Prediction: This Is What Has to Happen

As of this writing, SOL is trading at $141.06, marking a modest 1% increase over the past week. It currently holds just above the support level at $133.58. The continued rise in network activity could further propel these gains, driving Solana’’s price higher.

According to Fibonacci Retracement readings, SOL is positioned for a surge, potentially reaching $188.52 if network engagement continues to grow.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if the network experiences a decline in user activity and demand for its native token weakens, Solana’s price could break below support and potentially drop to its August 5 low of $110.