After posting an impressive 18% rally over the past 30 days, Solana’s (SOL) price now faces the risk of a deeper pullback that could wipe out a substantial portion of those gains. On Wednesday, October 15, SOL attempted to retest the $160 level but failed to break through.

The cryptocurrency is now on the verge of falling below the critical $150 support level. If SOL dips beneath this region, this analysis indicates that the drawdown could result in the asset ending October with a net negative return.

Solana Faces Collapse as Bearish Signals Emerge

Currently, Solana’s price sits at $153.10, reflecting a modest 1.20% decline over the past 24 hours. Historically, similar movements in SOL’s price have often led to sharper declines.

In August, when SOL reached the $153 mark, it quickly lost 15% of its value, dropping to $129.35. September saw a similar pattern with a 12% decline, while October followed suit with a 10% drop under comparable conditions.

If this pattern continues, Solana could be facing another double-digit decline. The Bollinger Bands (BB), which tracks volatility, support this outlook. While SOL’s price remains above the middle band, it is not in an upward trend. Thus, if the token drops below the middle band, the anticipated correction could materialize.

Read more: 13 Best Solana (SOL) Wallets to Consider in October 2024

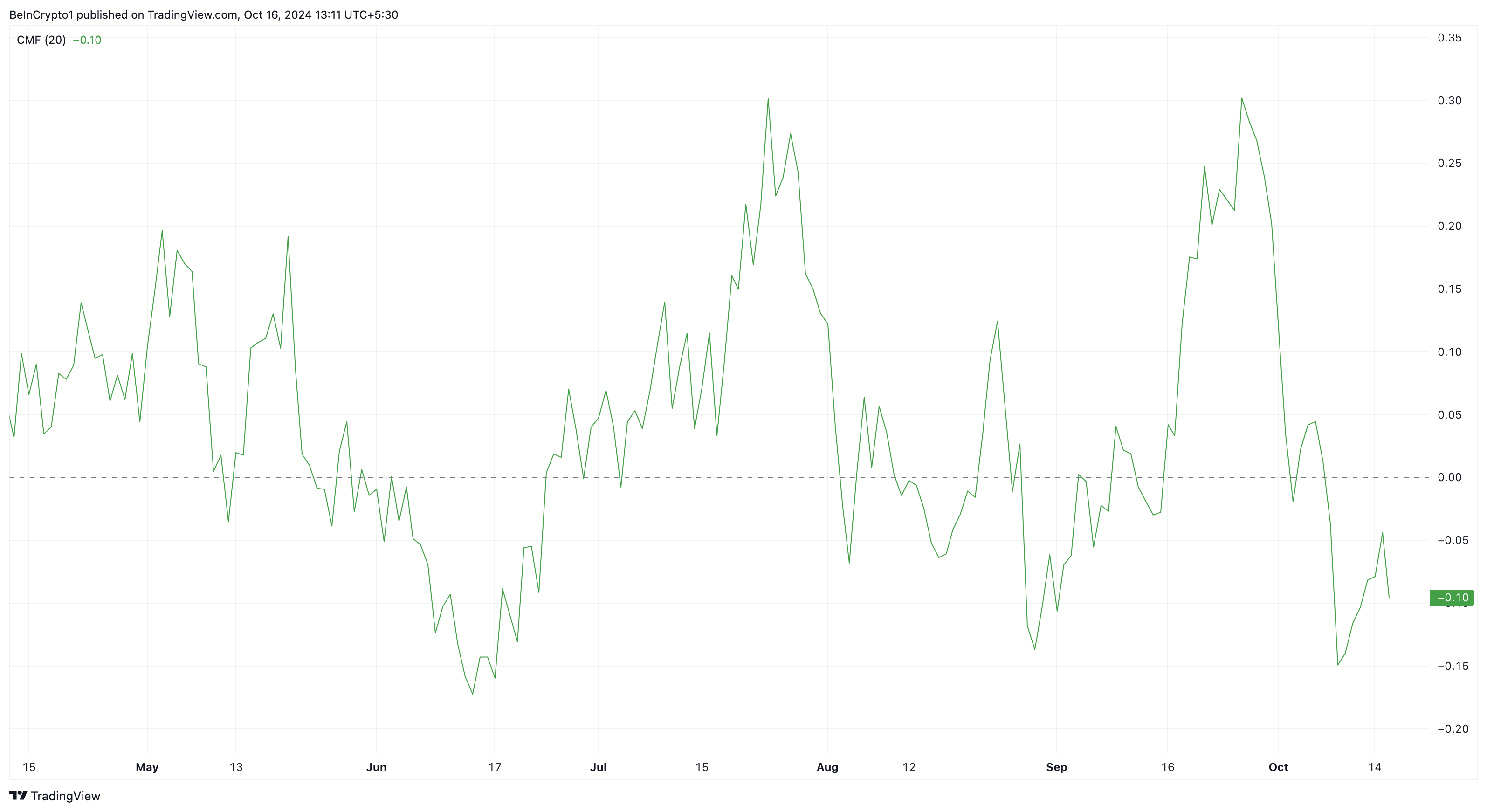

Another indicator reinforcing this bearish outlook is the Chaikin Money Flow (CMF), which measures the volume-weighted average of accumulation and distribution. A higher CMF reading signals stronger accumulation, while a lower reading indicates increased distribution.

On the daily chart, the CMF has dropped below the zero signal line, signaling that Solana is facing heightened selling pressure. If the current trend continues, this further supports the forecast of a potential double-digit decline in SOL’s price.

SOL Price Prediction: 10% Retracement Next

As noted earlier, Solana’s price is likely to fall below the critical $150 psychological support level. Given the current market conditions, bulls may struggle to defend this zone, potentially leading to another price drop.

If this scenario plays out, SOL could see a 10% decline to $136.07, echoing the price movement seen between October 1 and 3. In an even more bearish scenario, if selling pressure intensifies, Solana might experience a further decline, with its price dropping to $125.02.

Read more: 7 Best Platforms To Buy Solana (SOL) in 2024

Conversely, if SOL manages to hold above the $150 support, a rebound could be on the horizon. In this case, Solana might rally toward $173, a level it hasn’t reached since July.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.