Solana (SOL) is currently trading at its lowest level in 4 months. In the last 24 hours, SOL’s price has dropped by 5%, continuing a sharp correction of 45% over the past 30 days.

This downward trend has pushed its market cap to $70 billion. The ongoing bearish momentum is evident in both the Ichimoku Cloud and EMA indicators, signaling that further downside could be on the horizon.

Solana Ichimoku Cloud Shows a Strong Bearish Setup

The Ichimoku Cloud for Solana shows a clearly bearish trend. The price is positioned well below the cloud, indicating a strong downward momentum. The red cloud ahead reflects a bearish sentiment, with Leading Span A (green line) positioned below Leading Span B (red line).

This suggests that the prevailing negative momentum is likely to continue. The Tenkan-sen (blue line) is below the Kijun-sen (red line), which reinforces the bearish pressure, and the Chikou Span (green lagging line) is also below the price action, confirming the overall negative sentiment.

There was a brief consolidation phase, but SOL price failed to regain strength and fell again. Currently, the price is stabilizing, but the bearish structure remains intact.

For any indication of trend reversal, the price would need to cross above the Tenkan-sen and Kijun-sen, followed by a movement through the cloud. However, as long as the price remains below these key Ichimoku levels, the bearish trend is likely to persist.

SOL Whales Are Trying a Recovery

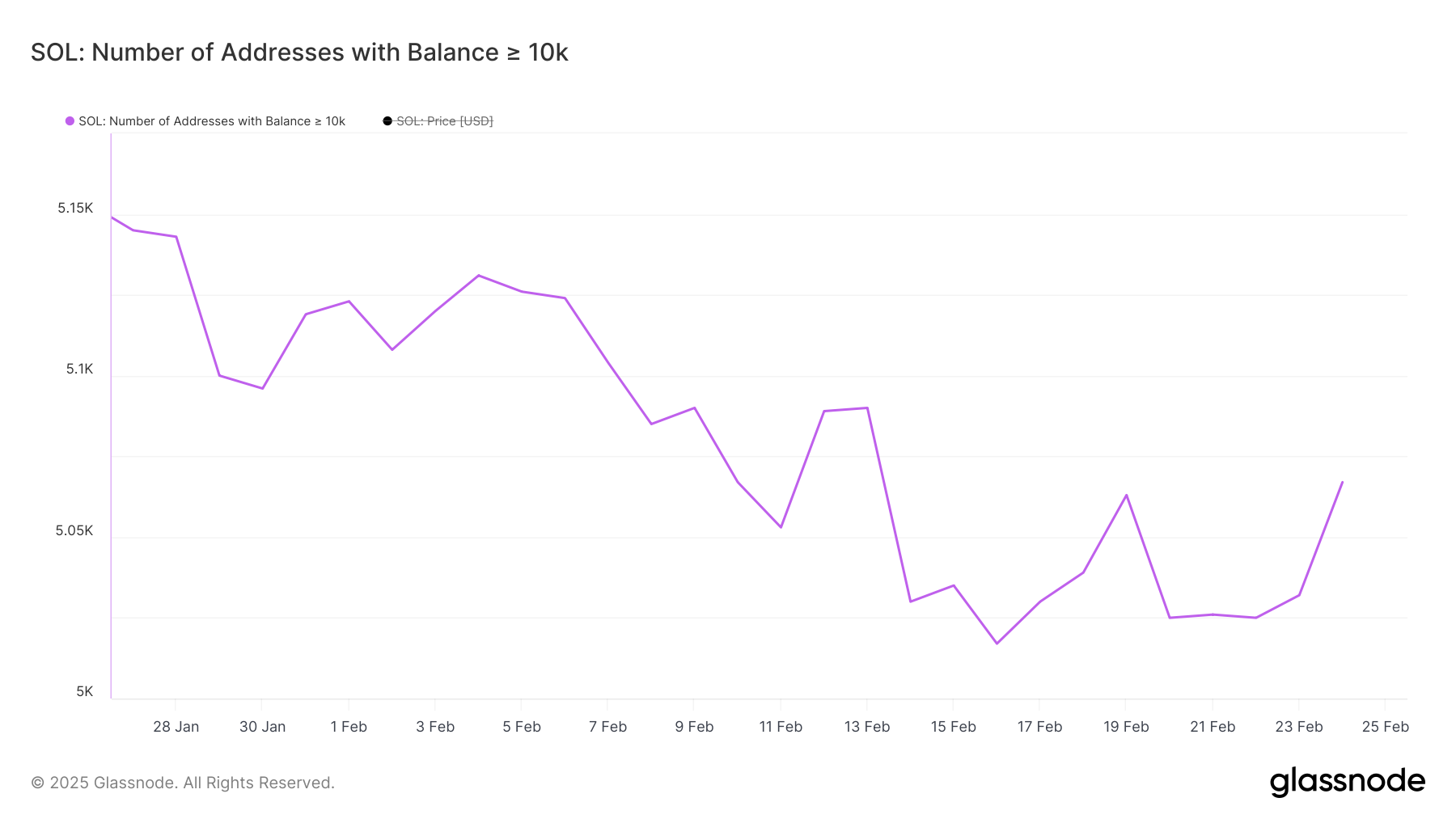

The number of Solana whales – addresses holding at least 10,000 SOL – has been declining steadily over the past 30 days, hitting 5,017 on February 16, the lowest level since December 2024.

This indicates that large holders have been selling, contributing to the bearish trend seen on the Ichimoku Cloud. When whales reduce their positions, selling pressure often increases, reinforcing negative momentum in the market.

This aligns with the overall bearish sentiment shown by the cloud indicators.

Tracking whales is important because they significantly influence price movements. Their buying or selling activity can signal market trends, as they control a substantial portion of the supply.

Recently, the number of Solana whales has shown signs of recovery, reaching 5,067. While this is an improvement, it’s still lower than in recent months but relatively high compared to historical values.

This suggests cautious accumulation but not enough to change the bearish outlook reflected in the Ichimoku Cloud.

Will Solana Reach Its Lowest Levels In 6 Months?

SOL’s EMA lines are showing a very bearish setup, with short-term lines positioned below the long-term ones and a significant gap between them.

This indicates strong downward momentum and suggests that the selling pressure is dominant. If this downtrend continues, SOL could test the support at $133, and if that level is lost, it could drop further to $120 or even $110, which would be its lowest point since August 2024.

The wide separation between the EMAs reinforces the strength of this bearish trend, aligning with the negative sentiment seen on the Ichimoku Cloud.

On the other hand, if the trend reverses, it could signal a potential shift in momentum. If Solana price manages to regain strength, it could first test the resistance at $152.

If this resistance is broken, the next target would be $171, and if that level is also surpassed, SOL could rally back to $180. Users are also carefully watching how a $1.9 billion Solana unlock coming on March 1 can impact its price.