Solana’s recent price action has shown signs of weakness, with the altcoin slipping below $200 amid bearish broader market cues.

Investors are increasingly focused on securing profits as skepticism grows about Solana’s ability to sustain a meaningful recovery. The lack of momentum has left the altcoin in a precarious position.

Solana Investors Pullback

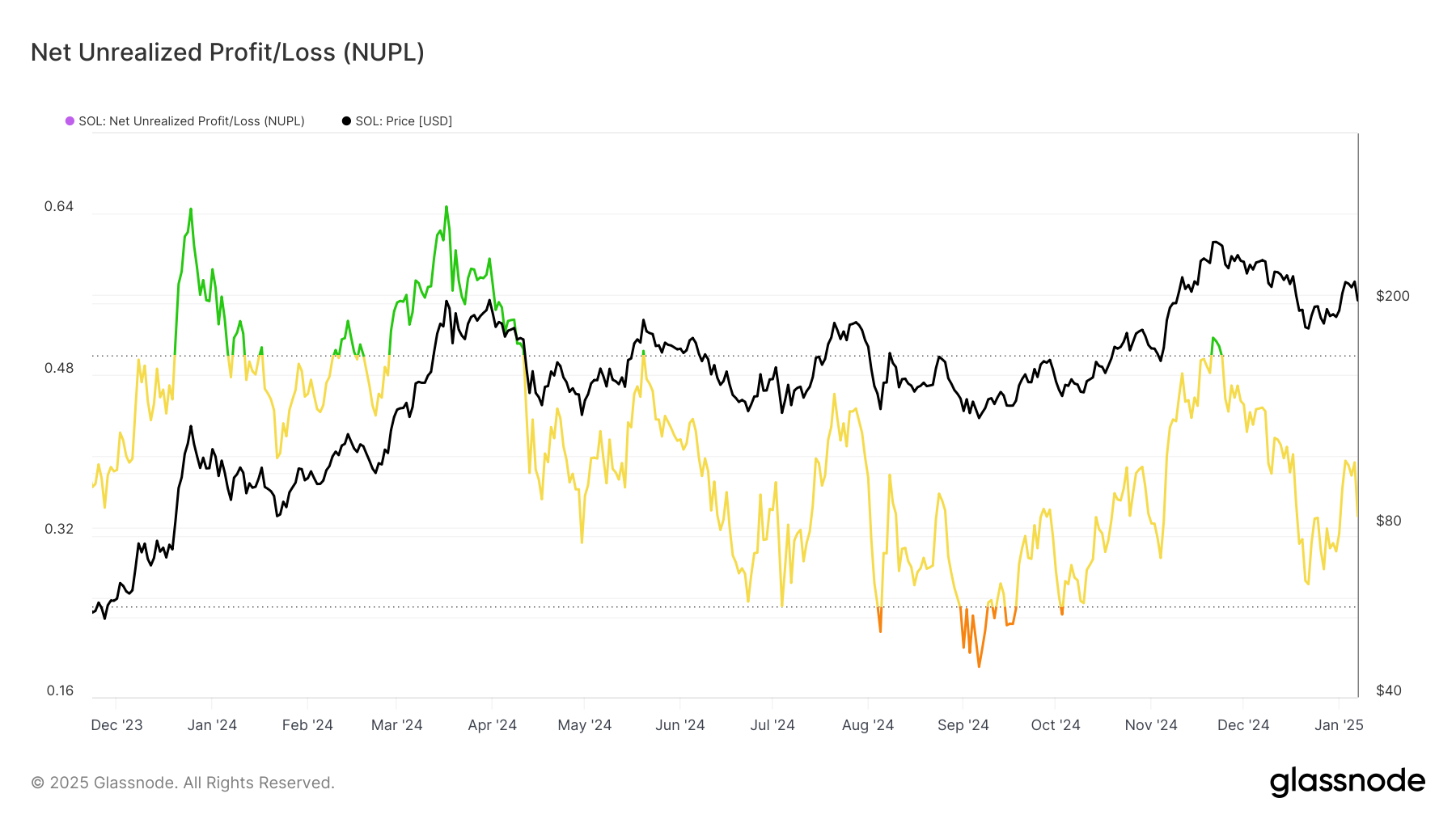

The Net Unrealized Profit/Loss (NUPL) metric indicates that Solana investors remain optimistic, with many still holding onto profits. Historically, Solana’s presence in this zone has often resulted in stagnation. While this scenario reduces the likelihood of sharp drawdowns, it also diminishes the chances of sustained upward momentum.

The reduced volatility, a typical feature in this profit zone, has kept Solana from both significant declines and substantial rallies. For now, this sentiment reflects a market that is cautious but not entirely bearish as investors wait for clearer signals of recovery.

On the macro front, the Chaikin Money Flow (CMF) indicator is signaling an uptick, a positive sign for Solana’s recovery potential. The CMF’s position above the neutral line reflects increasing inflows into the cryptocurrency, which historically supports price recoveries.

This uptick in inflows suggests that despite the broader bearish cues, investors are gradually re-entering the market. However, sustained momentum will require these inflows to persist and align with a shift in broader market conditions favoring growth.

SOL Price Prediction: Finding Momentum

Solana’s price fell 11% in the last 24 hours, bringing the altcoin to $194 after dropping below the $200 mark. Despite the decline, Solana managed to hold above the critical support level of $186, which remains a key level for the asset.

The current indicators suggest a few quiet days ahead, with recovery likely if Solana can breach the $201 resistance level and turn it into support. However, a rally back to its all-time high (ATH) of $264 would require stronger bullish momentum and improved market conditions.

If bearish market cues persist, Solana risks slipping below the $186 support. Such a scenario could lead to further declines, potentially sending the price to $175 or lower, invalidating the bullish outlook and intensifying investor concerns.