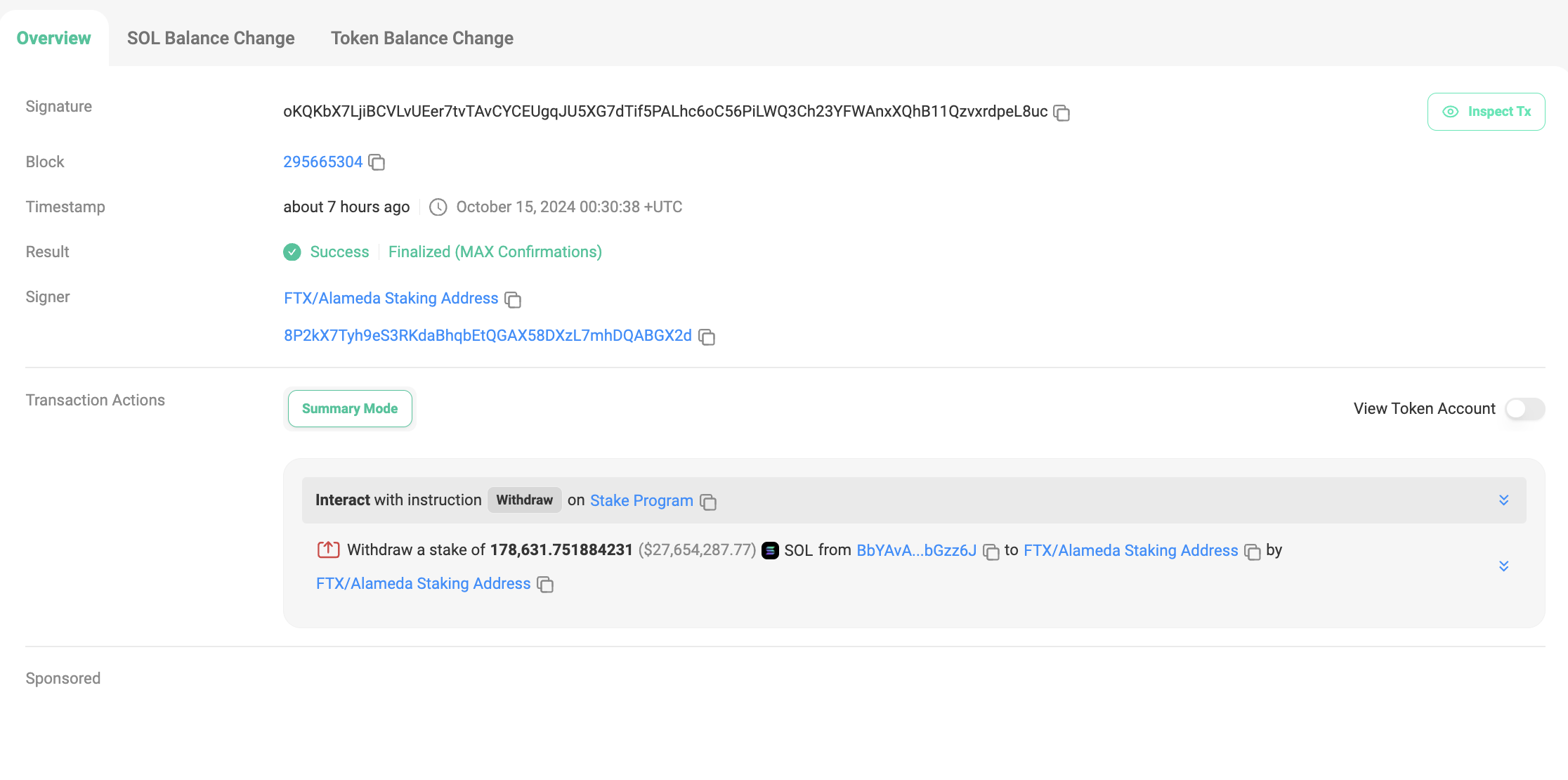

Solana’s price could face further downward pressure as the SOL staking address associated with FTX/Alameda redeems 178,631 SOL, valued at approximately $28 million.

If a significant portion of the redeemed SOL is sold on exchanges, the altcoin’s value may decline by double digits. The question remains: how soon will this happen?

Solana At Risk As FTX Makes a Move

Early Tuesday, the SOL staking address belonging to FTX/Alameda redeemed another 178,631 SOL coins valued above $128 million at current market prices.

According to Solscan, this marks the latest in a series of regular redemptions and transfers of SOL from this address, with roughly 170,000 SOL being redeemed and moved out around the 12 to 15 of each month.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

The recently redeemed SOL tokens are likely to flow into exchanges like Coinbase or Binance for sale, particularly after a Delaware judge approved FTX’s reorganization plan, which allocates over $14 billion in payouts to customers of the collapsed cryptocurrency exchange. If this happens, it could lead to a temporary decline in SOL’s price in the near term.

However, traders may rest easy as SOL currently benefits from the general market uptrend. The altcoin is trading at $154.56 as of this writing, noting an 8% price uptick over the past week. It enjoys a bullish bias, as evidenced by its Parabolic Stop and Reverse (SAR) indicator.

This indicator identifies an asset’s trend direction and potential reversal points. Its dots rest above Solana’s price at press time, suggesting that the altcoin is in an uptrend. Traders interpret this as a signal to either hold or open long positions.

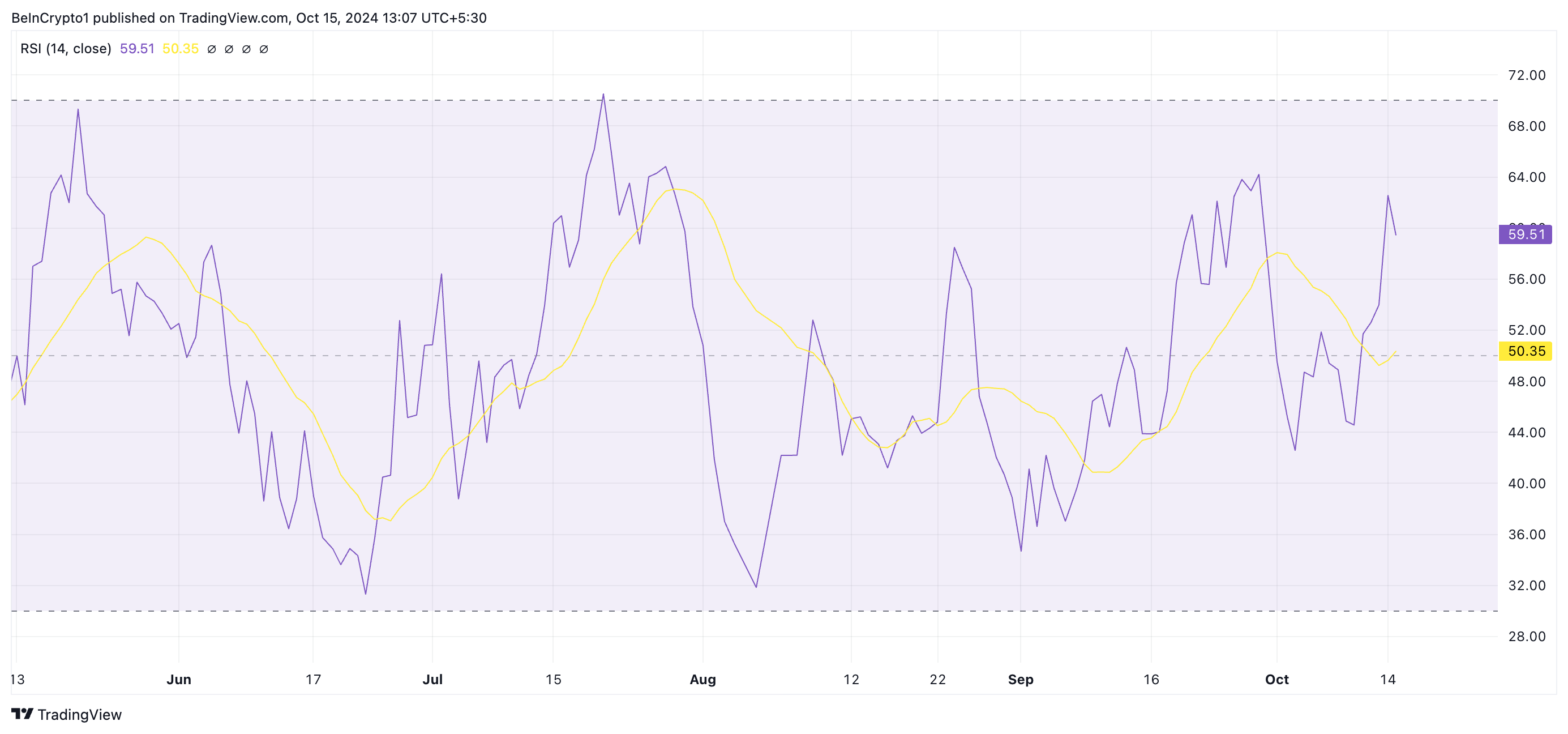

SOL’s Relative Strength Index (RSI) supports this bullish outlook. At 59.51, the coin’s RSI, which measures its oversold and overbought market conditions, indicates that Solana is gaining strength and experiencing a bullish trend.

SOL Price Prediction: All Rests in FTX’s Hands Now

Solana is currently trading at $155.18, shy of the resistance level of $159.77. If the bullish momentum continues, the price could break above this level and aim for $186.29, a high last seen in July.

Read more: 13 Best Solana (SOL) Wallets to Consider in October 2024

However, Solana may lose its recent gains once FTX begins liquidating its redeemed tokens without sufficient demand to offset the increased supply. A 15% decline could push its price down to the support level of $131.04.

If this support fails to hold, Solana’s price could see further downside, dropping to $109.55.