The Solana price has been on a larger downtrend after the FTX collapse, and investors are left wondering if a bottom has been reached. It’s no secret that Solana had connections to Sam Bankman-Fried and FTX, which

While many cryptocurrencies managed to chart relief rallies after taking a battering due to the collapse of FTX, the SOL price remained bearish. Solana was one of the biggest underperformers in the crypto space in November 2022.

The SOL price performance in November has been controlled by bears, but can it make one final push to the upside before the end of the year?

Retailers Wary of SOL

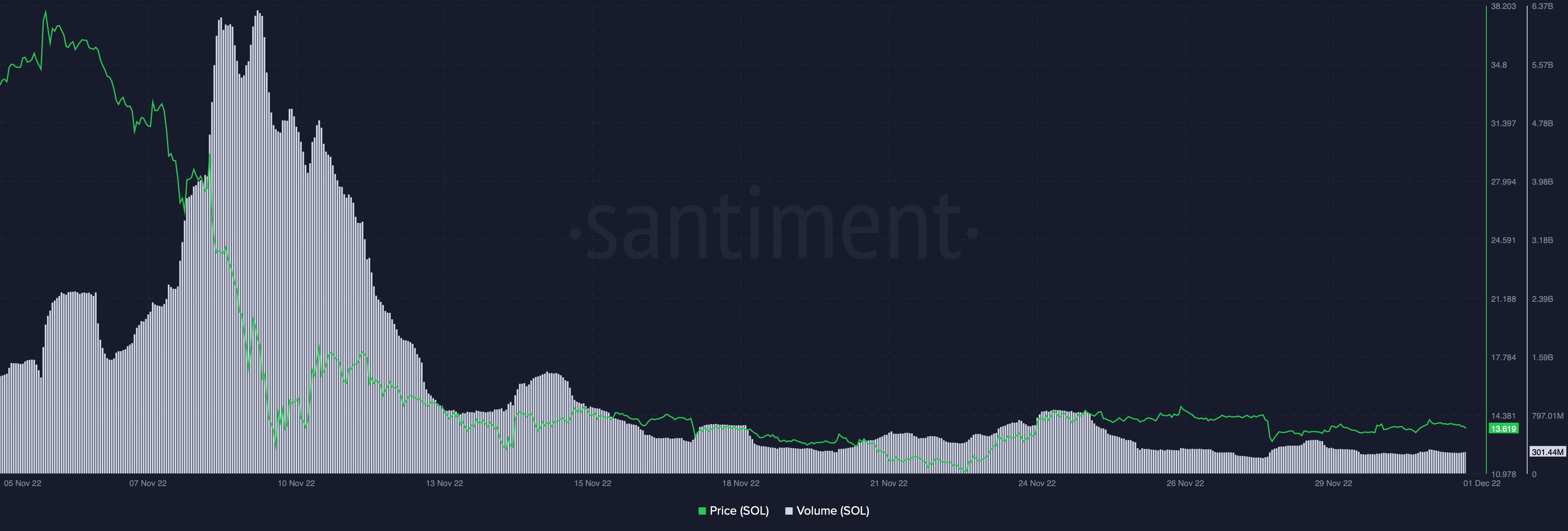

From a November peak of $38.79, the Solana price fell 65% further and is currently trading at $13.50.

Furthermore, daily trade volumes had dropped by 25% from the previous day, measuring around $220 million at press time. Retail interest and trade volumes for SOL have taken a major hit since the fall of FTX.

Trade volumes are currently sitting at monthly lows. And while the Solana spot market looked largely barren, the futures markets weren’t showing much better.

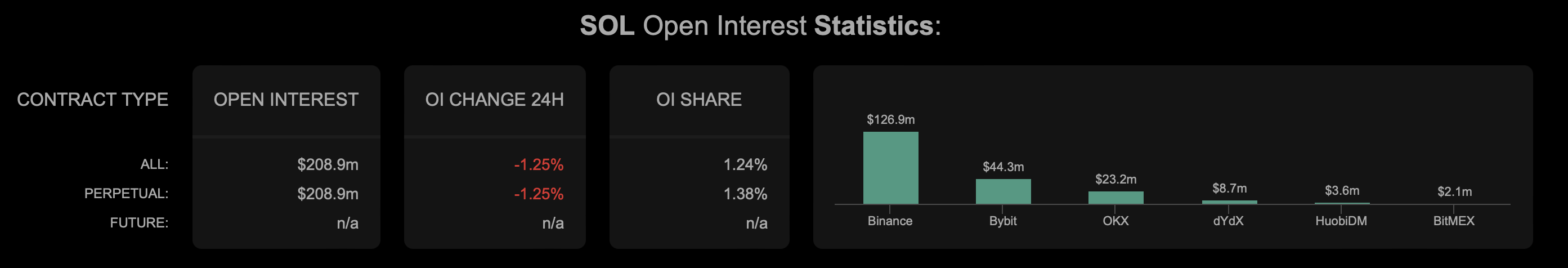

Solana’s open interest was down by 1.25% and stood at $208.9 million on Dec. 2.

Funding rates were also still negative, which means that short-position traders were dominant and were willing to pay long positions. This is normally indicative of a bearish trend.

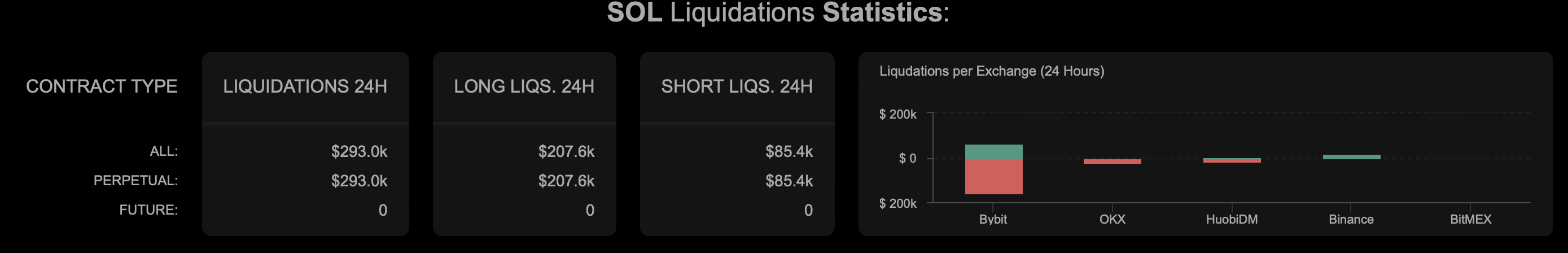

In addition to that, there was around $207,000 worth of long liquidations and $89,000 worth of short liquidations on SOL in the past 24 hours. More longs being liquidated is another obvious signal of a bearish trend.

Low Social Interest in Solana Weighs Down Price

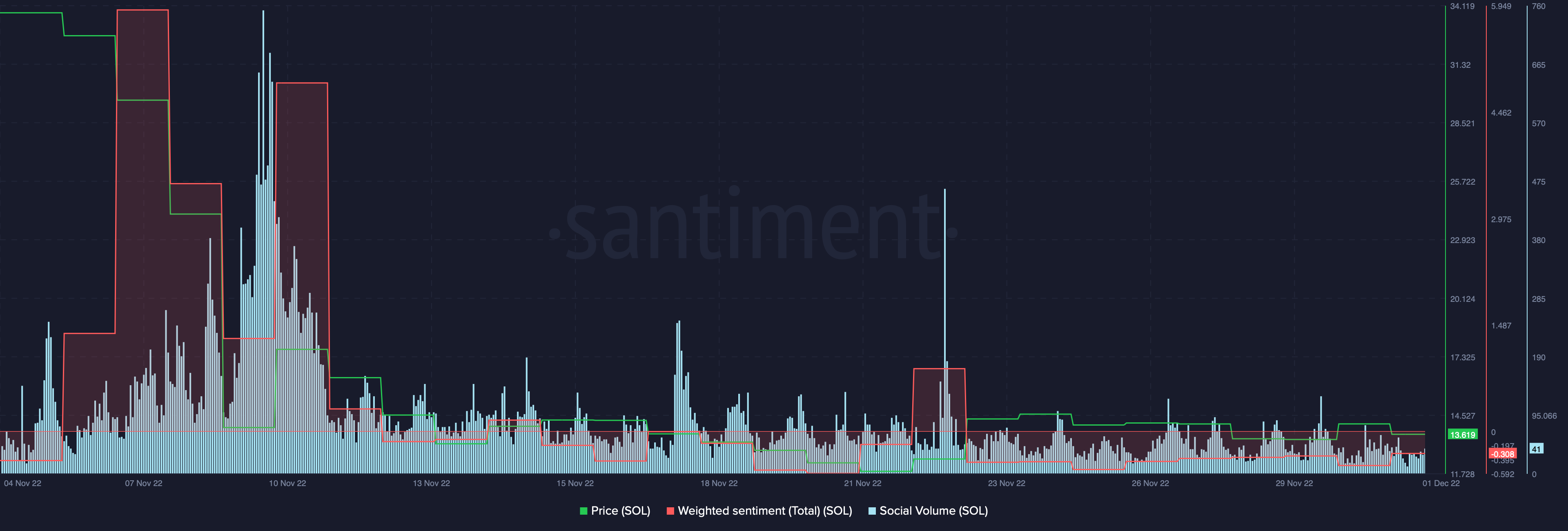

Social metrics for Solana showed no major spikes. Social volumes have been dwindling while weighted social sentiment was still in the negative territory.

Negative weighted social sentiment signaled a low demand for SOL in the market. Furthermore, recent NFT statistics from Messari showed that the Solana landscape was one of the worst hit by bears in regard to that specific sector.

Solana NFT sales fell by 48%, the highest drop in sales compared to its peers like Ethereum and Polygon.

One positive on-chain trend for SOL was its development activity picking up steam, which could potentially boost investor confidence.

Nonetheless, with everything else tilting bearish, there is only so much that developers can do to push price action. The overall outlook for Solana suggests a prolonged recovery, with bears still dominating bulls in the near term.

The $20 psychological resistance could play an important role in confirming a SOL price recovery. If the bearish price action continues, the price could possibly dip below the $10 level.