Solana has been hailed for its significant growth in the blockchain space, earning the tag “macOS of blockchains” from several key industry experts.

The SOL ecosystem has progressively become the go-to blockchain for new tokens, especially meme coins, solidifying its position in the industry.

Solana Likened to Apple’s MacOS

In a “Blockchain Letter,” three executives at Pantera Capital have likened the Solana ecosystem to Apple’s macOS. The letter cites general partner Franklin Bi, portfolio manager Cosmo Jiang, and investment analyst Eric Wallach as quoting blockchain oligopoly.

Pantera executives acknowledge the power of the Ethereum blockchain seen with its developer dominance (70-80%). Nevertheless, they highlight Solana as a formidable contender, especially over the past year.

“Ethereum’s dominance appears to be yielding to the multi-polar model. Solana has gained a significant share over the past year. The shift is reminiscent of Microsoft’s dominance of the early desktop computer market until Apple broke through with its vertically integrated approach. Solana is now a major contender for the future of blockchain development,” the experts wrote.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

The execs liken Solana to Apple. Its monolithic architecture, seen in its product roadmap, focuses on blockchain component optimization. According to Bi, Jiang, and Wallach, this is the same thing Apple has done, vertically integrating hardware and software stack in macOS. Notable perks for this modus operandi include a seamless user experience (UX), faster innovation, and enhanced security.

Further, they cite the Solana blockchain’s “architectural advantages” that make it superior to peers like Ethereum and Cosmos. These tenets make the SOL network desirable for use cases such as content distribution, DePIN (decentralized physical infrastructure networks), and CLOBs (central limit order books). Solana’s high-performance blockchain also enables the creation of capital-efficient financial markets, such as CLOB-based Phoenix and lending protocol MarginFi.

A March research also branded Solana the Apple of crypto, citinginnovation focused on leveraging hardware for Web3 experience enhancement. Its network performance and commitment to community and ecosystem development set it apart. Technical enhancements and strategic partnerships also reflect Solana’s leadership in bridging blockchain with financial systems.

SOL Records Strong Fundamental Growth

The letter also highlights fundamental growth in the Solana blockchain, including user growth and accelerating transaction fees. These developments have positioned it as the primary destination for retail users and memecoin traders, displacing Ethereum’s NFT dominance from the previous cycle.

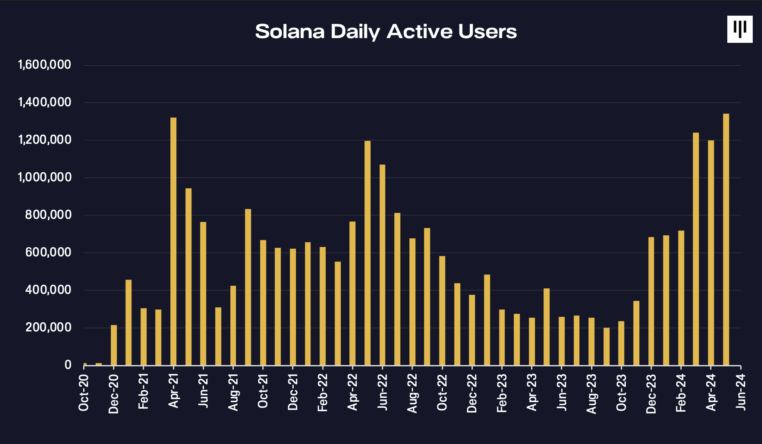

The chain has seen a significant increase in unique active addresses, rising 1,342% between 2020 and 2023, from 14,000 to 202,000. It has now reached 1.34 million, marking a remarkable growth in user activity.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

The report noted the intensity of demand for block space on Solana, which is seen with rising priority fees on the network. New tokens are also sprouting atop the SOL chain, beating what is seen on BNB, Ethereum, and Polygon blockchains.

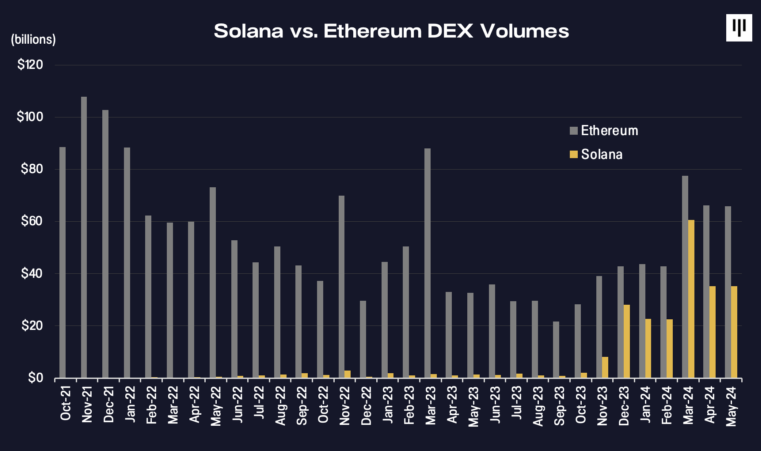

“By May 2024, Solana accounted for 85% of all new tokens appearing on DEXs, up from 50% a year ago. This rise in Solana-based tokens reflects its strength in retail usage, driven by memecoin activity,” the report notes.

The dominance of Solana’s leading wallet, Phantom, in the iOS app store rankings, also reflects the growth of retail users on the SOL chain. The execs ascribe the retail influx mostly to the memecoin trading boom on Solana decentralized exchanges (DEXs).

Read more: 11 Top Solana Meme Coins to Watch in June 2024

Noteworthy, Solana’s share of DEX volume has skyrocketed by more than 24% since 2021, an astonishing growth that saw it capture over 60% of incremental DEX volume in May 2024 alone.

This points to significant momentum behind Solana’s DEX ecosystem, highlighting the contribution of its high-performance architecture in enabling rapid growth in market share. The report concludes that soaring user activity and DEX volumes have translated into real economic value for SOL holders.