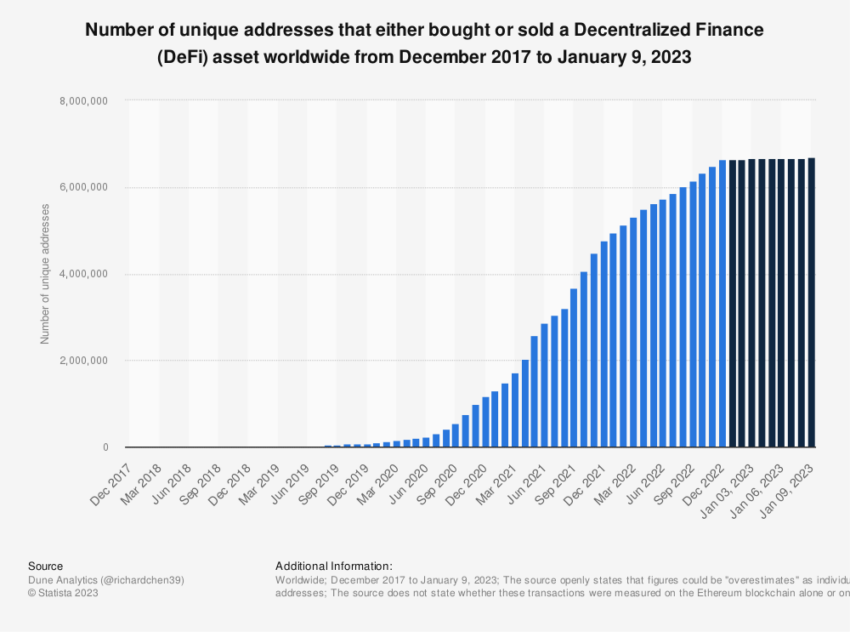

Ethereum, the second-largest cryptocurrency by market capitalization, has played a pivotal role in the blockchain industry, particularly in decentralized applications (dApps) and decentralized finance (DeFi). However, it has long been critiqued for its scalability issues and high transaction fees, opening the door for other blockchain networks to solve these problems. One such blockchain network that has emerged as a serious contender is Solana.

Solana, compared to Ethereum, has quickly gained attention in the cryptocurrency market for its high speed, low transaction fees, and scalability. These attributes have allowed it to stand out from Ethereum and other blockchain networks, creating a promising alternative for developers and users.

Solana vs. Ethereum: What’s the Difference?

Ethereum has been a pioneering force in the blockchain industry, setting the stage for the advent of DeFi. The blockchain has fostered a vast ecosystem of dApps.

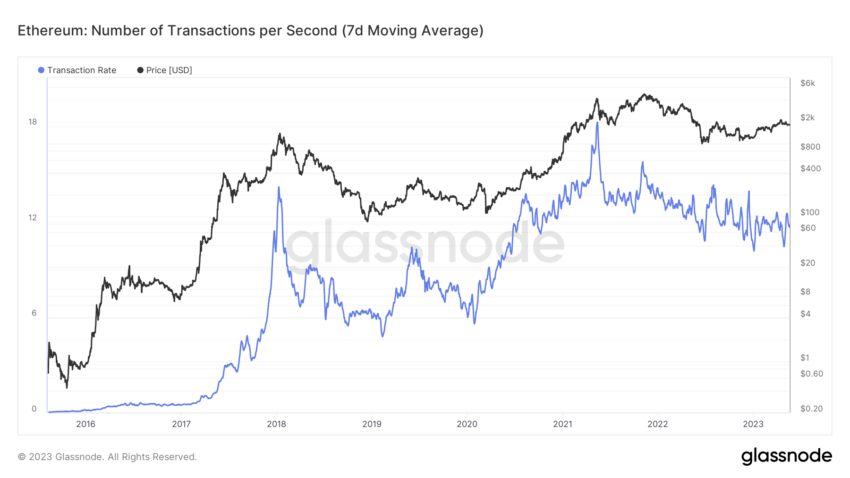

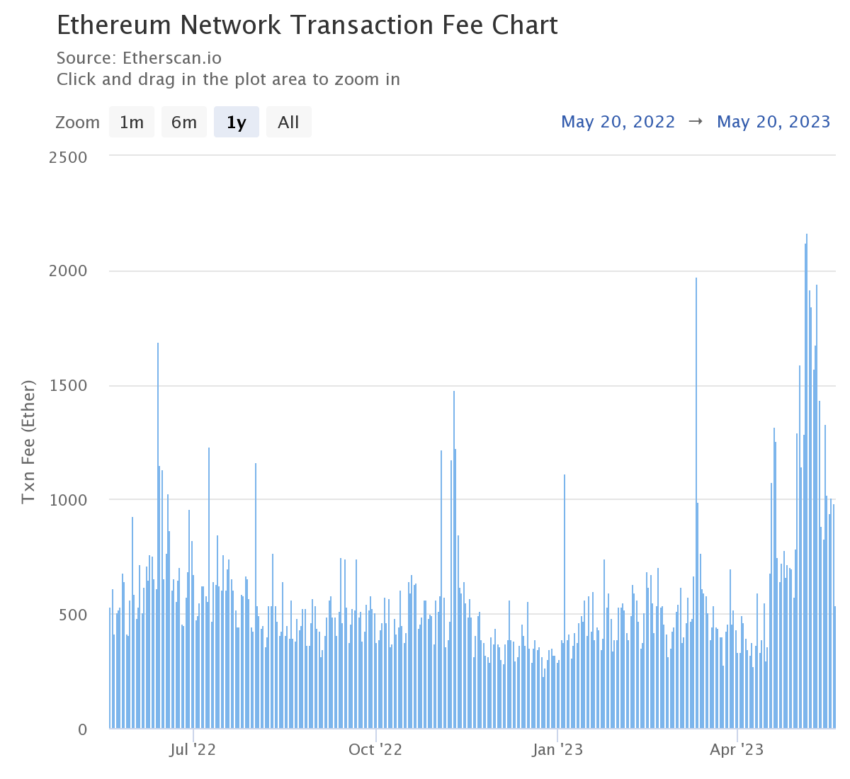

Still, it has encountered scalability issues that have hindered its ability to efficiently handle a high volume of transactions.

This limitation is reflected in Ethereum’s transaction execution time, which ranges from 13 seconds to 5 minutes. Meanwhile, transfer fees can be volatile, sometimes exceeding $100, even for small ETH transfers.

Although Ethereum has taken steps to address these issues, notably with the planned transition to ETH 2.0, these challenges have created opportunities for competitors.

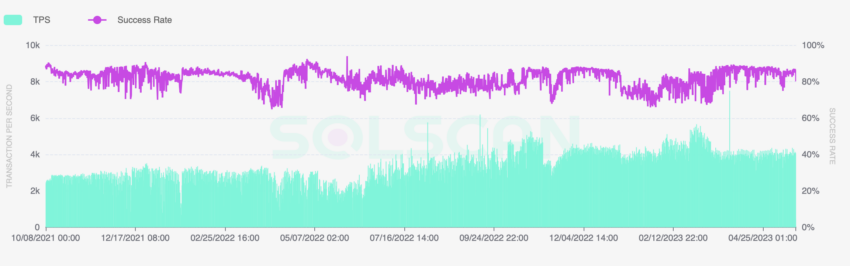

Often referred to as a third-generation blockchain, with Bitcoin representing the first and Ethereum the second, Solana has significantly raised the bar regarding transaction speed and scalability.

It boasts an impressive capability of supporting over 50,000 transactions per second (TPS), a leap compared to Ethereum’s capacity.

In perspective, Visa, a traditional payment network, typically processes about 1,700 TPS in day-to-day operations.

Solana Compared to Ethereum: Key Innovations

One of the main differentiators of Solana is its innovative approach to handling network throughput. While Bitcoin and Ethereum rely on Layer 2 solutions for scalability, Solana has built scalability into its main chain, Layer 1. This architecture offers several advantages, including increased efficiency and reduced complexity.

Moreover, Solana utilizes a Proof-of-Stake (PoS) consensus mechanism. Unlike Bitcoin’s Proof-of-Work (PoW) mechanism, which requires miners to perform energy-intensive computational work, PoS blockchains allow validators to use their token holdings as a qualification to participate in the network’s security. This design not only offers greater scalability but also promotes energy efficiency.

Solana introduced three key design innovations that further enhance its performance:

- Proof-of-History (PoH): In addition to a Proof-of-Stake (PoS) consensus mechanism, Solana uses PoH. This pre-consensus time-stamping protocol establishes a chronological timeline across all added data blocks (transactions). As a result, network nodes don’t have to wait for other blocks to be added, significantly reducing transaction overhead. This key innovation, in turn, increases network throughput.

- Tower BFT: Working in tandem with PoH is Tower Byzantine Fault Tolerance (BFT), a custom version of the classical Byzantine Fault Tolerance consensus algorithm. Tower BFT further reduces the network’s latency by achieving consensus more quickly, enhancing the speed and efficiency of the network.

- Turbine: This protocol is essentially Solana’s implementation of data sharding. Turbine breaks data into smaller pieces and then distributes them to nodes in the network. Creating smaller node collections, or “neighborhoods,” spreads the transaction settlement load, increasing the network’s capacity to handle large traffic volumes.

What Is the Problem With Solana Network?

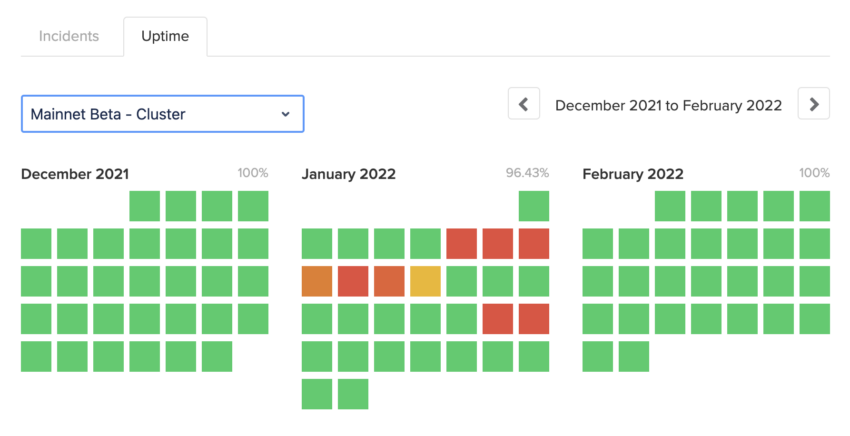

Security is a critical concern for any blockchain platform, and Solana has not been without its issues in this regard. Despite its high-performance capabilities, the blockchain has experienced several network outages in the past. At least seven were recorded in 2021 and 2022 alone, and one was recorded in 2023 thus far.

These outages have been attributed to “excessive transactions,” leading to duplicate transactions that overload the network’s capacity. These disruptions have raised questions about the network’s reliability and robustness.

Solana responded to these concerns by partnering with blockchain infrastructure developer Jump Crypto to build a new validator client to increase the network’s throughput capacity. However, the successful mitigation of these issues remains to be seen and will be a key factor in Solana’s long-term success.

While Solana has made strides in handling high transaction volumes, it is still a relatively new blockchain. There remain questions about how it will scale as it grows in popularity. The scalability issue of Solana, compared to Ethereum, is about handling an increasing volume of transactions and managing a growing network of users, applications, and services.

It remains to be seen how Solana’s architecture will adapt and evolve to meet these demands and whether it can maintain its performance advantages as it scales.

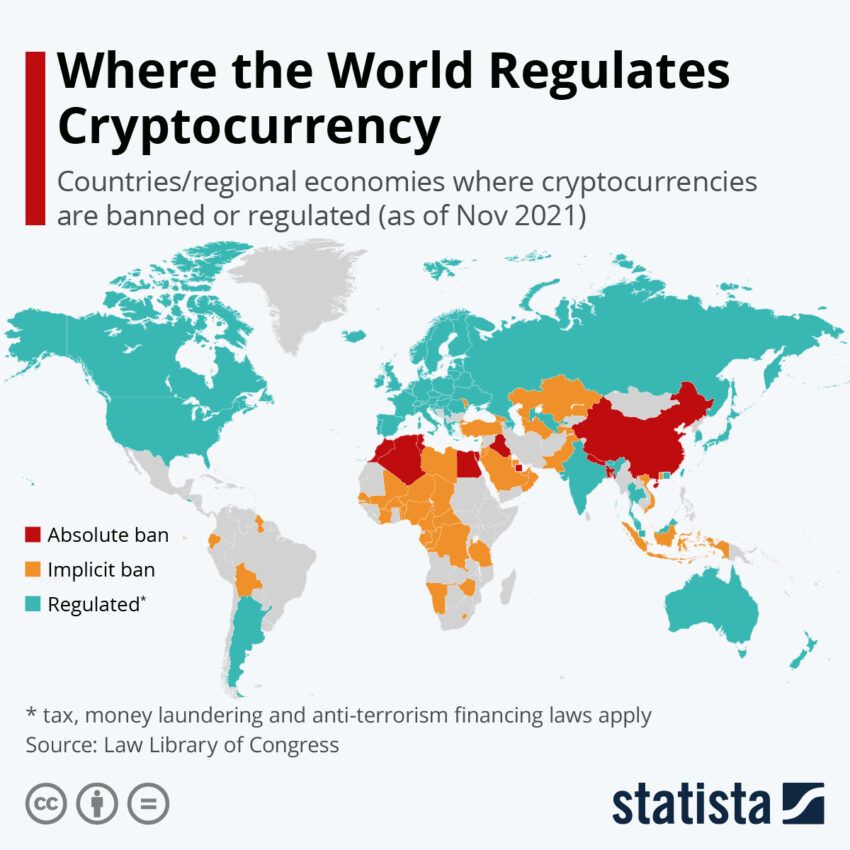

Like other cryptocurrencies, Solana faces the prospect of increased regulatory scrutiny. Regulatory bodies worldwide are paying closer attention to the crypto market, and new regulations could impact Solana’s growth and adoption.

While regulation can provide clarity and protection for users, it can also create obstacles and uncertainties for blockchain platforms.

The implications of regulatory changes for Solana are not yet clear, but it is a challenge that the platform and the rest of the industry must navigate.

The Quest to Becoming the Top Layer 1 Blockchain

Solana must focus on several key areas to achieve mass adoption and potentially surpass established cryptos like Bitcoin and Ethereum.

Solana has already made significant strides in scalability with its capacity for high-speed transactions. However, it needs to ensure that its infrastructure can maintain this performance as the user base and number of transactions increase.

The ability to interact seamlessly with other blockchains is also a critical feature that will increase Solana’s appeal to users and developers alike. Solana’s Wormhole bridge is an example of this, allowing the transfer of assets between different blockchain networks. Continued investment in such technologies will be crucial for Solana’s growth.

Moreover, Solana must foster a strong developer community to build a diverse range of dApps on its platform. Ethereum’s success largely reflects its vibrant developer community and a vast array of dApps. The more useful and innovative dApps available on Solana, the more likely it is to attract users.

Establishing partnerships with businesses and other projects in the crypto space can greatly increase Solana’s visibility and user base. Since many potential users and developers are unfamiliar with Solana, investing in education and marketing can help to raise awareness. Similarly, integrating with popular wallets, exchanges, and other crypto services can make it easier for users to access and use SOL and other tokens built on Solana.

Surpassing Bitcoin and Ethereum is a formidable challenge given these networks’ first-mover advantage, established user bases, and broad recognition. However, Solana, compared to Ethereum, could increase its adoption by focusing on these areas and potentially compete more directly with these established networks.

FAQs

What Makes Solana Better Than Ethereum?

Does Solana Have More Potential Than Ethereum?

Why Is Solana More Centralized Than Ethereum?

Solana vs. Ethereum Long-Term

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.