Solana’s (SOL) value has dropped by 25% over the past month, recently falling below key moving averages.

This decline suggests that SOL is struggling to break above resistance levels, which further weakens the market’s positive sentiment and signals the potential for an extended price decline.

Solana Loses Bullish Support, Trends Downward

Recent readings from Solana’s (SOL) one-day chart reveal that its price fell below both the 20-day exponential moving average (EMA) and the 50-day simple moving average (SMA) on August 27, after an unsuccessful attempt to stabilize above them. Currently, SOL’s 20-day EMA stands at $147.72, and its 50-day SMA is at $155.74, while the coin itself is trading at $137.86.

The 20-day EMA reflects SOL’s average closing price over the past 20 days, and the 50-day SMA tracks its average closing price over the past 50 days. In a downtrend, these moving averages act as resistance levels, where the asset typically faces significant selling pressure, making it difficult for the price to break above them.

SOL has spent most of the month trading below its 20-day EMA and 50-day SMA. Although a brief surge in buying pressure on August 24 pushed the price above these averages, this rally was short-lived as profit-taking activity quickly brought the price back down.

When the price falls below the 20-day EMA and 50-day SMA, it reinforces the bearish trend. The inability to stay above these moving averages indicates strong selling pressure and a lack of buying interest to drive the price higher.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

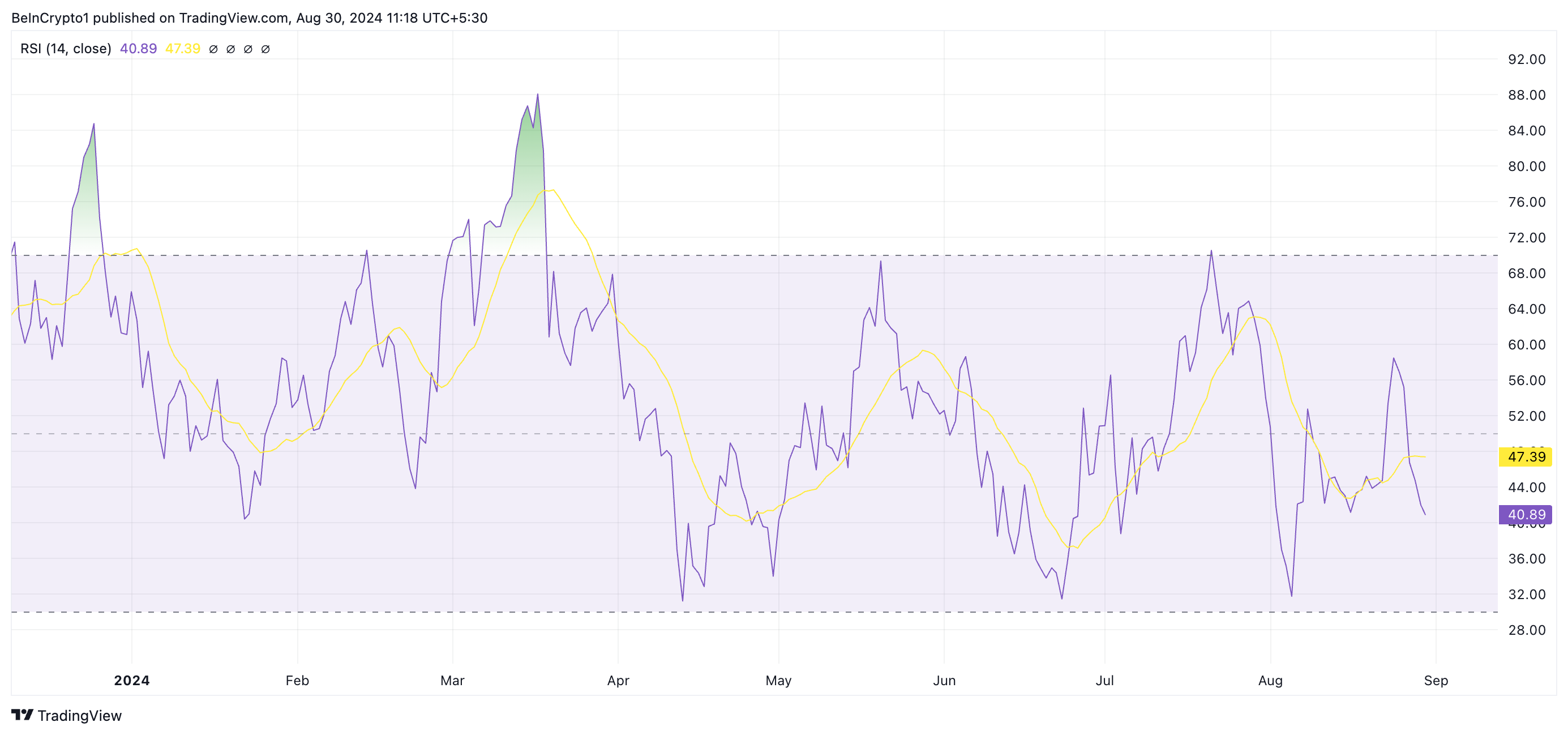

The decline in SOL’s Relative Strength Index (RSI), which is at 40.89 and trending downward, further confirms the low buying pressure. This suggests that market participants are more inclined to sell rather than accumulate SOL, contributing to the ongoing downtrend.

SOL Price Prediction: a Fall Below $130 May Be Imminent

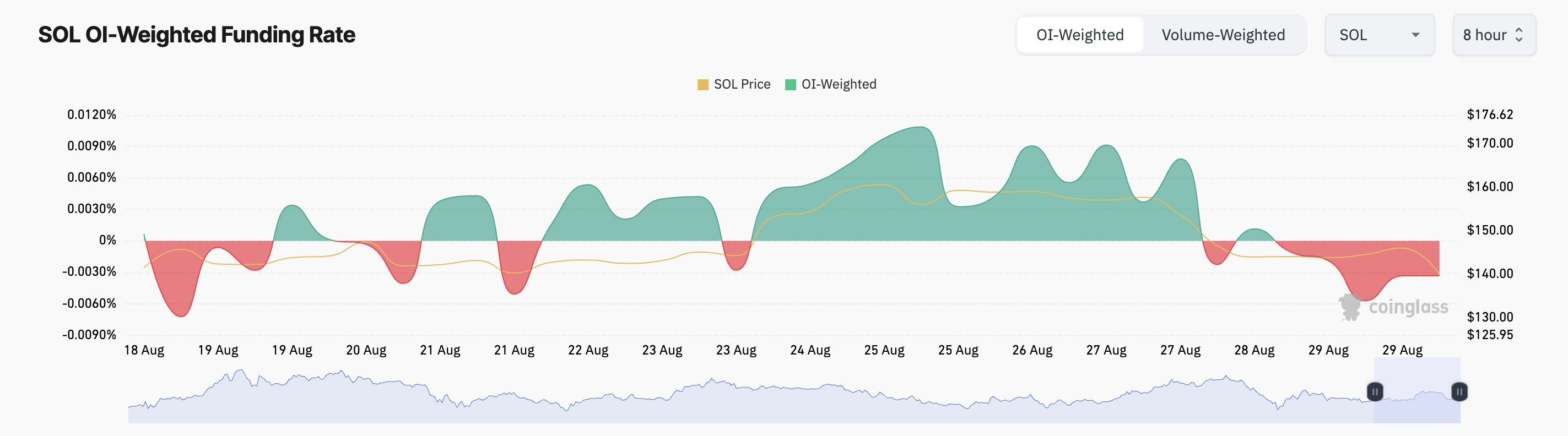

The sentiment in SOL’s futures market mirrors the bearish outlook in its spot market, with traders increasingly taking short positions over the past two days. Since August 28, SOL’s funding rate has remained negative, indicating that more traders are betting on a further decline in the asset’s price.

If the current downtrend continues, SOL’s price could fall to $133.64. Should the negative sentiment persist, the next target could be $110.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

On the other hand, if there is a resurgence in demand, SOL’s price might recover and climb to $148.27.