The ongoing maelstrom over the collapse of the cryptocurrency exchange FTX continues to pull in more parties. One of the latest to be ensnared is Temasek, the international investment firm owned by the government of Singapore.

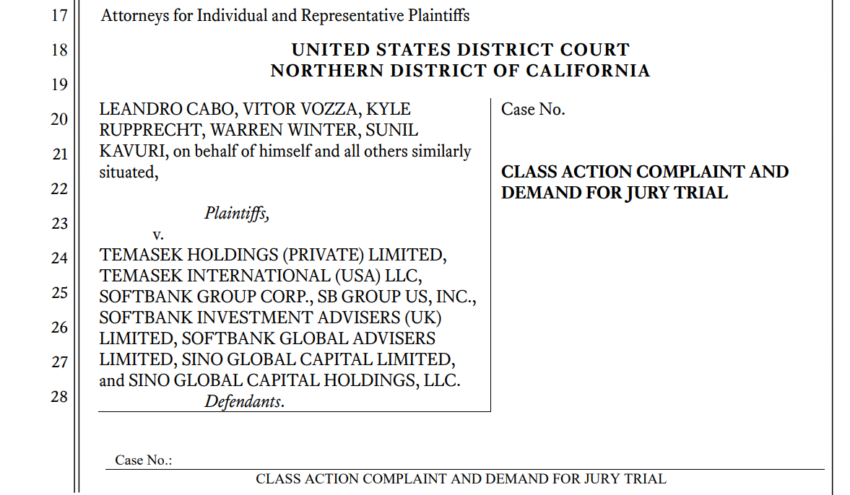

A United States class action lawsuit charges that Temasek, and others, did not do their due diligence before partnering with FTX. The lawsuit, filed on August 7, accuses the firm—along with 17 other companies—of aiding and abetting FTX’s multibillion-dollar fraud.

Temasek and Others Accused of Helping FTX Perpetrate Fraud

Temasek does not need more bad news. Last month, the firm reported a $6 billion net decline in its portfolio value compared to a year ago. As per CNBC’s July 11 report, this is the first such loss on Temasek’s books in more than ten years.

Amid the financial turmoil, Temasek now faces a bitter lawsuit over its role in promoting FTX. The suit names Temasek, Sino Global, Sequoia Capital, Softbank, and others as companies who used their “power, influence and deep pockets to launch FTX’s house of cards to its multibillion-dollar scale.”

The complaint also alleges that FTX Group illegally sold securities without proper registration. This may have deprived plaintiffs of financial and risk-related disclosures that would have influenced their decision to invest.

The suit goes so far as to accuse Temasek and the other defendants of aiding and abetting these securities law violations.

Temasek claimed to have conducted an eight-month-long financial audit of the disgraced exchange in 2021 and found nothing of concern. A story some may question, considering that just a year later, FTX would implode in spectacular fashion.

The company attempted to justify its $275 million investment in a statement posted on November 22, 2022, soon after FTX’s collapse. It read, in part:

“The thesis for our investment in FTX was to invest in a leading digital asset exchange providing us with protocol agnostic and market neutral exposure to crypto markets with a fee income model and no trading or balance sheet risk.

We invested US$210 million for a minority stake of ~1% in FTX International1, and invested US$65 million for a minority stake of ~1.5% in FTX US.”

In the statement, the company also argued that although its due diligence processes may reduce risk, it was not “practicable to eliminate all risks.”

Strangely, part of its reason to invest appears to have turned on the character of Sam Bankman-Fried, founder and then-CEO. However, its belief in his “actions, judgment and leadership” was “misplaced,” the report admitted.

When FTX failed in November 2022, Temasek lost its investment and cut the pay of the executives behind the decision.

Learn how FTX imploded, wiping out billions from the crypto markets: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Bankman-Fried’s Trial to Begin in October

Temasek are not the only ones to have been fooled by Bankman-Fried’s charisma. Before the collapse of FTX, and his subsequent arrest, the founder had become a public face of the crypto industry.

Crypto was once considered the domain of geeks and criminals. Bankman-Fried was, in theory, a part of the industry’s rehabiliation, regularly sharing the stage with politicians and business leaders.

At present, Bankman-Fried is under house arrest as he waits for the beginning of his trial in October. Prosecutors accuse Bankman-Fried of stealing billions of dollars in FTX customer funds. A large part of which then went to his Alameda Research hedge fund.

They also claim the stolen assets funded his political and charitable activity, as well as personally enriching him. Along with a few whose favor he sought, such as the asset manager K5 Global, which received $700 million. A sum that Alameda now seeks to claw back.

Bankman-Fried has pleaded not guilty to all charges against him.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.