The Monetary Authority of Singapore (MAS) has launched Project Guardian by collaborating with 15 financial institutions, including the Financial Services Agency of Japan (FSA), the Swiss Financial Market Supervisory Authority (FINMA), and the United Kingdom’s Financial Conduct Authority (FCA).

Lately, Singapore has been making significant progress in regulating the crypto assets. The launch of Project Guardian is the latest step taken by one of the leading financial centers in the world.

MAS Aims to Develop Cross-Border Crypto Regulatory Framework

According to the official announcement from MAS, Project Guardian will focus on advancing crypto pilots in fixed income, foreign exchange, and asset management products.

Moreover, it is a well-known fact that the crypto realm is borderless. And it facilitates near-instant transactions across borders. While these facilities solve the problems that traditional finance cannot, it is also subject to misuse by the bad actors.

Hence, there is a need to keep the illicit transactions in check through cross-border collaborations. To maintain the same, MAS Singapore also launched a project guardian policymaker group that includes FSA, FCA, and FINMA.

Leong Sing Chiong, Deputy Managing Director at MAS states:

“MAS’ partnership with FSA, FCA and FINMA shows a strong desire among policymakers to deepen our understanding of the opportunities and risks arising from digital asset innovation. Through this partnership, we hope to promote the development of common standards and regulatory frameworks that can better support cross border interoperability, as well as sustainable growth of the digital asset ecosystem.”

Read more: The Future of Digital Asset Management and Decentralized Gaming Economies

Apart from this, Singapore has taken various steps for crypto regulation. On October 18, BeInCrypto reported that the nation launched dedicated task forces to fight tech and crypto crimes.

As a part of its regulatory drive, the MAS has also been granting licenses to crypto firms. On Oct. 1, Coinbase obtained a Major Payment Institution (MPI) license from the MAS.

Later, it granted an in-principle approval (IPA) to another crypto exchange, Upbit, while awaiting full license approval.

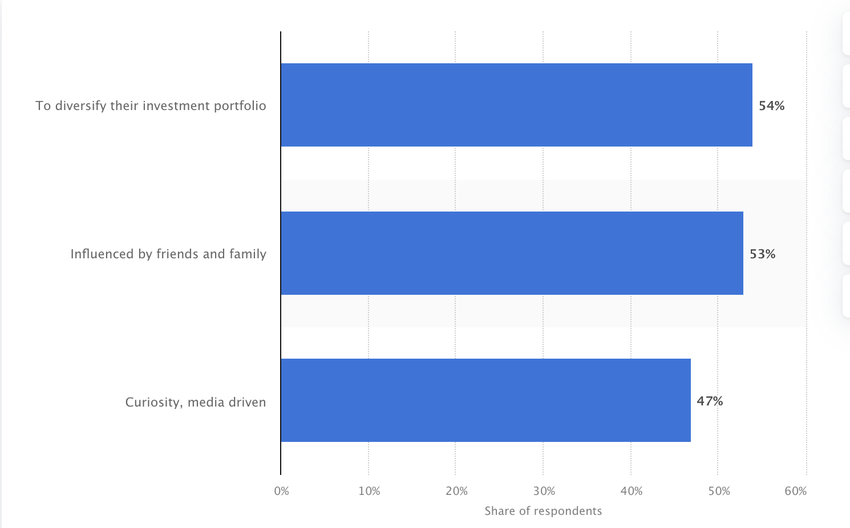

According to Statista, as of February 2023, 54% of respondents were influenced towards crypto adoption to diversify their investment portfolio. While friends and family influenced 53% of the participants for crypto adoption in Singapore.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Do you have anything to say about MAS Project Guardian, Singapore crypto regulation, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.