According to media reports, Silicon Valley Bank (SVB) paid annual bonuses to all eligible employees while its CEO cashed out stock options before its collapse.

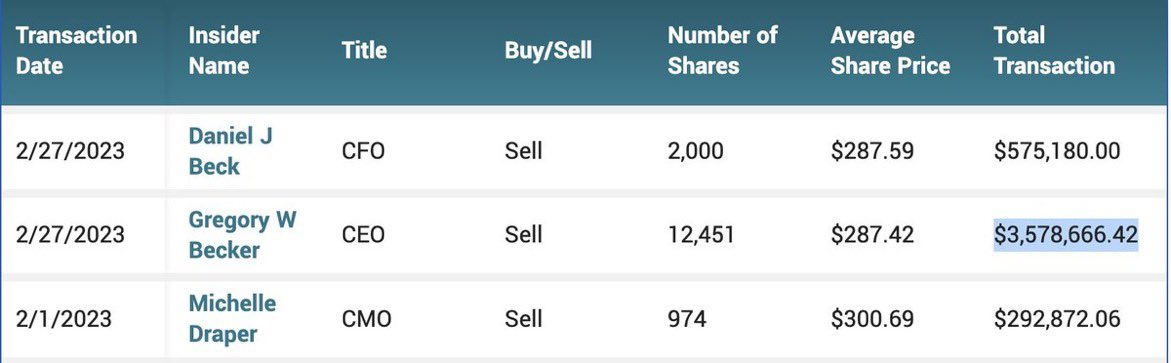

SVB CEO Greg Becker sold $2.27 million worth of the bank stocks on Feb. 27, according to an SEC filing. The sales were part of a 10b5-1 program that Becker filed on Jan. 26.

Another SEC filing showed that Becker had sold $1.1 million in stocks in January to cover the tax liability. Per the filings, the CEO mostly sold his stocks between $285 and $302.

Meanwhile, a CNBC report said the top executives at the embattled bank, including the CEO, sold shares worth $4.5 million before its collapse.

SVB Paid Bonuses Hours Before FDIC Took Control

Axios reported that SVB paid eligible U.S. employees their annual bonuses on March 10—a few hours before Federal Deposit Insurance Corporation (FDIC) took over the bank.

However, the payments appear to be a coincidence, as they fell on the same day the bank collapsed. The bonuses were for 2022 and had been previously scheduled for March 10.

Employees in other countries were scheduled for payment later in the month. But with the FDIC now in control of the bank, it is unclear if the payment will proceed as planned. Meanwhile, the government agency has offered to retain some bank staff for 45 days to assist with the transition.

Will SVB Get a Bailout?

These new revelations further shine the spotlight on SVB. It is the largest U.S. bank to collapse since the 2008 financial crisis, and several stakeholders are already calling for a government bailout.

Billionaire investor Bill Ackman urged the government to bail out the bank because several large venture capital-backed firms use it. According to Ackman, SVB’s failure could be disastrous for the economy.

Ackman noted that it was unlikely for another private bank to bail out SVB, considering what the regulator did to JPMorgan when it bailed out Bear Stearns.

He added:

“To be clear, a bailout should be designed to protect SVB depositors, not equity holders or management. We should not reward poor risk management or protect shareholders from risks they knowingly assumed.”

Crypto Community Lampoons Regulators

Several crypto community members have pointed out SVB’s failure as proof of the US.. regulators’ and policymakers’ hypocrisy.

Anti-Crypto lawmaker Senator Elizabeth Warren has especially come under criticism for tweeting about sham crypto audits when regulated banks are collapsing.

BlockTower Capital founder Ari Paul tweeted, “Silvergate has met all withdrawal requests. The far larger non-crypto bank SVB just forced a lot of good companies into bankruptcy.”