The altcoin market capitalization is only a few percentage points away from its all-time high. Many analysts believe it can reach a much higher level in September.

Several reasons indicate that the altcoin season has entered its acceleration phase, where almost any altcoin purchase could bring profit. What are those signs? Below are the key observations and explanations.

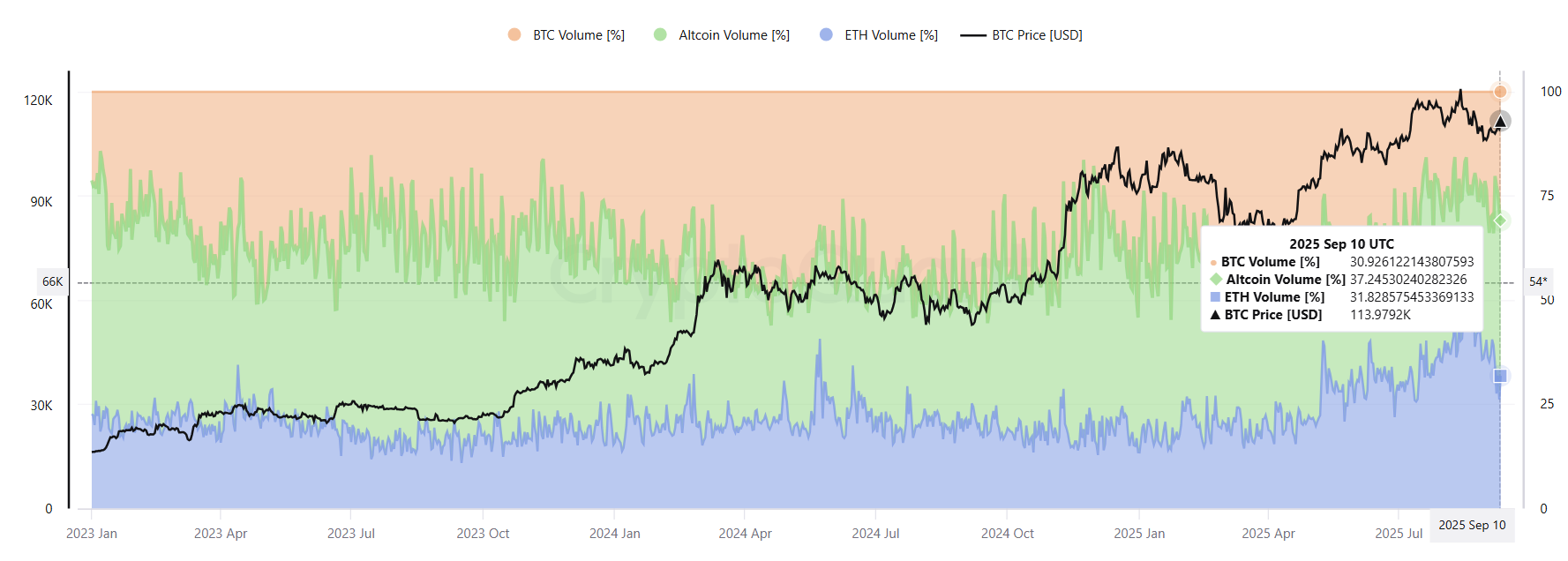

1. Altcoin Trading Volume Share Surpasses ETH and Bitcoin

Analyst Maartunn recently noticed that altcoin trading volume surged in September while BTC and ETH volumes declined. This rare signal confirms capital is flowing into altcoins.

Data from CryptoQuant also shows that in September, altcoin spot volume share rose while ETH and BTC shares shrank. Specifically, altcoins accounted for 37.2%, while ETH and BTC made up 31.8% and 30.9%, respectively.

This shift often signals liquidity rotation from Bitcoin and large-cap coins to mid- and small-caps, confirming the acceleration of altseason.

“Altseason Hints? Ethereum spot volume is down over the past week, while altcoin volume is up,” Maartunn said.

The decline in ETH’s volume share fits the well-known capital rotation cycle. Capital typically begins with Bitcoin’s rally, flows into ETH, and accelerates into a broad altcoin surge.

Maartunn added that 8 out of 10 indicators in CryptoQuant’s bull/bear score are now bearish for Bitcoin.

Meanwhile, Bitcoin dominance has dropped alongside BTC’s price in September. With the altcoin market cap rising, this reinforces the view that capital favors altcoins.

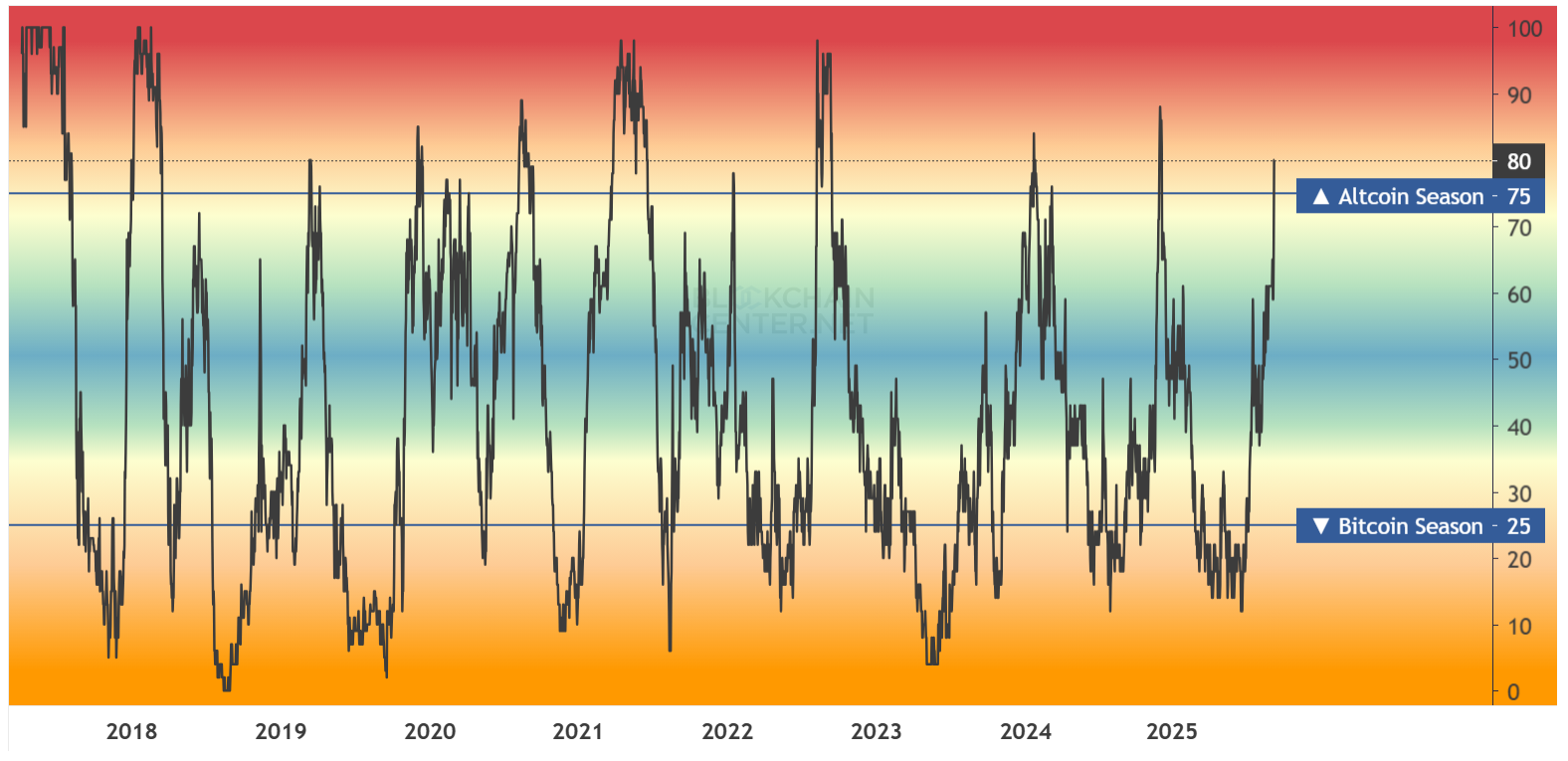

2. Altcoin Season Index Hits 2025 High

The second sign is the Altcoin Season Index (ASI) from Blockchain Center, which hit 80 points, its highest level in 2025. This confirms the market is in altcoin season.

ASI measures the performance of the top 50 coins (excluding stablecoins) against Bitcoin over the past 90 days. With 75% of coins outperforming BTC, the index shows that altcoins dominate.

During the acceleration phase, ASI can climb to 100 before the cycle ends, similar to previous peaks. This reflects a strong preference for high-risk altcoin investments.

Analyst Lau noted that the acceleration period of altcoin season can last from 17 to 117 days.

“Historically, the average duration of alt season is 17 days, with a record of 117 days. Now we just have to wait and see how long the new cycle will last,” Lau said.

3. TOTAL3 Forms a Massive Bullish Triangle

The third sign comes from technical analysis. TOTAL3 (the total altcoin market cap excluding BTC and ETH) has been forming a massive bullish triangle over the past four years and is now on the verge of a breakout.

Charts show that TOTAL3 is testing its all-time monthly highs, with rising volume and price pressing resistance. A breakout would officially mark a powerful acceleration of altseason, similar to 2019–2021 cycles.

Simon Dedic, founder of MoonrockCapital, called this the most important structural signal right now.

“Imagine calling for the top while TOTAL3 is on the verge of breaking out of a 4-year wedge, being on track for the highest monthly close in crypto history,” Simon Dedic said.

If TOTAL3 breaks above $1.16 trillion to set new highs, it will boost investor confidence in altcoins. With no historical resistance levels to reference, the rally’s ceiling will depend entirely on retail investors’ FOMO momentum.

4. Exchanges Like Upbit, Coinbase, and Bithumb Ramp Up Listings

Rising liquidity in altcoins has fueled a wave of new exchange listings in September.

- Upbit has added nearly one token per day (LINEA, PUMP, HOLO, OPEN, WLD, FLOCK, RED) to maintain its 50.6% market share against Bithumb (46%).

- Bithumb listed EUL, WLFI, LINEA, and PUMP.

- Coinbase listed KMNO, DOLO, LAYER, SPX, AWE, and WLFI.

These listings enhance altcoin liquidity, attract speculation, and increase trading volume. The feedback loop between listing news and rising volumes accelerates the altcoin season even further.