The market crash on October 11 caused severe losses for retail investors. It also triggered notable behavioral changes among Bitcoin whales. Recent on-chain data reveals three major shifts in this group’s activity.

What are they, and can the market adapt to these new patterns? The following analysis explains.

1. Dormant Whales Are Waking Up

After the crash, Bitcoins from long-dormant wallets began to move. This suggests that older whales are feeling pressure to take action. For example, on October 14, around 14,000 BTC that had been inactive for 12–18 months were moved on-chain.

On October 15, over 4,690 BTC from the 3–5 year age band were reactivated. Since the start of 2025, nearly 892,643 BTC from this cohort have been moved, representing a significant portion of the total supply.

The 2–3 year-old Bitcoin cohort also saw strong movement, with 7,343 BTC transferred on-chain this week. Additionally, today, one OG whale moved 2,000 BTC and still holds almost 46,000 BTC, worth more than $5 billion.

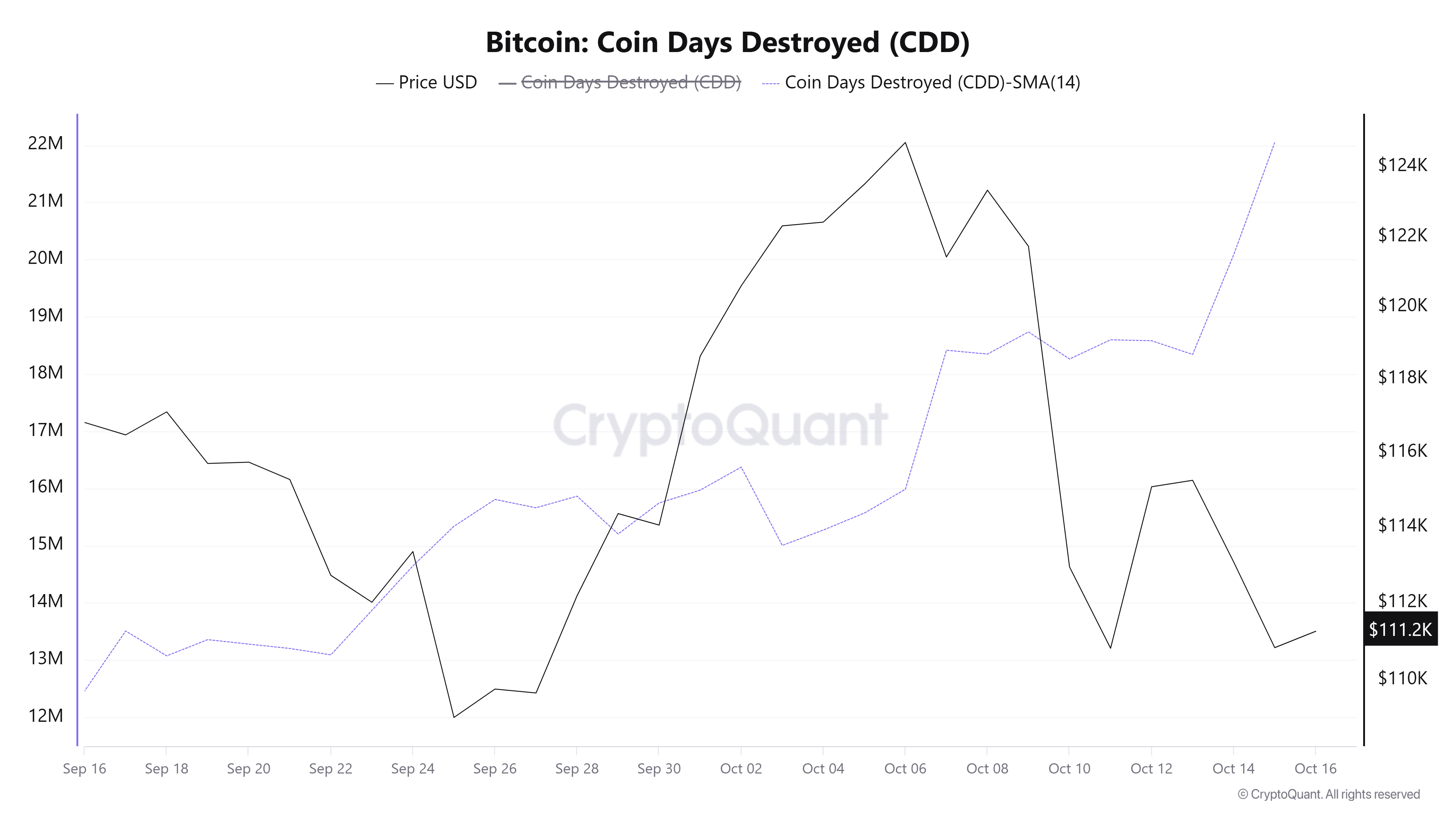

As a result, Coin Days Destroyed (CDD) spiked sharply this week, reaching its highest level in a month. This is also the highest reading since early July, when whale reactivation contributed to Bitcoin’s drop from $120,000 to $112,000.

“Watch out, selling could have resumed…” – Analyst Darkfost warned.

2. Increased Whale Inflows

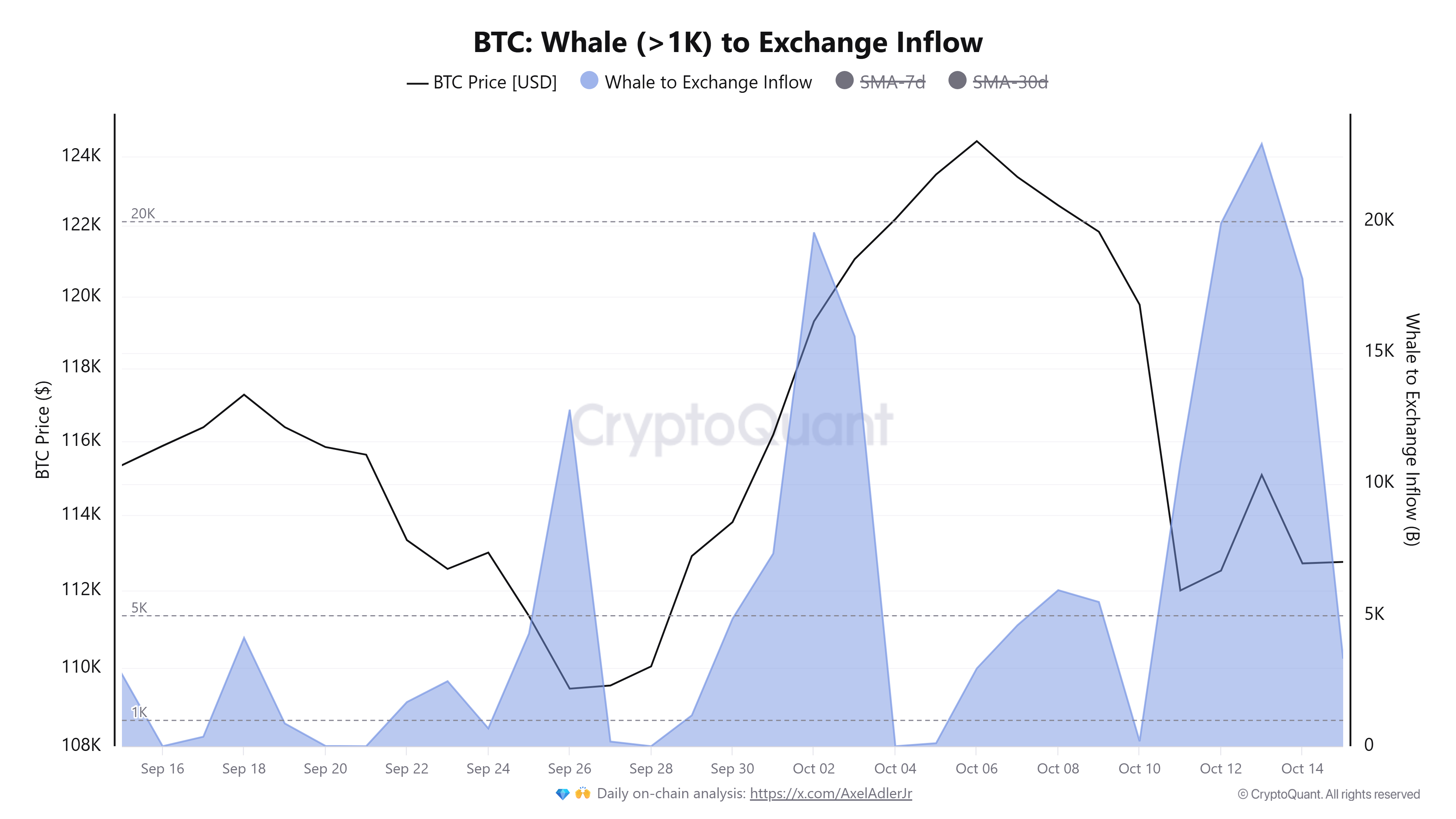

Data from CryptoQuant shows that inflows from whale wallets holding over 1,000 BTC surged after October 11.

Analyst Maartunn noted on October 15 that 17,184 BTC were sent to exchanges by these large wallets — the highest transfer level since the beginning of the month.

A rise in whale inflows is often a bearish short-term signal. When whales send BTC to exchanges, they may be preparing to sell to take profits or cut losses, which increases selling pressure.

3. Higher Whale Transaction Ratios on Exchanges

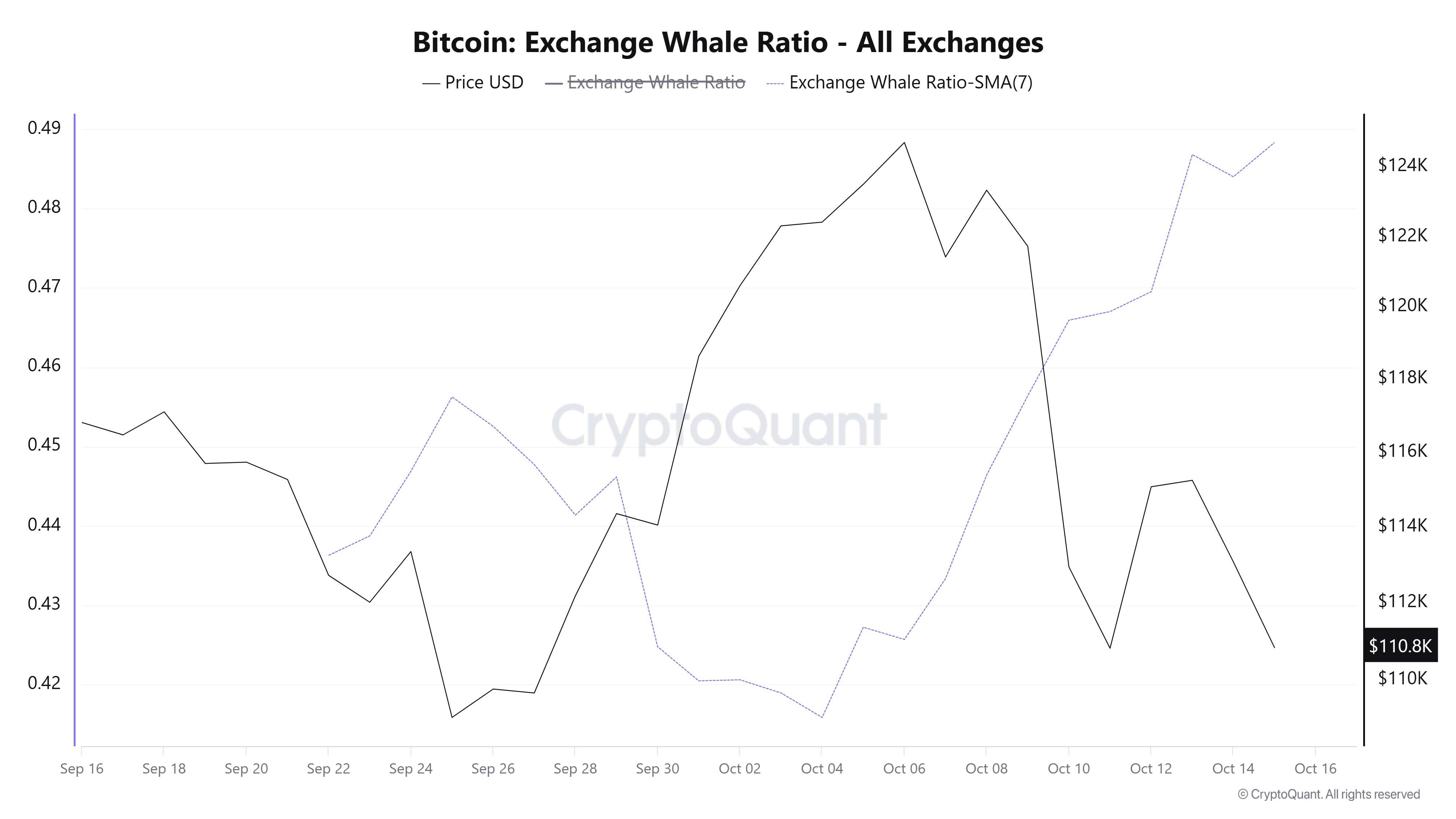

Another key metric is the Exchange Whale Ratio, which measures the proportion of the top 10 inflow transactions relative to total inflows on exchanges.

A higher ratio means whales are responsible for a larger share of trading activity, indicating that they use exchanges to execute large transactions.

CryptoQuant data shows that since the October 11 crash, this ratio has jumped to its highest level in a month. Such spikes often lead to market volatility, as large whale trades can easily disrupt liquidity.

These changes can be considered part of a normal redistribution phase, where Bitcoin moves from older whales to new ones — a process that can help the market mature. The new whales include ETF funds and institutional accumulators.

“This is just typical redistribution, similar to what we’ve seen in previous cycles. Nothing else.” – Analyst Maartunn explained.

However, if this activity becomes too intense — such as persistently high inflows or a sharp rise in whale ratios — it could place significant pressure on prices and lead to deeper volatility.