Shiba Inu’s (SHIB) futures traders have maintained a bullish outlook despite the meme coin’s price consolidation in the past month.

An assessment of the coin’s price movements on a 3-day chart revealed that it has trended within a parallel channel pattern since 12 April, witnessing resistance at $0.000027 and finding support at $0.00002.

Shiba Inu Long Traders Bet in the Coin’s Favor

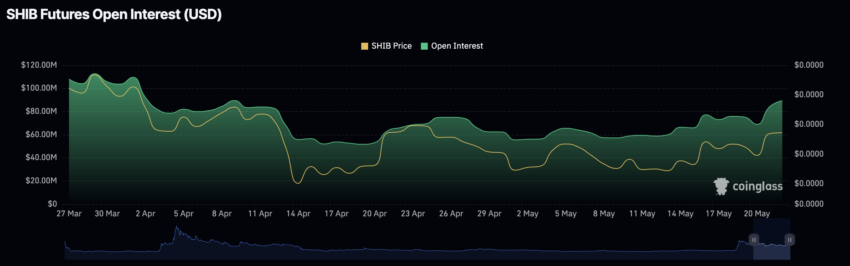

SHIB’s futures open interest has trended upward since the beginning of the month. As of this writing, the meme coin’s futures open interest was $89 million, pegged at its highest since April 4.

An asset’s futures open interest refers to the total number of outstanding futures contracts that have not been closed or settled yet. When it surges, it suggests an uptick in the number of traders entering the futures market for that asset.

SHIB’s funding rate has maintained a positive value, confirming that the rise in its open interest is a bullish sign.

Read More: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

Funding rates are used in perpetual futures contracts to ensure the contract price stays close to the spot price. When their value is positive, they suggest a strong demand for long positions.

The rise in an asset’s futures open interest, alongside a positive funding rate, signals an increased demand for long positions.

SHIB Price Prediction: Meme Coin’s Value May Fall If…

While SHIB’s futures traders are opening positions in favor of a rally, readings from its price charts hint at the possibility of a short-term decline.

Firstly, the dots of its Parabolic SAR indicator were atop its price at price time. They have been positioned this way since April 3.

The indicator gauges an asset’s price direction and potential trend reversals. When its dots appear above the asset’s price, it signals that the current trend is downward and may continue if sentiment fails to improve.

Also, the coin’s Money Flow Index (MFI) rested below its 50 neutral zone at press time. 44.62 SHIB’s MFI showed that selling pressure exceeded accumulation amongst its traders.

Shiba Inu Analysis. Source: TradingView

This indicator measures money flow into and out of an asset over a specific period. Its values range between 0 and 100. A reading below 50 suggests that, on average, there has been more downward price movement accompanied by higher trading volume than upward price movement.

If this trend continues, the coin’s price may fall from the $0.000026 region and settle at $0.000024.

However, if this is invalidated, SHIB’s value is expected to rise to $0.00003.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.