Shiba Inu (SHIB) price is working to recover from its recent losses, attempting to breach a key resistance level that could unlock substantial profits for its holders. The meme coin has been showing signs of resilience, and successfully breaking through this barrier could generate over $7 billion in gains for investors.

As SHIB approaches critical price points, market sentiment is shifting, with many anticipating a potential rally.

Shiba Inu Investors Have Profits Ahead

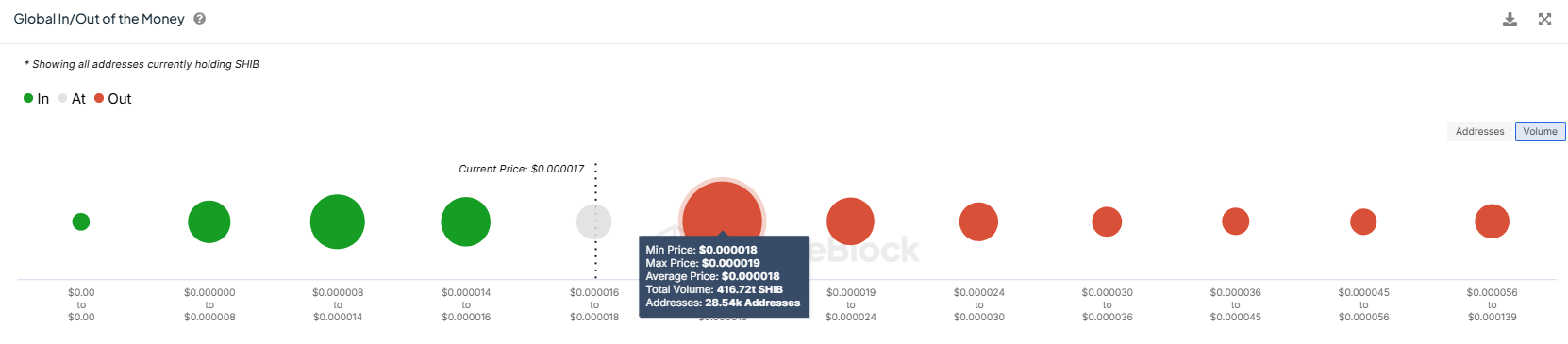

The Global In/Out of the Money (GIOM) metric indicates that approximately 416 trillion SHIB, worth over $7 billion, is currently awaiting profits. This supply of SHIB was acquired when the price ranged between $0.00001800 and $0.00001900. Thus, a 25% rise is necessary to bring this supply back into profit.

This accumulation near critical price points reflects growing optimism among SHIB holders. If Shiba Inu manages to sustain upward momentum and breach key barriers, the potential of earning more profits could reinforce further buying pressure, pushing the meme coin even higher.

Read more: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

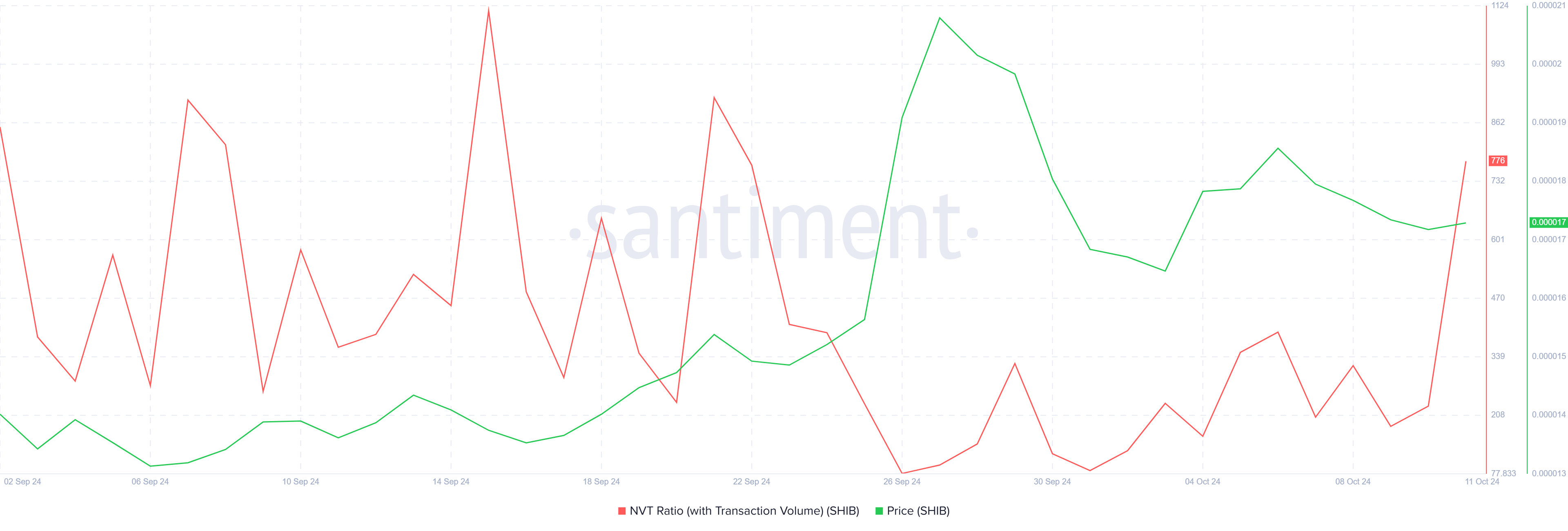

Despite the positive sentiment, Shiba Inu’s macro momentum presents a more cautious outlook. The Network Value to Transactions (NVT) ratio shows that SHIB may be overvalued at its current levels. A spike in this metric indicates that the network’s value exceeds its transaction volume, often leading to a disconnect between price and underlying activity.

Historically, assets with an inflated NVT ratio tend to see price corrections, as the overvaluation creates an unsustainable environment for continued growth. If Shiba Inu’s price action fails to align with its transaction value, the market may witness a pullback, potentially stalling the meme coin’s recovery efforts.

SHIB Price Prediction: Profits in the Making

Shiba Inu is currently trading at $0.00001687 and is testing support at $0.00001676. A successful bounce from this level could send the price toward $0.00001961, recovering the losses incurred during September’s 20% crash. Reaching this point would restore some of the lost ground, bringing renewed optimism to the market.

However, for the $7 billion worth of SHIB supply to turn profitable, the meme coin would need to breach $0.00001961 and rally to $0.00002093. A rise to this price point would mark a 25% rise. This level is crucial for unlocking the anticipated profits and sustaining bullish momentum.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

If the elevated NVT ratio leads to reduced buying pressure, Shiba Inu could lose support at $0.00001676 and fall to $0.00001462. Such a drop would invalidate the meme coin’s chances for a rally. This would also eliminate the prospect of realizing profits for holders.