SHIB price has been on the move recently, with a sharp rise in its 7-day MVRV ratio indicating that many holders are in profit. Whale activity has been cautious, with only modest accumulation, which could limit further price gains. Although SHIB’s EMA lines are bullish, with a golden cross forming, the token faces strong resistance ahead.

These factors together suggest that SHIB’s current rally may face challenges sustaining momentum.

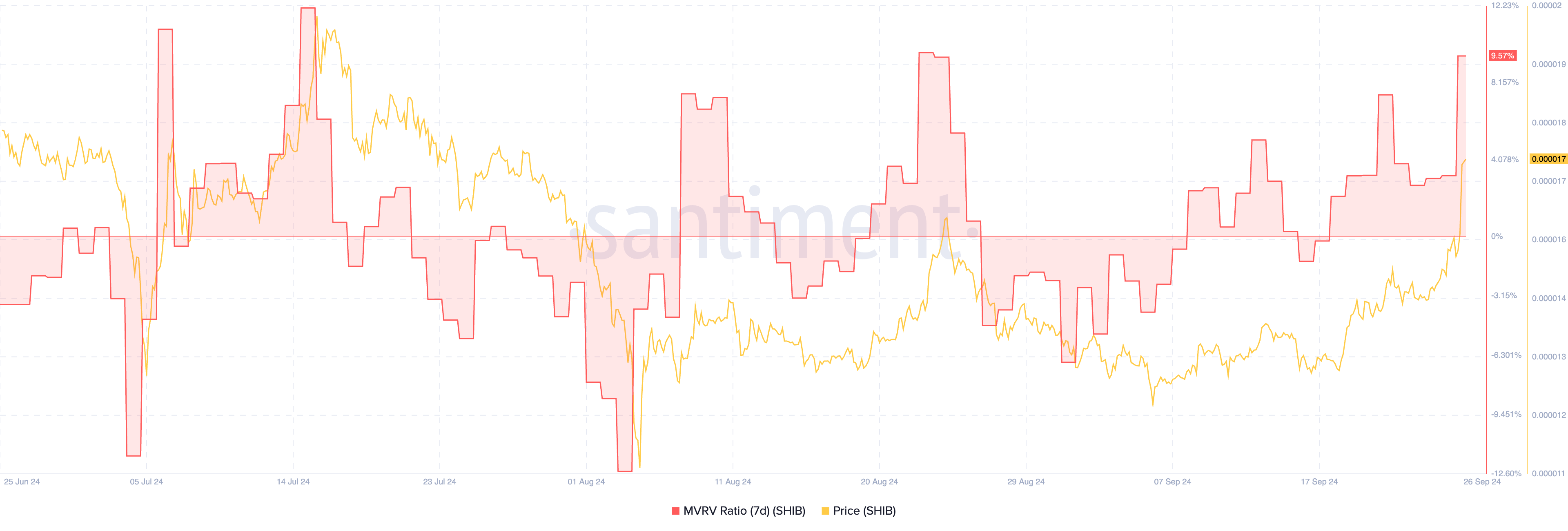

SponsoredSHIB 7D MVRV Hints at Correction

As one of the leading meme coins, Shiba Inu recently saw its 7-day Market Value to Realized Value (MVRV) ratio jump sharply from 3.1% to 9.57% in just 24 hours, alongside a 12% price surge. This spike indicates that a significant portion of SHIB holders are now in profit. The MVRV ratio measures the average gains or losses of tokens in circulation relative to their acquisition prices over the last seven days, helping gauge short-term profitability.

When the MVRV ratio increases, it often signals that more investors are in the green, which can lead to profit-taking behavior. The 7-day MVRV Ratio is a critical metric for assessing short-term market sentiment. A high ratio suggests that the asset may be overbought, indicating the potential for a price correction.

Read more: 6 Best Platforms To Buy Shiba Inu (SHIB) in 2024

Historically, SHIB’s MVRV ratio crossing the 9% mark has been a precursor to major pullbacks. The last two times SHIB’s 7D MVRV ratio exceeded this level, the token experienced significant corrections of 50% and 18% in the following weeks.

Given this historical context, while the recent price jump may appear bullish, it could also signal that SHIB price is entering a phase of heightened risk for a potential sell-off.

SponsoredWhales Are Not Accumulating A Lot Of SHIB

Now, let’s analyze the movement of whales in relation to Shiba Inu. From the end of July to mid-August, whales offloaded large amounts of SHIB, coinciding with a 42% drop in price over the course of three weeks.

Analyzing whale activity is important because these large holders have significant market influence. Their transactions often signal shifts in trends. When whales dump tokens, it can suggest they are expecting a price decline. On the other hand, their accumulation is generally seen as a bullish indicator, showing confidence in future price increases.

While whales began accumulating SHIB again at the end of August, this accumulation was short-lived, and they quickly dropped their holdings again. In recent days, we’ve seen some accumulation of SHIB by whales. However, the scale of this accumulation has been relatively modest compared to previous periods.

SponsoredThis suggests that the recent price pump might not last long, or at the very least, that whales are not fully convinced of the strength behind the current rally. The cautious accumulation from whales signals that they are still unsure. This could indicate potential instability or a lack of confidence in the longevity of the recent upward movement.

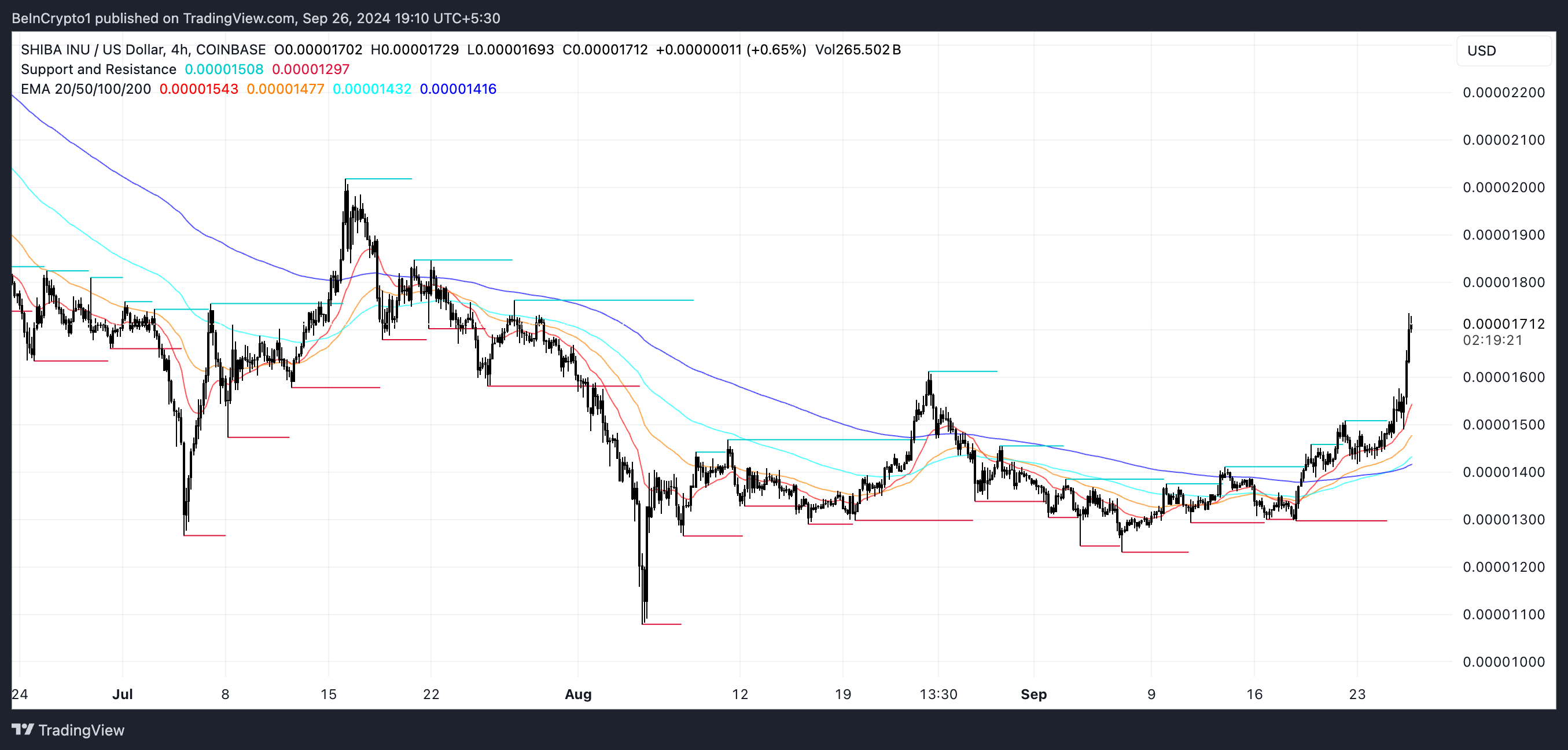

SHIB Price Prediction: Can It Break Into $0.0002?

SHIB Exponential Moving Average (EMA) lines are currently showing a bullish trend, with a golden cross forming just a few days ago. The golden cross is a widely regarded bullish signal in technical analysis. It occurs when a short-term EMA crosses above a long-term EMA.

EMA lines differ from simple moving averages by giving more weight to recent price data. When the shorter EMA is above the longer one, it indicates bullish momentum, as buyers are pushing prices higher. Conversely, a bearish signal occurs when the short-term EMA falls below the long-term EMA, signaling downward pressure.

SponsoredWhile SHIB’s EMA lines look promising and point to a potential continuation of the upward trend, there are strong resistance levels ahead at $0.0001763 and $0.0001846. These resistance zones have historically been tough barriers for SHIB.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

Breaking through them is crucial for the coin to test the $0.0002 mark. If these levels are breached, SHIB could experience a new wave of buying pressure, pushing the price toward higher highs.

If the MVRV ratio continues to put pressure on the market, and whales maintain their cautious stance, there’s a risk that SHIB’s upward trend could reverse. In that scenario, SHIB could find itself testing critical support levels at $0.00015 and $0.00013, as meme coins are currently trying to get back to the hype from previous months.

A breakdown of these support levels could lead to a bearish shift in market sentiment, undoing much of the recent gains.