SEI price has witnessed a notable decline in the past 24 hours. It currently trades at $0.41, registering an 8% drop during the period in review.

The altcoin’s technical setup, assessed on a one-day chart, suggests a continued price decline unless market sentiment shifts from negative to positive. This analysis delves into what token holders should anticipate in the near term.

Sei Sellers Dominate Market

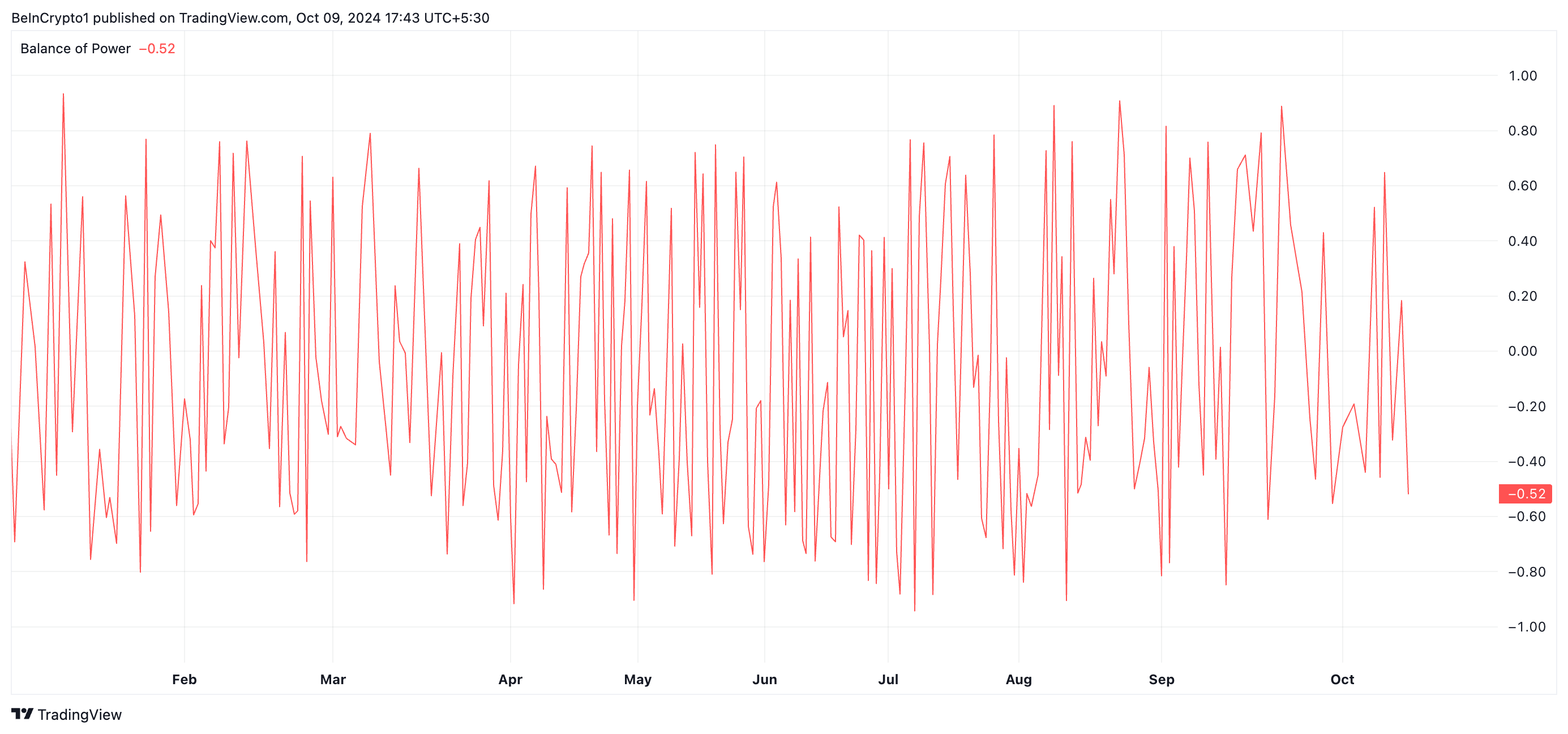

SEI’s negative Balance of Power (BoP) confirms the low demand for the altcoin among market participants. As of this writing, it stands at -0.52.

The BoP measures the strength of buyers versus sellers over a specific period. It helps identify whether buyers or sellers are dominating price movements. When its value is negative, it indicates selling pressure outweighs buying pressure.

Read more: 10 Best Altcoin Exchanges In 2024

SEI’s BoP of -0.53 suggests that sellers control the market and drive its price decline. This is a bearish signal that can lead to further declines if buying interest does not increase to counteract the selling activity.

Furthermore, the setup of SEI’s Parabolic Stop and Reverse (SAR) indicator supports this bearish outlook. At press time, the dots of this indicator rest above the token’s price, signaling a downward momentum in the market. Traders view this as a signal to sell their holdings or avoid taking long positions.

SEI Price Prediction: Futures Traders Are Betting on Further Drawdown

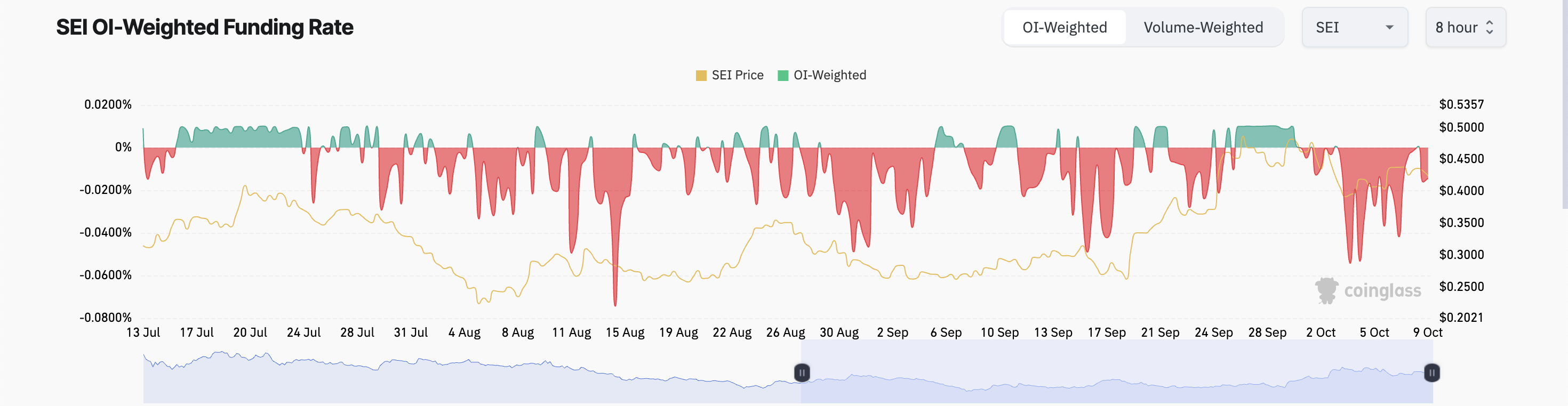

Traders in SEI’s futures market continue to bet against positive price growth, as evidenced by its negative funding rate. The token’s funding rate is -0.014% and has remained predominantly negative since the beginning of October.

A negative funding rate means that most traders are opening short positions, indicating expectations of a further price decline. It reflects the prevailing bearish market sentiment.

Readings from SEI’s Fibonacci Retracement tool suggest that if the downtrend persists, the next price target is the August 5 low of $0.20, representing a 52% drop from its current value.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

However, if market sentiment towards the altcoin shifts from bearish to bullish, SEI’s price will increase and rally toward $0.67.