The Securities and Exchange Commission (SEC) has fined 11 Wall Street firms a total of $289 million for failing to maintain electronic communications records.

The SEC has maintained a rigid stance against crypto companies. But on Tuesday, the firms had to face up to charges of alleging poor record keeping.

Wall Street Broker-Dealers and Investment Advisors Fined by SEC

The SEC charged the firms with not maintaining and preserving electronic communication records concerning the businesses. The Wall Street firms admitted to the SEC’s investigators that employees engaged in business-related conversations on personal devices through platforms like iMessage, WhatsApp, and Signal.

The registered broker-dealers and investment advisors are required to comply with the record keeping provision of federal securities law. The firms will pay fines totaling $289 million as follows:

- Wells Fargo Securities, Wells Fargo Clearing Services, and Wells Fargo Advisors Financial Network will together pay a fine of $125 million

- BNP Paribas Securities Corp – $35 million

- SG Americas Securities- $35 million

- BMO Capital Markets Corp – $25 million

- Mizuho Securities USA LLC- $25 million

- Houlihan Lokey Capital, Inc. – $15 million

- Moelis & Company LLC – $10 million

- Wedbush Securities Inc – $10 million

- SMBC Nikko Securities America, Inc. – $9 million

With the announcement of these fines, the SEC has demonstrated it is not just the crypto industry it is clamping down on. In June, the SEC sued Binance and Coinbase, two of the largest crypto exchanges.

Click here to learn more about the best crypto exchanges for beginners.

Through various lawsuits against crypto firms, the SEC has named over 67 cryptocurrencies as unregistered securities.

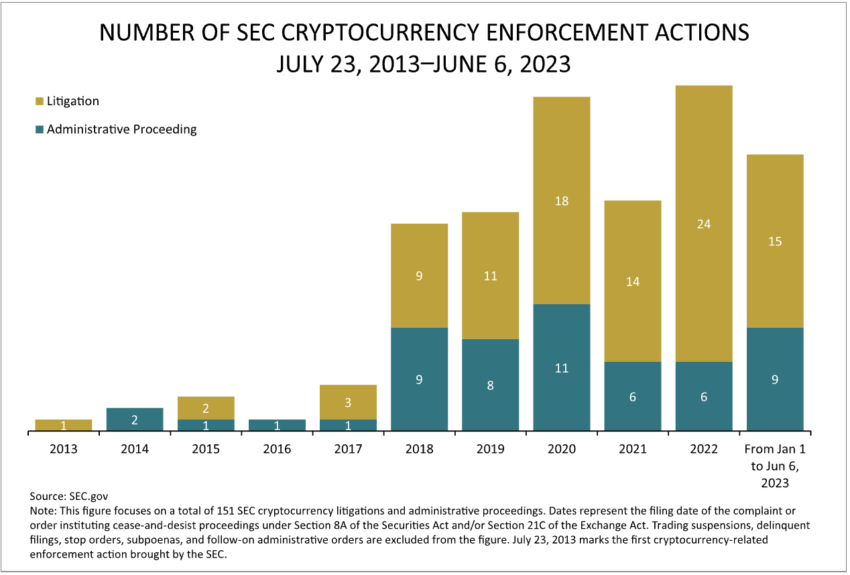

Several companies, such as Revolut, have had to halt crypto business in the US entirely. Even Nasdaq has been forced to pause its crypto ambitions as regulatory challenges mount in the country. This year so far, the SEC has filed at least 24 enforcement actions against crypto firms.

Got something to say about SEC Wall Street or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.