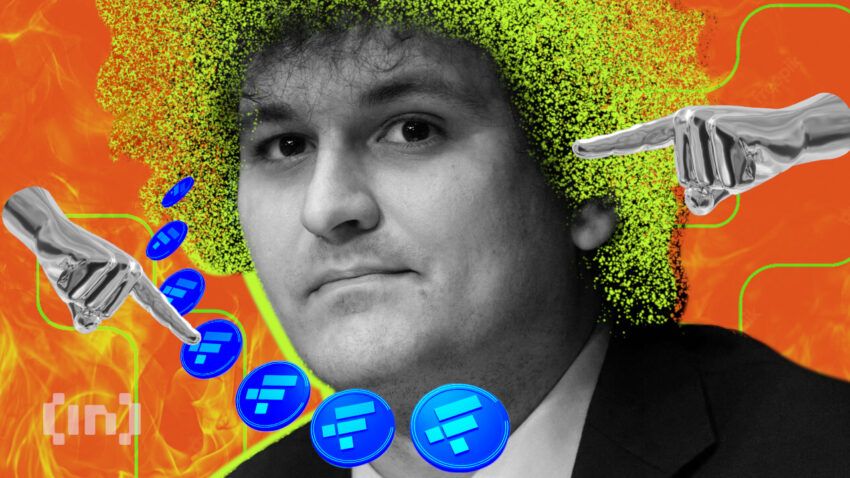

The crypto industry’s public enemy number one, Sam Bankman-Fried (SBF), has confirmed he’ll show up at a New York Times event. However, the crypto community is not amused.

On Nov. 24, SBF tweeted that he would show up in person to speak at the New York Times DealBook Summit on Nov. 30.

NYT columnist Andrew Ross Sorkin manages the annual event. It delves into current business and policy news headlines, and SBF is a hot topic at the moment.

Additionally, it would be the FTX founder’s first public appearance since he filed for bankruptcy earlier this month.

The NYT currently expects SBF to participate in the interview from the Bahamas, where he is currently located.

Crypto Community Reacts

On Nov. 24, Sorkin retweeted SBF’s appearance pledge adding his own commentary. “There are a lot of important questions to be asked and answered,” he said before adding, “nothing is off limits.”

The New York Times has recently received a lot of flak for publishing what the crypto community view as “puff pieces” for SBF.

Last week, the outlet ran an article titled “How Sam Bankman-Fried’s Crypto Empire Collapsed.” It did not address any of the issues surrounding the FTX collapse, mismanagement, or fraud. Even Twitter’s new CEO Elon Musk commented about the article asking, “Why the puff piece @nytimes?”

The outlet appears to be pandering to SBF again, and the crypto community is incensed. SBF has taken to Twitter since he resigned as CEO, and the new boss is not amused.

According to Bloomberg, FTX lawyers said that SBF’s “incessant and disruptive tweeting” were undermining their restructuring efforts.

The Daily Gwei founder Anthony Sassano questioned how he could enter the country without getting arrested:

Civic and Gyft co-founder Vinny Lingham opined that SBF was probably not going to jail, adding:

“Don’t get me wrong. He absolutely should. But, he won’t. He might get convicted but he won’t serve time. He spent your billions insuring against that.”

Furthermore, most of the responses to SBF’s tweet confirming his appearance were too colorful to republish.

The Latest in the SBF Saga

On Nov. 22, BeInCrypto reported that FTX and Alameda company tax returns claim that the companies were running at a loss of $3.7 billion since inception.

On Nov. 23, SBF sent a letter to company employees claiming that investors were waiting to pour in billions of dollars to save it. “Maybe there is still a chance to save the company,” he wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.