The Sandbox (SAND) continued its bullish trend, hitting a new yearly high of $0.86 during Monday’s early Asian session. However, it has since pulled back by 14%, trading at $0.76 at press time.

Despite the recent surge, on-chain and technical indicators suggest that the much-anticipated $1 price target remains unlikely for now. Here’s why.

The Sandbox’s Long-Term Holders Book Profit

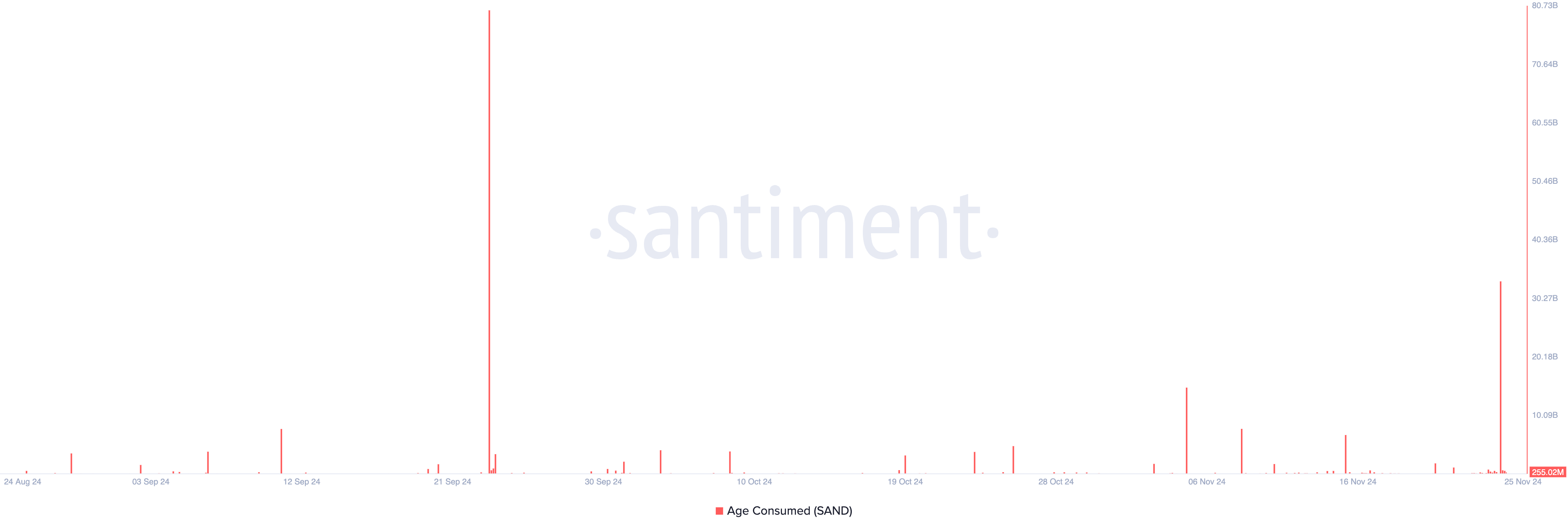

SAND’s price hike over the past week has prompted its long-term holders to move their previously dormant tokens around. This is reflected in the surge in the token’s age-consumed metric, which measures the movement of long-held coins. According to Santiment, this skyrocketed to a two-month high of 33.19 billion on Sunday.

This metric’s rally is notable because long-term holders are not in the habit of moving their coins around. Therefore, when they do, especially during periods of price uptick, it hints at a shift in market trends. Significant spikes in age-consumed during a rally like this suggest that long-term holders are offloading, possibly leading to increased selling pressure.

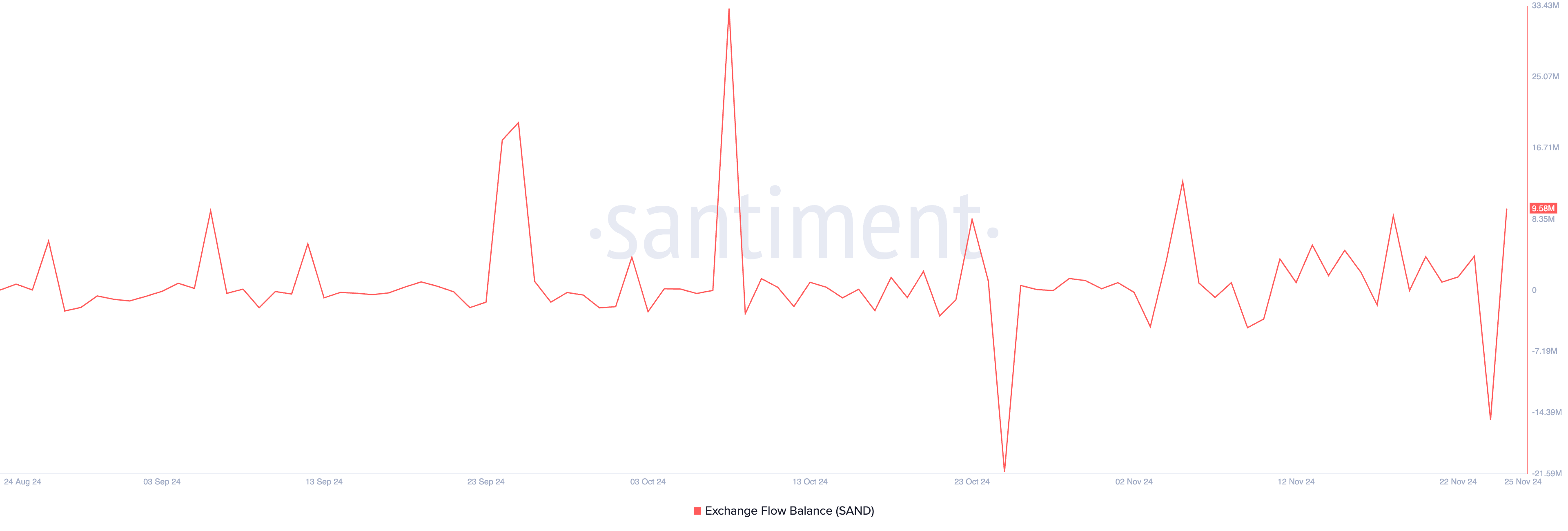

Notably, the rise in SAND’s Exchange Flow Balance over the past 24 hours confirms the selling activity. According to Santiment, this metric, which measures the net difference between the amount of an asset sent to exchanges and the amount of an asset withdrawn from exchanges over a specific period, has climbed by 162%.

This reflects an increase in the amount of SAND tokens being deposited to exchanges. It signals that holders are preparing to sell, possibly leading to downward price pressure.

SAND Price Prediction: Metaverse Token Is Overbought

On the daily chart, SAND’s Relative Strength Index (RSI) stands at 87.18, indicating overbought conditions. The RSI measures whether an asset is oversold or overbought, ranging from 0 to 100. Values above 70 signal that the asset is overbought and could face a decline, while values below 30 suggest it is oversold and might rebound.

With an RSI of 87.18, SAND is signaling overbought conditions, putting it at risk of a near-term pullback. If a decline occurs, its price could drop to $0.72. Increased selling pressure at this level may push SAND further down to $0.61, distancing it even more from the sought-after $1 target.

On the other hand, the SAND token price may reclaim its year-to-date high of $0.86 if the selling pressure wanes. This will invalidate the bearish thesis above.