Starting September 1, Russia will enforce strict restrictions on the general circulation of crypto assets such as Bitcoin. Only digital financial assets issued within its jurisdiction will be allowed.

Anatoly Aksakov, Chairman of the State Duma Committee on the Financial Market, leads this initiative. It is part of a broader governmental effort to control the crypto ecosystem amid rising geopolitical tensions.

Why Russia Wants to Restrict Crypto?

Aksakov stated that the forthcoming legislation aims to restrict non-Russian crypto operations to reinforce the ruble’s dominance.

“Digital financial assets issued in Russian jurisdiction, and digital rubles will be allowed. The need for restrictions is due to the fact that today cryptocurrency – is a quasi-currency that replaces the ruble in the country. But only the Russian ruble fulfills the mission of the monetary unit, so this decision has been made. From September 1, restrictions will be introduced,” Aksakov explained.

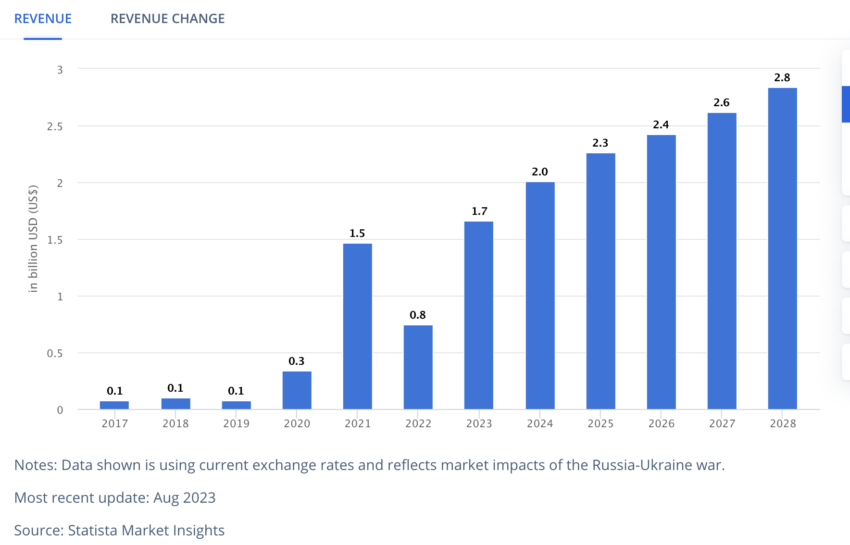

The bill will carve out exceptions for crypto miners and Central Bank-sponsored test projects within an experimental legal framework. This is because crypto mining significantly boosts Russia’s tax revenues. Approximately, crypto miners produce over $2.59 billion in liquidity for foreign trade settlements.

However, Anton Gorelkin, a Member of the State Duma, clarified that Russia does not intend to ban crypto outright. Restrictions will affect the creation of crypto exchanges and other platforms that will provide services for the exchange of cryptocurrencies.

“Of course, the circulation of cryptocurrencies will not be banned. The creation of exchanges outside the zone of the experimental legal regime will fall under the ban,” Gorelkin wrote.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Concurrently, there’s a robust internal debate among Russian policymakers regarding this approach. Artem Kiryanov, Deputy Chairman of the State Duma Committee on Economic Policy, stressed the importance of precise regulations.

“The regulation of cryptocurrency should be prescribed in the digital code, which would clearly spell out the conceptual apparatus and common judicial law enforcement practice,” Kiryanov said.

In contrast to these restrictive views, Russia’s Finance Minister, Anton Siluanov, has pushed for a more moderated stance. Earlier this year, Siluanov opposed a complete ban on cryptocurrencies, advocating for regulation to enable their use in both domestic and international transactions.

“I am sure that the Central Bank and we will come to an agreement. This issue has been discussed for several years. We cannot prohibit the circulation of cryptocurrencies. Therefore, we need to regulate this channel. I am sure that we will find a solution,” Siluanov stated.

These discussions hint at a potential inclination towards using cryptocurrencies for external payments, reflecting a deeper understanding of their potential role in global finance. This approach is also endorsed by Elvira Nabiullina, Head of the Bank of Russia, who supports the experimental use of cryptocurrencies in international settlements.

Meanwhile, recent reports indicate that Russian entities have used cryptocurrencies, particularly Tether’s USDT, to procure critical components for military technology.

Read more: 9 Best Crypto Wallets to Store Tether (USDT)

One notable case involved Andrey Zverev, a Russian operative based in China. In 2022, Zverev used USDT to bypass traditional banking channels and purchase drone components essential for military operations in Ukraine. This maneuver avoided the scrutiny typically associated with sanctions-wary financial institutions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.