A major financial institution in Russia has declared its intention to utilize a digital financial asset (DFA) to monitor the four prominent assets within the Russian Federation.

Russia’s Alfa-Bank has confirmed that it will conduct the issuance of this digital asset on its “A-Token” platform, providing exposure to stocks, bonds, gold, and money market instruments.

Russian Bank Moves Closer to Digital Asset Adoption

In a recent statement, Alfa-Bank revealed that the product will be made in collaboration with its side-arm asset management institution.

“Alfa-Bank and Alpha Capital Asset Management Company have created a digital financial asset (DFA) for the first time based on exchange-traded mutual investment funds – the ‘Evergreen Portfolio.'”

It further clarified that the investment product aims to provide customers with high rates of return. It also ensures steady capital growth on their initial investment.

“The DFA investment strategy pursues two goals simultaneously: through active management principles, to ensure attractive income potential even with moderate market growth, and at the same time mitigate the effects of possible volatility.”

Read more: Top 12 Crypto Companies to Watch in 2024

Since the middle of last year, the Moscow Stock Exchange has been actively considering a particular product.

In July 2023, BeInCrypto highlighted the Moscow Stock Exchange’s intention to commence issuing and trading digital financial assets.

However, there is still ambiguity surrounding the definition of digital financial assets in Russian legislation. The current position is somewhere between digital and traditional assets.

Specifically, according to the 2021 Act, Digital Financial Assets (DFAs) constitute a distinct category of assets bridging the gap between cryptocurrencies and traditional securities.

Speculation Over Russia’s CBDC

Meanwhile, the introduction of Russia’s Central Bank Digital Currency (CBDC), the digital ruble, in August 2023 has sparked suggestions that it could challenge the strength of the US dollar.

Russian officials, including State Duma’s Financial Markets Committee Chairman Anatoly Aksakov, have highlighted the international interest in the digital ruble. It is especially a point of interest for cross-border settlements.

Read more: 10 Best Crypto Exchanges And Apps For Beginners In 2024

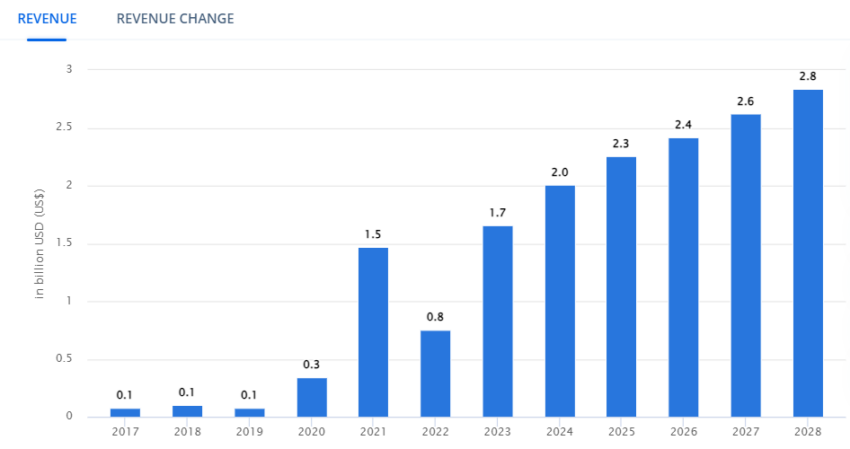

Statista data suggests that by 2028, the annual crypto revenue in Russia could reach $2.8 billion.

The Central Bank of Russia declared its findings in a recent report that the number of fraudulent projects using crypto in the nation is rising steadily.

In 2023, the bank observed that cryptos were mainly used by pyramid schemes and illegal brokers for fraud.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.