Blockchain firm Ripple has called on UK policymakers to seize the moment and position the country as a global leader in digital assets.

Matthew Osborne, Policy director of Ripple Europe, revealed that panelists at Ripple’s recent London Policy Summit stated that the country has the right mix of financial expertise, infrastructure, and international reputation to lead this evolving sector.

UK Has ‘Second-Mover Advantage’

In a blog post, Osborne pointed out that one of the key takeaways from the summit was that the UK holds a “second-mover advantage” in the race for crypto regulation.

According to the post, the UK can adopt a more balanced and innovation-friendly regulatory framework by observing the early efforts of jurisdictions like the EU, Singapore, and Hong Kong.

They believe that this approach could ensure consumer protection while encouraging responsible growth across the sector.

“There is a huge opportunity for digital assets in the UK. With growing consensus that blockchain technology will transform financial markets, the UK already boasts a globally leading, competitive financial services center. And with particular strengths in FX, capital markets, insurance and professional services, the UK has all the building blocks to be a global leader in digital assets,” Osborne wrote.

The panelists furthered that these clear rules will improve institutional confidence, raise industry standards, and lower systemic risks. However, they also warned that the window to act is quickly closing.

“The window of opportunity is narrowing, and one clear theme that emerged from industry participants is the need to provide regulatory clarity with greater pace and urgency,” the blockchain firm noted.

The need for urgency stems from projections that digital assets could represent up to 10% of global capital markets by 2030, potentially holding a combined value of $4 to $5 trillion.

Osborne stressed that the UK must act boldly and collaboratively to remove unnecessary legal obstacles and create an innovation-friendly environment.

Meanwhile, another pressing concern the panelists highlighted was the lack of clarity around stablecoins.

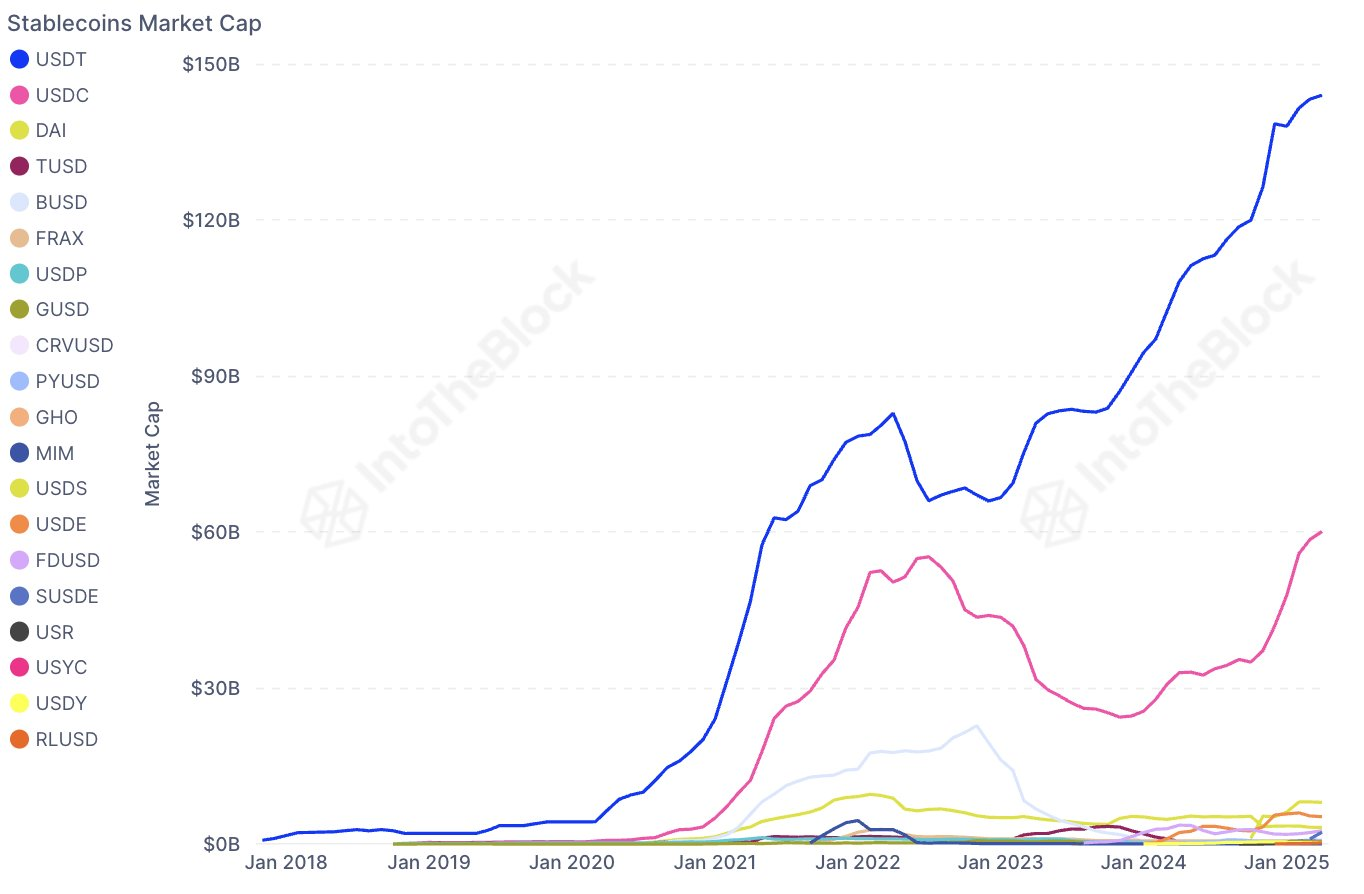

Stablecoins are digital tokens pegged to fiat currencies like the US dollar and are essential to the broader crypto economy. As they are increasingly used for trading, payments, and settlements, stablecoins have become the backbone of the digital asset ecosystem.

With a current market valuation exceeding $230 billion, stablecoins are expected to grow further as adoption increases.

Considering this, there are calls for the Financial Conduct Authority (FCA) to fast-track its stablecoin framework. The panelists emphasized the need for policies that support both domestically issued and foreign stablecoins operating within the UK.