Reserve Rights (RSR) has been moving upwards since its May 12 bottom, but has yet to reclaim the previous all-time low support level.

RSR has been decreasing underneath a descending resistance line since April 2021. The downward movement led to a new all-time low price of $0.003 in May 2022.

The price has been moving upwards since and managed to break out from the line in the beginning of June. However, despite the breakout, it has failed to initiate any sort of sustained upward movement.

To the contrary, the price is still trading below the $0.0095 resistance area, which previously acted as the all-time low bottom.

Additionally, the weekly RSI is below 50, in what is also considered a sign of a bearish trend.

Failed attempt at upward movement

The daily chart shows that the upward movement after the May 12 bottom followed an ascending support line. While it led to a high of $0.013, RSR created a long upper wick after it was rejected by the $0.0114 resistance area (red icon).

Afterward, the downward movement caused a breakdown from the aforementioned ascending support line and its validation as resistance.

Moreover, the daily RSI is below 50 in what is considered a sign of a bearish trend.

So, the daily time frame does not provide any signs for a potential bullish trend reversal.

RSR wave count analysis

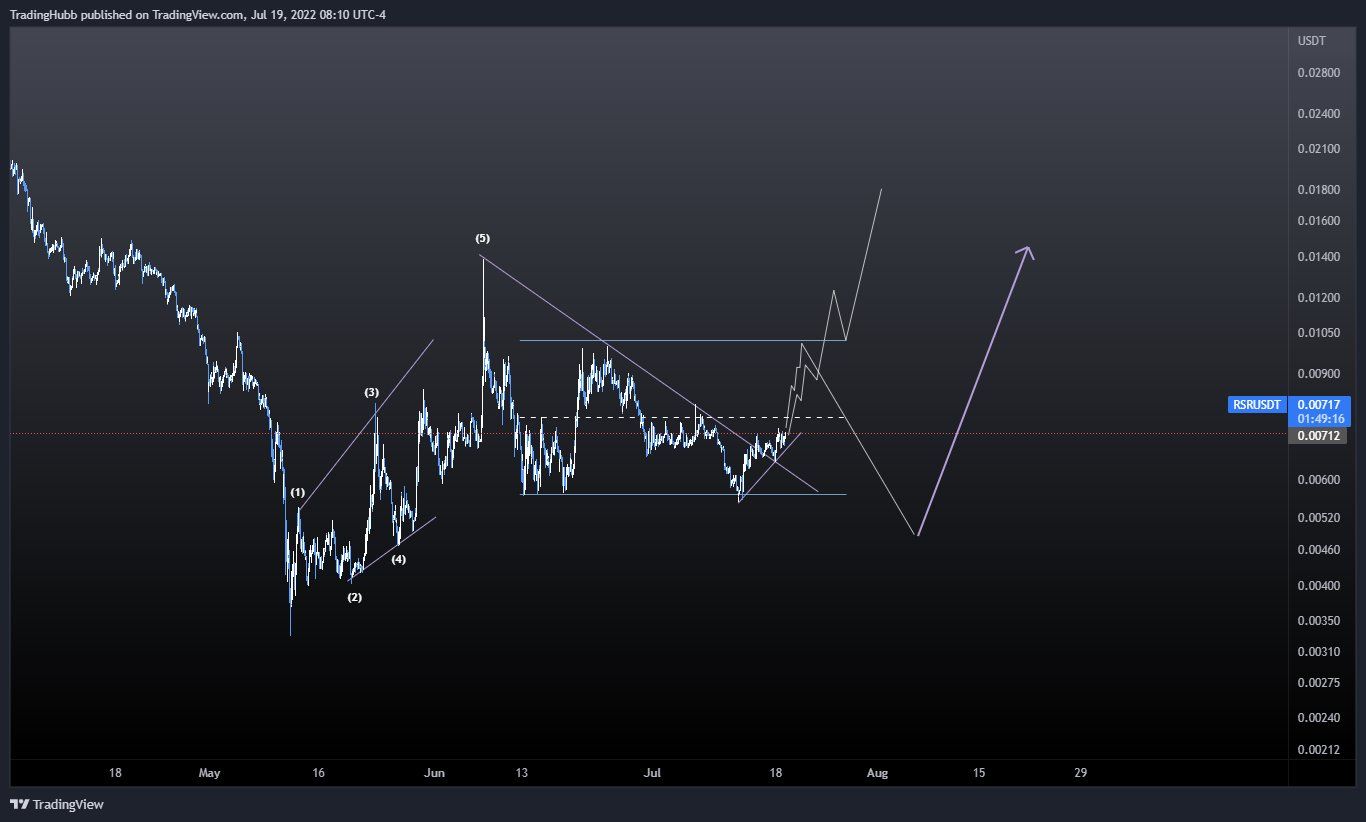

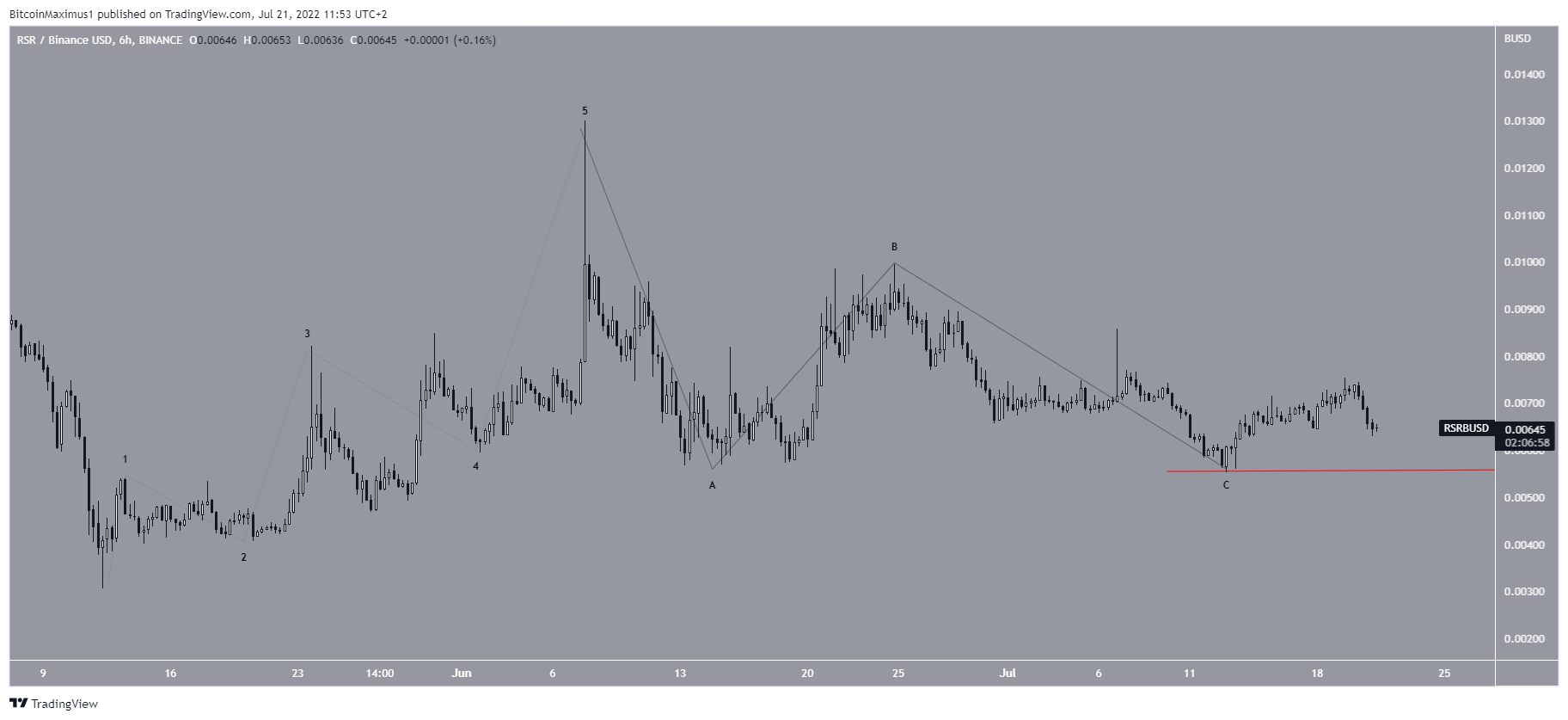

Cryptocurrency trader @TheTradingHubb tweeted a chart of RSR, stating that the price has completed a five-wave upward movement and another one could follow soon.

Unlike the weekly and daily charts, the wave count provides a more bullish outlook. The reason for this is that the increase after the May 12 bottom is a five-wave structure, while the ensuing decrease is an A-B-C corrective structure.

If the wave C low (red line) of $0.0055 holds, the price could resume its upward movement. However, a decrease below that level would indicate that new lows are in store.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.